Housekeeping: An extemporaneous but well-studied take on the events leading up to Gold Stablecoins and the path forward from here. (Including opportunities and risks from a physical person’s POV) Starting off with a definitive history on how the Wall Street monster survives and thrives from the Nixon Gold default to now.

Overview: How The Wall Street Monster Survives Change

Audio only: Historical context describing how Wall Street survived from 1971 to 2025.

Intro:

There were two important gold stories yesterday—two stories that seem to stand in stark contrast to each other. They intersect at a critical point in time: where the past and the future of gold meet.

Story 1- China Gold Ponzi Blows Up

The first story involves a Ponzi scheme: a company selling gold it didn’t actually have to Chinese investors. This is a classic case of fraud, as old as the invention of money itself. Opportunists have always preyed on the naive and the greedy.

Story 2- Rise of the Digital Treasury

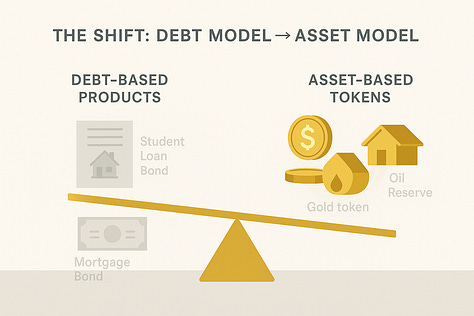

The second story is about the creation of a treasury firm—one that plans to use gold to issue a stablecoin and develop financial products for investors. These two stories appear to occupy opposite ends of the spectrum. One represents old-fashioned, physical fraud. The other represents modern abstraction (also susceptible to fraud): the financialization of gold through digital tokens, stablecoins, and decentralized finance. In truth, this is the old meeting the new.

The Ponzi scheme is self-explanatory and needs little elaboration. The treasury firm, however, might be harder to grasp—especially for people who focus on physical gold and rightly distrust innovation that obfuscates ownership. The crypto jargon alone can also be off-putting, and the concept itself might seem like yet another abstract financial product pretending to represent the real thing. That skepticism is valid. But this isn’t a naked argument against the concept, nor is it a recommendation of it. The rest of this discussion is about how the future of gold is unfolding, and how we will be pulled into it whether we like it or not. And we are NOT telling you to go out and embrace it. But Gold will benefit from it. You can just sit back and watch it unfold while you profit, or you can dabble. 1

That doesn’t mean there won’t be frauds or Ponzi schemes. It means a new monetary infrastructure is forming. This infrastructure is about monetizing and financializing assets that were traditionally difficult to manage in those terms. In this particular case, that asset is gold.

What is the Stablecoin Model?

“Like everything that Wall Street produces, rent stablecoins, own the real thing”

- VBL

Stablecoins aim to replicate basic financial transactions with fewer risks, while preserving the benefits of the underlying asset. In their latest evolution, gold-backed stablecoins are being used to issue financial instruments—specifically, digital tokens backed by real gold. These tokens can be traded, borrowed against, or used in DeFi applications. In essence, they function like shares, similar to ETFs, but each token corresponds directly to a specific amount of physical gold.

Breaking Down JPMorgan's Stablecoin Analysis

JPM wrote a massive 2 part report on Stablecoins. Here is our breakdown of the second more important part for hardcore readers.

This creates a custodial business for them. The firm buys gold and issues a token for each gram or ounce it holds. The token acts as a digital wrapper around the physical gold. While the custodian is still centralized, the existence of the token is meant to ensure that the gold is actually there. The token becomes a hardwired representation of ownership.

The Investor Spectrum and how it will play out

Let’s assume, for simplicity, that there are two broad types of gold investors.