Covid Mini-Crash Warrants No Changes Yet- Goldman Sachs

HouseKeeping: We’ve picked up another bunch of Founder subscribers for which we are grateful. Founders also have full access to Masterclass Archives.

For the holidays all subscribers can get 20% off annual memberships whether they upgrade from free or are new to the site.

Existing subscribers automatically get a free month added to their subscriptions to keep things fair.

SECTIONS

Market Summary: weekly recap

Precious: analysis

Reports: research

Technicals: active trading levels

Podcasts: GoldFix and Bitcoin

Charts: related markets

Calendar: next week w/ Bank levels

1. Market Summary

Instead of QE and ZIRP making people wealthier by pushing up asset prices, it now makes them poorer by pushing up consumer prices instead. Monetary stimulus has become a sedative. It's game over!"- Peter Schiff

Not sure if it is “game over” Peter… Maybe “game slowing down” a bit. But the point is well taken. Where to start?

Friday’s Covid Crash Notebook:

Speedy global mobilization by the CDC and WHO may be an overreaction, but can you blame them? They screwed up royally last time. Better to err on the careful side this time for their own job security.

Markets likely reacted to the CDC response rather than the actual threat. Prices should rebalance quickly if this is found to be a less lethal variant.

Goldman clients probably freaked out. The bank issued a “stay the course” memo that in no way says they should make changes yet.

Goldman: we do not think that the new variant is sufficient reason to make major portfolio changes."

If the threat is real ( or even not so real) and stocks do continue to crash, then we know this market is hopelessly addicted to money printing and cannot stand on its own 2 feet at all.

Oil move seems way too big and we suspect it is in part based on too many longs needing to exit for end of year and all doing so at same time on the fearful news.

Oil: We’re told Mexican production was underhedged, paper longs were looking to sell for end of year, and fresh allocations into oil will not be very large.. thus a flush

Oil: Its insane to think OPEC wouldn’t cut production quicker this time anyway… There are now trapped longs

Also Goldman: a worst-case outcome means [ Brent} oil is fairly priced at $80. At its closing price below $73 it's a steal. [ EDIT- implies that approxomately $7 of the $10 drop on Friday should be undone if all is well- VBL]

If the oil move is too big, then maybe its all too big.. and that means the dollar is a buy, and Gold might be a sale again.

Oil should rip higher when the pros come back ifthis is all correct.. which would mean Gold may clip lower if that happens…its all panic flows

The meta message is this mini Covid crash showed the limitations of policy right now. The next round of easy money will increasingly find its way to consumer goods more and Stocks less. AKA inflation

Politicians do not want to go back to lockdowns and all the problems they caused like last time. They will not stand for this.. Which means we should have an aggressive bounce. if not, then they really are losing it.

Price controls are likely coming, possible stimulus is on hand, and the most apparent idea is that the Fed may have to defer its planned tapering.

In panic events like this, time can be seen to speed up. Meaning: what happens in the economy at a leisurely pace gets sped up due to crisis.

How markets and governments react if this persists should be seen as a fast forward of where we are going anyway…. like the pandemic taught us last year

Chaos makes things more efficient after the initial world changing event..

New Variant

At 3 a.m. Friday, when London and European bourses opened in full swing; market alarms went off in Stocks, the Dollar, and Gold simultaneously. Markets were all reacting violently to the fears of a new Covid Variant that presented in South Africa as a concern.

By The Way

The Variant name was going to be “NU” but that was skipped over because of concerns it would be called the “New Covid”. The next Greek letter in line was “Xi”. That was also skipped over in favor of Omicron. Plenty of community members were quick to point out what was being protected on that one.

We did not see a gun pointed at anyone’s head as our picture humorously suggests. But after Jamie Dimon kow-towed to his Chinese overlords last week, we can guess why.

Potentially high transmissibility has triggered market concern:

It is gaining pace rapidly sequencing 90% of new cases just 2 weeks since emergence. For comparison the Delta needed 3 months to reach that intensity. This is the most concerning data point that has attracted market attention.

That is what the markets focused on. No hospital data was available as of this writing. Goldman’s detailed comment here. People in the markets reacted to the ease with which it spread, not anything else.

That said: almost all market behavior directionally made sense (not necessarily in magnitude however) in this context. When you combine the holiday week and the half-day on Friday with this event, you get what we saw. Stocks crushed, Bonds bid, and Gold violently stable.

Friday’s early morning behavior was chronicled in our post Markets' First Reaction to The New Covid Variant

At 3:50 a.m. we posted this online:

What is it: it seems to be a variant with many sub variants or strains. They think Ground Zero South Africa. And nations are closing borders internationally [until] they figure it out

At 6:30 a headline came out that showed the spread to Europe:

Two suspected cases of the new Covid-19 variant have been detected in Belgium: Telegraph

That set the stage for market turmoil all the shortened livelong day.

