Housekeeping: includes CTA analysis at bottom

Normal variation/ Trend week

1st day was the tell

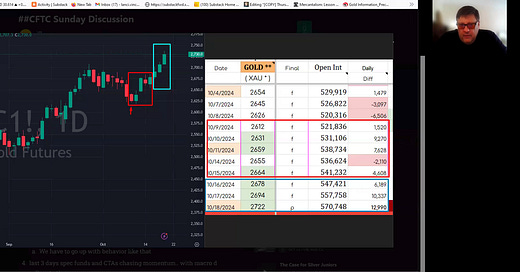

50 higher and the banks sell 4k???? 50 lower thy buy 17-20k.. lol..

We have to go up with behavior like that until the events

last 3 days spec funds and CTAs chasing momentum.. with macro-d selling to them

banks nibbled on option trades.. and got burnt again

Sell some gold buy some bitcoin now.. forget oil it seems

position update

CTAs definitely are adding again..This is the hottest of hot money

Discussion: Why Gold Vol is cheap right now (see last chart)

There is no reason to be short still.

CTAs are long and getting longer in Gold.