Housekeeping: There will be no Founders class next Sunday. Therefore we did a huge podcast with a lot of content for Technical traders, Metals traders, and students of markets. Enjoy! - VBL

Podcast Slides and Preview HERE

Technical Trading: Triple Top Formations

“Triple Tops are made to be broken”. Why?

Starts 0:33

Triple Top (weak) and Double top (strong) formations

Why their perceived as they are

How they are formed

Whales, Sharks, and Piranha traders create the formations

Some ways to trade them

London/US Backwardation means there is physical buying and paper selling

Using Gold & Silver Spot to prompt Comex Backwardation as Oversold/Overbought Indicators

Starts 19:30

London Spot versus Comex futures

Why does backwardation happen in a huge selloff?

Why does contango steepen in a big rally?

Backwardation after selloffs, Steep contango after rallies

Bank flows and EFP arbitrage

How a bottom forms from this

Understanding Physical orders and Bank “leans”

Block trades: Wholesale versus retail executions

The ways they can resolve

Question: What can create a Real Gold (temporary) short squeeze?

Starts 43:30

Central Bank Behavior between 1987 and Covid

Historic perspective

Central Bank breaks ranks, France 1971

Bifurcation of Banking East/West

Question: What would happen if we overnight went back on the Gold Standard?

Starts 48:20

Money supply to Gold price

Government reaction to mute the effect of this

Have your physical

Gold bugs are right

The Role of Comex and western exchanges

Why would we do that?

Gold War: BRICS New Money and West BW3 retaliation

Ruble strength

Brazil arbitrage as example

The Gold black market

Why Silver goes through the roof

Question: CBDC, physical metal, Digital money future

Starts 57:05

Events as sign posts of change

Abolish cash, use CBDC

Why you buy when you can, not when you have to

Wear your wealth- China

Korean immigration to USA

CTA Positoning and Behavior in Copper, Gold, and Silver

Starts 1:04:30- Ends 1:17:00

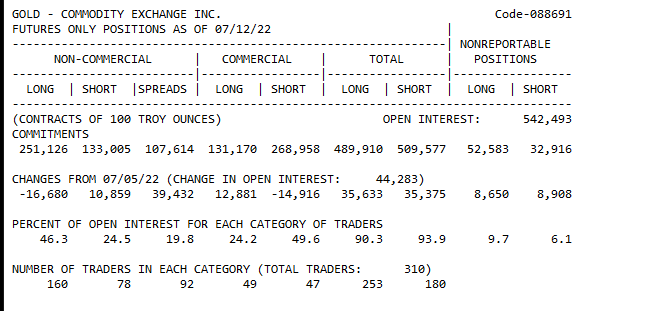

CoT Analysis

Starts 1:17:30

Gold, Silver, and Spreads weekly analysis

Long funds reduced and short funds added = same OI but more shorts

Short commercials reduced and Long commercials added = Same OI but less shorts

Tehcnical issues, reconnects 1:24:00

Spread comment: Banks closing Oi and using exchange?

1:29:00 Silver quick comment

Technical Overview of Moor Reports

Starts 1:33

Gold, Nat Gas, and Oil levels from Friday

A little Geo-pol oil comment

Reports courtesy Moor Analytics

Addendum:

Gold in different time zones and watching the market

Technical difficulty again End

Full Founders Archives HERE

Five Popular Classes

Bonus: a Rare ( these days) genuine Tesla buy recommendation?