Housekeeping: Good Morning.

“The reset is a process, not an event.”

Today

Discussion 1: DB Triples Down on Gold

Discussion 2: JPM Says Yes to $4,000 Gold

Analysis: DB Triples Down on Gold

Deutsche Bank believes there is a limit to the extent of a gold correction lower. The Bank argues it is not reasonable to expect a 'winding back of the clock' to a pre-tariff shock world from Tuesday's developments.

In a note titled Spot the Difference published April 22nd in the midst of the Gold selloff they said:

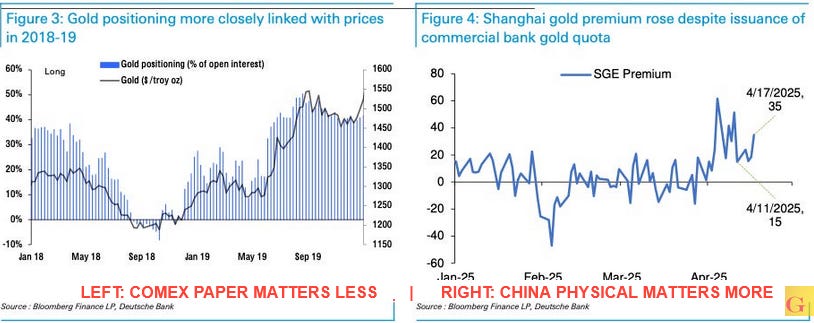

We believe that the demand picture makes a greater than-5% correction unlikely; from today's USD 3,395/oz this indicates a likely floor around USD 3,200/oz. The key constituents of the demand picture include the expanding role of official investment, Asian physical investors' acceptance of a higher price, and greater China ETF inflows, [Not US Fund buying]

Comex Deathwatch in full effect…..

The next day, as the second leg of the waterfall selloff was in full force they doubled down

From: There is no 'winding back the clock' for gold

If we combine a US insistence on pressing ahead with the aim of extracting material trade concessions with signals from key trading partners that negotiations will not be as smooth as Pres. Trump hopes, then a smooth reversion to a status quo appears untenable.

This all started April 7th with DB's re-emergence on the scene as a bank with a bias where they joined ranks of GS, BOA, UBS and the other Bullion Banks with a coming out report of sorts DB Raises Price Target to $3,350 on "Risks to USD Reserve Status" where they noted the true demand was Eastern and that Chinese official demand had now begun to disseminate from the government to the rest of the region

Quoting that report: The key constituents of the demand picture include the expanding role of official investment, Asian physical investors' acceptance of a higher price, and greater China ETF inflows that we described in early April.

Full analysis available to Premium subscribers…

Featured:

Full coverage of that report will be going out today…

Markets Recap:

Wall Street ended higher, and the dollar rebounded as optimism over tariffs and President Trump’s assurance that he has no plans to fire Fed Chair Powell boosted investor confidence. Treasury yields were mixed. Gold declined as risk appetite grew, while oil prices fell on report that OPEC+ was discussing a possible output boost.

The Toronto Stock Exchange's S&P/ TSX Composite Index ended up 0.69% at 24,472.68 points. Information technology shares rose 3.33% to 258.80.

Market News:

-Apple, Meta fined as EU presses ahead with tech probes -Investors relieved Musk will refocus on Tesla, but worry about brand damage -AI boom under threat from tariffs, global economic turmoil -Marlboro maker Philip Morris lifts profit forecast on ZYN demand -Tariffs may mean more US steel jobs. Will there be workers to fill them? -Tariffs restrain US business activity, boost asking prices for products

Full stories and recaps in premium…

Data on Deck:

MONDAY, APRIL 21 10:00 am U.S. leading economic indicators March -0.3%

TUESDAY, APRIL 22 9:30 am Philadelphia Fed President Harker speaks

WEDNESDAY, APRIL 23 S&P flash U.S. services PMI

THURSDAY, APRIL 24 Core durable orders (business investment) March

FRIDAY, APRIL 25 10:00 am Consumer sentiment (final) April 50.81

Summary and Final Market Check