JPM wrote a massive 2 part report on Stablecoins. Here is our breakdown of the second more important part for hardcore readers.

Intro:

Part 2 was a bear to get through.. and not exciting to read. But it has the players and case-uses well explained in Q&A form.

Here it is boiled down and with the graphs. It’s very Hong Kong-centric. This offers some insight as well into how China expects to stay competitive in this asset class while keeping its BRICS aspirations on target. If The US feels threatened, they will try to get the HK dollar peg broken soon. Judging from recent behavior, maybe they are already trying?1 The bank also seems to like Standard Charter alot.

Part one is in this Founders post from last week:

Summary:

This Stablecoin report analyzes the evolving stablecoin ecosystem, focusing on regulation, infrastructure, and equity implications. It highlights Hong Kong’s strategic push to become a digital asset hub, detailing its licensing regime and integration of stablecoins into trade, settlement, and B2B payments. While early movers like Futu and STAN are positioned to benefit, monetization remains minimal. Regulatory clarity in both the U.S. and HK aims to anchor stability and utility. The report concludes that stablecoins are becoming foundational financial infrastructure—not speculative assets—and that future value lies in licensed, scalable operations, not hype-driven adoption.

While the analysis examines stablecoins from a global perspective, it places considerable emphasis on Hong Kong. It highlights Hong Kong’s “LEAP” framework, its Stablecoin Bill effective August 1, 2025, and pilot programs in tokenized green bonds. The analysis delves deeply into HK-specific regulatory mechanics, multi-currency backing, licensing requirements, and use cases tailored to its digital asset ambitions. Thus, although it includes broader comparisons (like the GENIUS Act in the U.S.), the report is strongly centered on Hong Kong’s approach and strategic positioning in the stablecoin landscape.

Breaking Down JPMorgan's Stablecoin Analysis

Q1: How large is the stablecoin market today, and what are its growth prospects?

The stablecoin market has expanded from $3 billion in 2019 to over $230 billion by Q2 2025. This exponential growth reflects the increasingly foundational role of stablecoins in digital finance. The market is heavily concentrated, with USDT and USDC accounting for 66% and 26% respectively of market share. JPMorgan notes that projections by U.S. authorities place potential market size at $2–$3.7 trillion by 2028. Growth is no longer purely speculative; rather, it is expected to be driven by increasing utility in payment infrastructure across institutional, retail, and cross-border contexts.

Q2: What underpins this projected growth?

The answer lies in utility and regulatory endorsement. As jurisdictions like Hong Kong formalize digital asset frameworks, and as institutions search for compliant, liquid mediums of exchange for digital commerce, stablecoins stand to benefit. The U.S. Treasury and the Hong Kong Monetary Authority (HKMA) both foresee stablecoins playing a central role in cross-border trade settlement, tokenized bond transactions, and retail digital wallets. Regulatory momentum is no longer suppressive; it is now enabling.

Q3: Do fiat-backed stablecoins actually maintain price stability?

JPMorgan emphasizes that while fiat-backed stablecoins are designed to hold a 1:1 peg, real-world volatility occasionally disrupts that parity. The report cites the 2023 example of USDC briefly trading below 87 cents following news of issuer exposure to Silicon Valley Bank. Though the peg was restored quickly, the incident underscores the role of custodial transparency and regulatory backstops. Under regimes like the U.S. GENIUS Act and Hong Kong’s Stablecoin Bill, such volatility is expected to be mitigated by stronger reserve requirements and daily attestation mandates.

Q4: Who are the key players in the stablecoin ecosystem?

The ecosystem is segmented but interconnected. Issuers like Tether mint stablecoins and earn income on reserve holdings. Exchanges such as Coinbase generate revenue through transaction commissions, while custodians like ZA Bank store the underlying fiat reserves for issuers. Blockchain networks provide the infrastructure, brokers distribute access to end-users, and payment processors like Lianlian Global enable merchant integration. Monetization models differ by function, but control over the issuance and transaction rails defines economic leverage.

Q5: How do these players extract value from stablecoin usage?