Summary

Stocks were crushed early Friday morning with Small Caps leading the collapse (down over 5%) before the US open. A big wave of selling then hit the market after the US open. Stocks thus resumed accelerating back to the lows of the day as the European markets went into their close.

That made sense as the new variant had been identified in South Africa first. Then it had been seen to spread to Belgium soon thereafter. So the majority of the panic selling was EU based initially. There was plenty of US selling, but not the kind of volume normally associated with US markets.

Note in the graphs above that Friday’s selloff was most pronounced in Dow stocks. The slam was less pronounced in Nasdaq stocks, and the S&P 500 was somewhere in between the 2 extremes.

Flight to Covid Safety

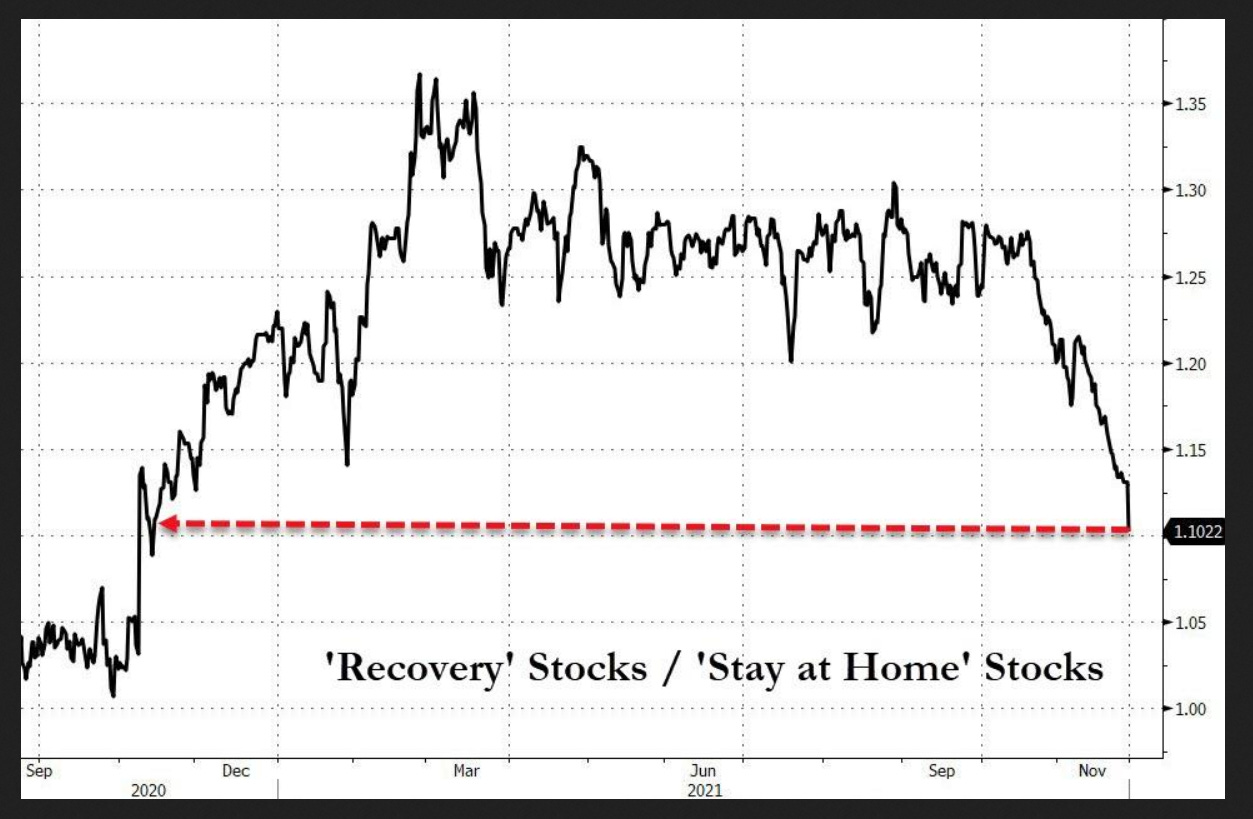

One read of this would be to note that any stock that could be described as a Covid “recovery” type was hurt the most. Those companies are mostly called “value” stocks and reside in the Dow.

The “stay at home” stocks held up relative to their Dow counterparts. Zerohedge provides a nice graphic representation of this above. This relationship deteriorated to levels not seen since last year this time

Friday was Russell 2000's worst day since June 2020. The Dow had the worst day since October 2020. S&P and Nasdaq both suffered their biggest daily losses since September 2021.

Sector Performance

On the week, all the US majors were in the red with Small Caps ( see 1) under-performing.

Growth and Value stocks were hammered on the week

Toilet paper stocks did well- see 4

Healthcare stocks lead by Pfizer did just fine- see 2

Copper miners defied the broader markets- see 3

Companies: Long Toiletries.

So, finally, what happens next?