“For countries that see CPI exceed 5%, it takes around 10 years for CPI to fall back to 2%.”

-JPMorgan

Market Rundown

Good Morning. The dollar is weaker down 17 points. Bonds are slightly stronger up more in the front end than the back. Stocks are up 10-30 bps so far. Gold is down $3.50. Silver is up 11 cents. Crude oil is up $1.50. Nat Gas (the harder they rally, the bigger they fall) is down 5%. Crypto continues its climb up 1.5% on average among the two majors. Grains are mixed with Soy the only one positive.

FOMC Rate Decision Today

Consensus is 50bp hike3% expectations of 75bp

FOMC Preview: Boil The Frogs Slower

Some summary points of note going into today’s rate announcement. Three things that will be watched at today’s FOMC announcement:

The Rate Hike: expected to be 50bp with a tiny chance of 75bp

The Dotplot Terminal Rate: expected to be raised from September’s (slower hikes/higher target reaction) 4.625% level.

Powell’s rhetoric.

Rate Hike:

This is straight forward. If the Fed should raise 75 bps (though odds are very much against it) things will get extremely ugly. Yesterday’s CPI increased chances of a 25bp hike (as opposed to 50bp) for February.

Terminal Rate:

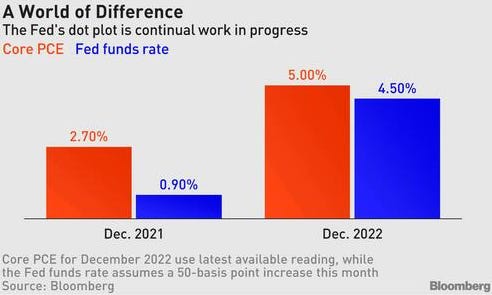

The dotplot is likely to be somewhat higher than September’s 4.625% for 2023 and money markets are pricing in a rate of 4.86%, implying a FF Rate of 4.75-5.00%. But how we get there ( 50 bps or 25bps a clip) is another story after yesterday’s CPI. All together up from Septembers levels, but down a little bit (was 5.0% before CPI) after cooling inflation.

Important to note, the Dotplot is as volatile as the market itself and unreliable in our view. But people keep watching it for discernable patterns which makes sense.

Powell’s Rhetoric:

His comments last week at Brookings caused a very strong positive reaction from stocks. We believed he would use the speech to hawkishly attenuate the rally if CPI were low yesterday. Turns out he doesn’t have to given the pullback all the way to unchanged after a rip higher. He probably has 2 speeches to use: one if stocks are too strong, another if they are much lower. But his words will cause gyrations again.

Hawks vs. Doves:

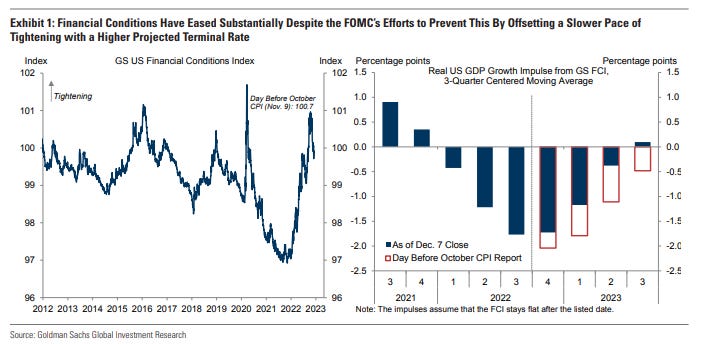

Hawks will cite the improving Financial Conditions index which actually signals more ease than before we started this.

Doves will focus on several things, one of which is the CPI relationship with M2 and how it will catch up very soon

You can pick your poison. Goldman1 (slide show below) which had been more hawkish than JPM (before today) citing their FCI analysis.

Looking Forward:

The Fed does not meet again until February. So the dotplot will likely be the most talked about piece of Fed info between now and then. In fact Nick Timiraos already made a point of mentioning it last night.

After today’s event is digested we expect markets to look towards earning season in mid January for its next reality check. Before then, the end of year reallocations and EOY selling will take precedent. If yesterday was any indication it will be bizarre for stocks and oil, yet predictable for Metals.

Why Gold is OK. The 10 year plan

More money is going into Gold again as incoming dovish expectations also lead to exacerbated back-end inflationary pressures later.

It is hard to make a case to not own a little Gold given the state of trust in government, markets, and politicians these past few months. Justified or not, the older stock investors are increasing their GLD and SLV in proportion to their fears of a return of what we just experienced. Younger ones would be smart to pay attention.

BTW- we don’t know why everybody is crowing about 7.5% inflation as a dovish moment. It isn’t. It is more like relief Powell wont crash stocks any more. It’s easier to boil investor frogs in debasement than it is to resuscitate them in depression