The clearest revenue models are visible in exchanges and issuers. Coinbase, for instance, derived 61% of its 2024 revenue from transaction fees, and an additional 14% from revenue-sharing agreements with Circle, the issuer of USDC. Custodians earn storage fees, and brokers collect retail commissions. Issuers, sitting atop pools of fiat collateral, benefit from interest income on cash and short-term instruments. Yet, the report stresses that this value chain remains in flux as regulators tighten requirements on transparency and license eligibility.

Q6: Can stablecoin holders themselves profit from holding coins?

Not directly. Both U.S. and HK regulations prohibit stablecoin issuers from paying interest to holders. Nevertheless, some exchanges offer incentives—Coinbase offers over 4% yield on USDC deposits—but these mechanisms rely on platform-level financial engineering rather than underlying stablecoin structure. The legal sustainability of such yields remains unresolved in Hong Kong, pending final interpretation of the Stablecoin Bill.

Q7: How do regulatory regimes in the U.S. and Hong Kong compare?

There is philosophical alignment but functional divergence. Both jurisdictions require 1:1 backing with high-quality liquid assets, prohibit issuer interest payments, and mandate audit disclosures. However, the U.S. restricts reserve assets to USD-denominated instruments, while Hong Kong permits multi-currency reserves, provided they match the currency denomination of the issued coin. Hong Kong also enforces a HKD 25 million paid-up capital requirement, a quantitative threshold absent from the GENIUS Act. Moreover, HK’s bill explicitly applies to both local and foreign-issued coins referencing the HKD, giving it broader jurisdictional scope.

Q8: How does stablecoin policy integrate into Hong Kong’s digital asset strategy?

Hong Kong has articulated a unified policy through its “LEAP” framework: Legal streamlining, Expanding tokenization, Advancing use cases, and People development. Stablecoins are positioned as essential plumbing for this vision. The government has piloted tokenized green bonds and plans to expand public-sector tokenization. Within this context, stablecoins are envisaged as the medium for both settlement and liquidity provision in digital asset markets. The state’s ambition is to serve not only as a regulatory hub but also as a facilitator of cross-sector digital financial integration.

Q9: What technical features will characterize HK-issued stablecoins?

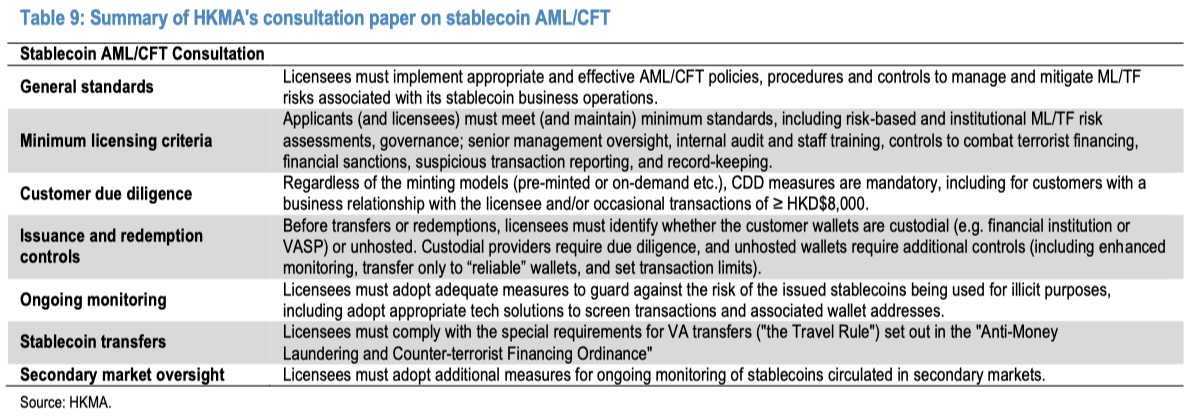

Most will likely be HKD-referenced, with USD reserves permissible in select cases. Reserve assets must be highly liquid—typically government paper with maturities under 12 months, or short-term bank deposits. A haircut mechanism is proposed (e.g., HK$120 in reserves for every HK$100 issued) to provide additional buffer. All ecosystem participants—including brokers, custodians, and exchanges—must obtain licenses from either the Securities and Futures Commission or the HKMA. KYC, AML, and redemption transparency are integral components of the structure.

Q10: What use cases are envisioned for stablecoins in Hong Kong?

