Housekeeping: Good Morning.

“Strategy is just tactics on a longer timeline”

Topics:

Bullion Bank Hates the Gold, But Raises its Target

Trump's Copper Tariff Hike in Context (starts 5:15)

Market Analysis:

HSBC Raises Gold Price Target, Then Gets Bearish

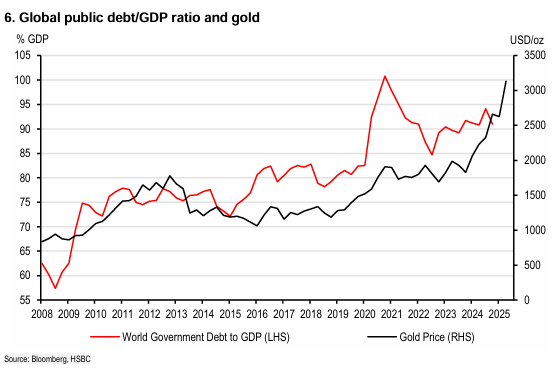

HSBC raised its gold price target—but still kept it below current levels—while simultaneously turning bearish into late 2025. The bank sees waning physical demand, rising mine supply, and ETF normalization as key risks. Jewelry and coin demand are collapsing, though that is to be expected at high prices.

On the other hand, central bank buying and bar investment are surprisingly strong. Retail is running out of bullets, but sovereign entities and high end physical buyers are still buying hand over fist.

Despite geopolitical and fiscal tailwinds, HSBC says the $3,500/oz ceiling holds unless new shocks emerge. The revised forecast underscores a behavioral paradox: higher targets, yet a lower conviction on sustained upside. Which is the signal, a raised target, or a lower outlook.

Full analysis in Premium Post: HSBC Raises Gold Price Target, Then Gets Bearish

Related Posts:

Podcast: Gold, Stablecoins and The Next Bubble

Wall street's methodology since 1971 is the intro. Stablecoins may soon dominate gold ETF markets by merging physical backing with digital convenience. Custodianship remains a trust risk, but the network may begin valuing tokenized gold on par with physical. A gold bubble will form, likely at much higher prices. The vaulting of Stablecoin gold alone will deplete comex vaults dry. Like cash before it, utility may then trump form until systemic risk intercedes. “Rent the stablecoin—own the real thing.” is the opinion.

Coming Soon

Final market check

Data on Deck: FOMC Minutes

MONDAY, JULY 7 None scheduled

TUESDAY, JULY 8 3:00 pm Consumer credit

WEDNESDAY, JULY 9 2:00 pm Minutes of Fed's May FOMC meeting

THURSDAY, JULY 10 8:30 am Initial jobless claims, Fed speakers

FRIDAY, JULY 11 2:00 pm Monthly U.S. federal budget-$66B

Full calendar1

Charts and Final Market Check

Copper jumps on Trump’s tariff threat. .Silver bounces, but remains susceptible to new selling in the form of Copper/Silver spreading… ultimately leading to another 4-5% day higher when Silver shorts realize that was a bad idea…

Meanwhile, gold largely shrugs off the potential tariff war uptick… thats not good.

Conclusion?- the goldsilver ratio may keep dropping even in a sideways choppy market for the actual metals.

MONDAY, JULY 7None scheduledTUESDAY, JULY 86:00 amNFIB optimism indexJune98.898.83:00 pmConsumer creditMay$10.0B$17.9BWEDNESDAY, JULY 910:00 amWholesale inventories-0.3%0.2%2:00 pmMinutes of Fed's May FOMC meetingTHURSDAY, JULY 108:30 amInitial jobless claimsJuly 5235,000233,00010:00 amSt. Louis Fed President Alberto Musalem speech2:30 pmSan Francisco Fed President Mary Daly speechFRIDAY, JULY 112:00 pmMonthly U.S. federal budget-$66B

Share this post