Housekeeping: In light of the large increase in depth and variety of content, as well as the increased time and effort put into this project1 subscription prices will likely be increasing soon. Founder class costs will definitely be increasing.

Silver CoT Analysis:

If you are truly serious about Silver as a trade-able contract and want to understand a little more about the market structure while getting timely insights into the current run up in the metal; Then this is for you. If you have the time and want to be a better informed trader/investor in every market with Silver as your jumping off point - Then this was done especially for you.

This Sunday’s Founder class spent a large time on Silver as it is on our radar for multiple reasons. What follows is almost 90 minutes of conversation on particular traits of Silver including: Short squeeze behavior, Backwardation2, SLV borrowing costs, CTA behavior, and a ton more that is going on right now in precious metals in general, and Silver specifically.

***Bonus: includes Bank CPI prep report for this week at Bottom***

Overview:

Last week we did 3 interviews on precious metals, economics, and commodities in general. In each interview we had extended comments on Silver as it had finally become very interesting of late and near some type of short term tipping point. More on those interviews in a subsequent post.

This Sunday at 2p.m. ET we tried to put the content of those interviews together into some actionable advice for Silver traders. The metal is covered from fundamental, Flows and technical perspectives. Enjoy. VBL

Time stamps are approximations. If you wish to discuss something in more detail, reach out to us for future classes.

0:00- Silver EFP discussion and physical demand

6:00- Current situation in SLV and extended walk-through of “hard to borrow” short squeezes

22:00- the “borrowed silver” in SLV concept touched on loosely

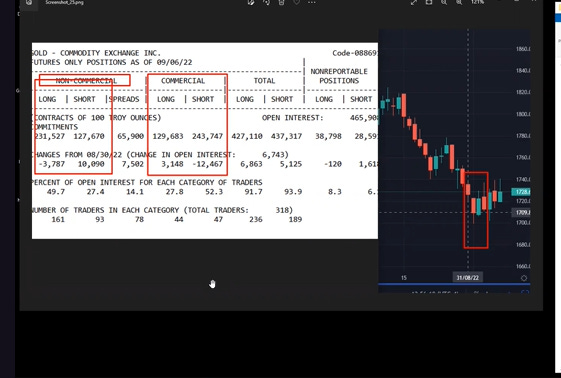

24:00- Silver CoT Weekly Analysis

Short Funds got shorter

26:25- Quotable

30:00 Gold CoT Weekly Analysis

in context of Silver’s behavior

the shorts aren’t nervous yet

if Silver is up, Buy Gold Monday

Commercial marketmaking bias

34:00- Gold seasonality between August and November

How banks recommend on this

35:00- Why Silver has so many shorts now

37:00 Copper and Silver

38:00 Silver short behavior analyzed historically

43:00- quotable

46:00- Who represents the “dumb” retail in Silver. The CTA/ CPO business model

49:00- How Silver bias was made and remade.

54:00- Who are CTA clients?

1:00- GoldSilver Comment

1:01- Gold Technical levels

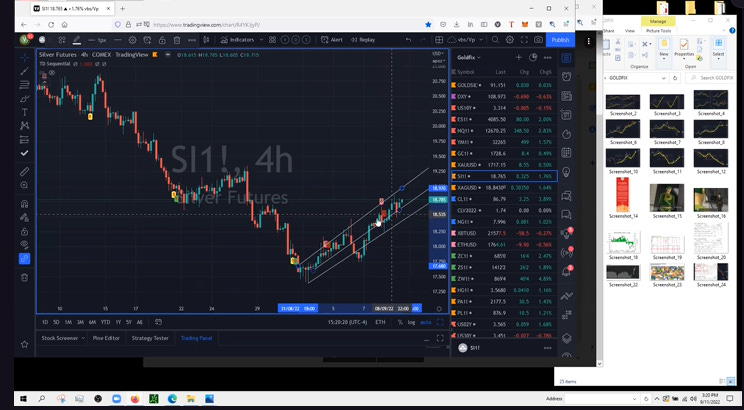

1:06 Silver chart pattern comment

1:09- buying in Europe and US hours now

1:11- Option hedges as fuel for Short squeeze fire- 5 day option comment

1:16- Bitcoin Ethereum futures CoT comment

END