Busiest Week of the Quarter | Market Rundown

ECI comes out weaker than expected: Lower inflation risks seen

Housekeeping: The Active Trader post will be out shortly

Today:

Market Rundown.

GS *must read* on stocks this week, Gold Technicals, a nice Crypto stat sheet, and Nat Gas.

1- Market Rundown:

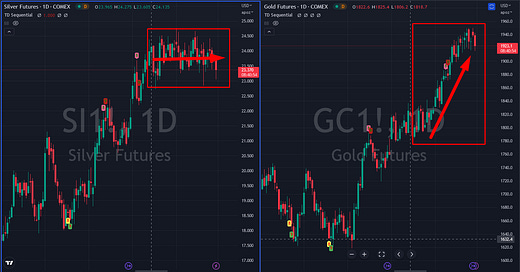

Good Morning. The dollar is up 20bps. Bonds are slightly stronger. Stocks are down 20-50 bps. Gold futures are down $22. Silver Fu. are down 58c. Copper is down 1%. Oil is down 78c. Nat Gas is down 4c. Crypto is up 30-50 bps. Grains are all down with Wheat the weakest at minus 1%…

Comment: Long story short: looking at the investment complex in a 2 day time frame.... this all makes sense so far

Yesterday’s selloff in stocks took the main economic commodities with them: Oil, Copper for example. It did not however budge Gold and Silver much until today. Chinese data did not help commodities this morning. Some reasons to be cautious (not buying for short term gains) but not bearish in metals…

Buy Season: Allocation “buy season” is completely over.. Meaning the flows allocated to metals starting post-Thanksgiving end January 6th.. and then sometimes/frequently you get momentum for the rest of January1. That is done.

Chinese New Year: Chinese New Year is always interesting in that whatever happens in the run up to the holiday frequently (but not always) unwinds somewhat after the holiday is over. So- they bought before the festivities.. they can be sellers afterwards.

FOMC Equities: almost as a backlash to the recent strength in stocks there has been a bunch of —“too far too fast… and the Fed is gonna tighten more for longer because china is coming out of recession”— etc type talk hit the tapes yesterday. Perhaps, this is just news nonsense, but keep in mind after a nice stock rally, there is inevitably jitters as the FOMC approaches

So maybe this all makes sense. Certainly it changes nothing for Gold and Silver in the bigger monetary picture for the next 5 years. But right now.. we’re not so sure.

We’re not worried and fully expect gold to take a possibly serious hit if the Fed decides stocks are too strong and tightens more than expected. But that will not change the destination… gold is going to continue to advance relative to stocks for a slow…long… time

TUESDAY, JAN. 31

8:30 am Employment cost index Q4 1.1% 1.2%

9 am S&P Case-Shiller home price index (SAAR) Nov. -- -3.1%

9 am FHFA home price index (SAAR) Nov. -- 0.1%

9:45 am Chicago business barometer Jan. 45.3 45.1

10 am Consumer confidence index Jan. 109.5 108.4

10 am Rental vacancy rate Q4 -- 6.0%

WEDNESDAY, FEB. 1

8:15 am ADP employment report Jan. 190,000 235,000

9:45 am S&P manufacturing PMI (final) Jan. 46.8 46.8

10 am ISM manufacturing index Jan. 48.0% 48.4%

10 am Job openings Dec. 10.3 million 10.5 million

10 am Quits Dec. -- 4.2 million

10 am Construction spending Dec. 0.0% 0.2%

2 pm Federal funds rate -- 4.25% to 4.5%

2:30 pm Fed Chair Powell news conference

Varies Motor vehicle sales (SAAR) Jan. -- 13.3 million

2- Also:

Goldman Says Buckle Up [Buttercup]…

Zen Moment:

ANALYSIS BELOW…