JPMorgan identifies four core applications. The first is settlement for digital asset transactions—replacing fiat with tokenized equivalents for smoother execution. The second is trade finance, especially in cross-border contexts. The third involves business-to-business payments within commercial platforms. The fourth is retail payments, though the report casts doubt on whether stablecoins can effectively compete with entrenched systems like Alipay or Apple Pay. The more immediate opportunity lies in medium-sized enterprises, where banking infrastructure for T+0 transactions is either cost-prohibitive or absent.

Q11: Which firms are positioned to benefit from stablecoin infrastructure growth?

Among listed entities, Futu and Standard Chartered (STAN) are early movers. Futu has crypto exposure through Airstar Bank and is applying for a Virtual Asset Trading Platform (VATP) license. STAN participates in the HKMA sandbox via a JV with Animoca and HKT, and maintains custody and tokenization subsidiaries under SC Ventures. ZhongAn Online and JD.com are also embedded in the sandbox ecosystem through subsidiaries. However, JPMorgan cautions that monetization remains nascent—digital asset revenues for both STAN and Futu contribute less than 1% of total income. The future depends on license acquisition and ecosystem expansion.

Q12: What are the broader implications for equity markets?

Stablecoin adoption is likely to reward infrastructure providers and challenge legacy payment operators. Communications services and discretionary sectors—particularly those already engaged in tokenization—stand to gain if they incorporate regulated stablecoin rails. Hardware, wallet software, and cloud infrastructure firms may also benefit from the technology’s expansion. In contrast, traditional credit card and remittance firms face potential margin compression as payment rails evolve. JPMorgan notes early price reactions in relevant equities (e.g., Gotion High-Tech, Tianfeng Securities), suggesting markets are already assigning speculative value to tokenization exposure.

Conclusion

JPMorgan’s report makes no sweeping predictions. Instead, it maps the infrastructure, regulatory evolution, and early commercial alignments that define the current phase of stablecoin development. The central message is not that stablecoins will revolutionize money, but rather that they will underpin the rails upon which tomorrow’s tokenized finance will operate. The winners will not be those who speculate first—but those who operate legally, transparently, and at scale within licensed frameworks. The geography of issuance may be global, but the control points—regulation, custody, exchange, and compliance—will remain jurisdictional. In this context, Hong Kong is is quietly building.

Q12: What are the implications for equities? As cryptocurrencies become more mainstream, we believe that MXCN’s Communications Services and Discretionary sector leaders (e-tailing platforms in particular) are well positioned to reap the benefit if they choose to obtain stablecoin licenses and execute solidly. Many large retailers, e-commerce, and gaming platforms around the world have issued their own corporate “tokens” or gift cards. Rising adoption of stablecoins either via the public or private blockchains will benefit related hardware, wallet, cloud, and software providers. Financials that offer crypto asset trading or stablecoins ahead of peers should also benefit. Since the start of this recent stablecoin trade around June 18, among MXCN constituents, Gotion High-tech, Tianfeng Securities, and Hundsun Technologies have posted the highest share price movements at 25%/18%/14% respectively (MXCN +3%). On the other hand, providers of traditional payment services in credit cards and money transfers may see softening payment rates and volumes over time.

Founders can read the actual report in June 30ths Founders AM

am having trouble squaring this with Catherine Austin Fitts comments on her interview with Greg Hunter (Usawatchdog.com) posted yesterday. She maintains (quoted on written blog post accompanying interview) that Stablecoin is way to get more investment in treasuries and continue to support USD as reserve currency another 10-15 years.

And, further issue I have here is this appears to be Hong Kong-centric. So that means mainland China, and I worry about their social credit system. So my gold, fiat, or Stablecoins token can suddenly be taken away from me?

With the devil being in the details, all these new terms and new business entities have a ways to go to earn my trust. Seems like an awful lot of middlemen in there to take their cut of my money.

I am pushing 70, maybe I am just too old for this?

Also, the big thing with bitcoin is limited creation. But these Stablecoins can just be created with a keystroke, unlimited in number?

Sticking with gold here as monetary metal, and copper and silver for industrial use value for now....

Are you able to share the full report? Would love to read it.