Fed Day Summary:

The market is discounting 25 bps today, with a tiny chance (under 2%) of a 50bp hike.

Assume the market fully expects a 25 bp hike and any activity on the back of that will initially be musical chairs for those who were hoping for a dip to buy versus those counting on a rally to sell.

The market will begin to parse the statement, the DotPlot and finally the speech.

Today’s Focus:

The biggest focus right now is if we are near the end and where it stops. The speculation in the market will hinge on that.

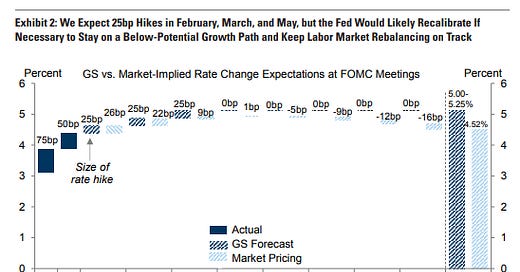

Some (and growing) are betting “one and done” after today. Some banks believe 2 more hikes. In aggregate the market is handicapping it as follows:

Between the day after today and May:

75% chance of only 1 hike

25% chance of 2 hikes

The market is thinking there will therefore be 1 more hike of 25 bps at the March meeting ( there is no April) and then no more.

Goldman says 25 bps in March and 25 bps in May.. but they are not so sure about May anymore:

"we expect two additional 25bp hikes in March and May, but fewer might be needed if weak business confidence depresses hiring and investment, or more might be needed if the economy reaccelerates as the impact of past policy tightening fades.

Fed officials appear to also expect about two more hikes and will likely tone down the reference to “ongoing” hikes being appropriate in the FOMC statement."

So….. if more people get fired then no May hike. If inflation re-accelerates (unlikely).. then one more after May1.

Last we left the Fed in December, they thought about 2 more after today. If we use the Fed December dot-plot.. on average they thought 2 more and done.

Zerohedge notes this:

As a result, [of the Fed thinking 2 hikes back in December] Goldman expects the FOMC will probably tone down the reference to “ongoing” hikes being appropriate in the FOMC statement, perhaps by replacing “ongoing” with “further.

Therefore the question is, will the Fed revise its dot plot to be more in line with the market.. or will the market get rudely awakened by their stubbornness on the future rate outlook. That may be the key today. We’re not sure.. but it seems like one thing to focus on today.

What may seem contradictory given the past few months is the following:

If people like Zoltan and the Feds own speakers have been talking tough trying to get stocks down this past 3 months… warning us that we are too wealthy… How can they let this most recent run up stand? Why are they not calling for more hikes? We have an opinion but it is too big picture and way too early.

But Didn’t They Want Stocks to Go Down?

Yes they did as a sign the economy was slowing. But they’ll be equally happy if you are getting fired. Because they were really worried about wage-price spiral inflation. Ultimately that is what drove hikes.

Post December…