G&R Quarterly: The Return of the West

And the Coming Copper-Uranium Divergence

Contents:

Intro

UBS reaffirms 2025 Gold Target

G&R Precious Metals: The Return of the West

Copper and Uranium: The Coming Divergence

UBS Week Ahead

1- Intro:

The much respected Goehring & Rozencwajg’s Natural Resource Market Commentary for 2024 has been published. The pdf can be accessed on their website here (we would request you sign up for their reports) or at bottom.

Find below broken out the G&R Precious Metals commentary below along with additional observations footnoted and subtitles added. First a quick summary of their Uranium-Copper Thesis.

The G&R Uranium-Copper Divergence

The real focus here for G&R is what they believe will be a large divergence between Uranium and Copper. The case for uranium as you might presume, is bullish, especially in the wake of renewed nuclear power interest stemming form AI/Database needs and the accompanying increased awareness our power infrastructure is sorely in need of refurbishing.

Copper, however is less obvious: Here’s the firm’s main point

Our perspective on renewables and their impact on global copper markets has radically changed. After extensive study […]we’ve concluded that large-scale adoption of renewables—including EVs—will be unfeasible unless societies are willing to accept substantial declines in economic growth and living standards. Our research suggests that the universally bullish copper demand forecasts are poised to unravel, potentially leading to bearish copper price implications.

The reality check coming will make it hard to justify the expense in an idea that is neither efficient nor inexpensive. The math does not work.

For us: their copper analysis puts Silver in focus with a slew or questions that will need to be answered in coming months and footnoted below1

2- Bonus: The UBS Week Ahead

Also find attached at bottom UBS Week ahead in which they reassert their bullish call for 2025

We anticipate that trade-related tariffs, geopolitical risks, lower interest rates, and eventual USD weakness will drive upside in precious metals. Our end-2025 target for gold is USD 2,900/ oz.

Full commentary bottom

Here is the G&R Precious metals section with GoldFix commentary footnoted

2- Precious Metals: The Return of the West

Gold & Precious Metals Recap

Gold and silver prices increased in the third quarter, with gold climbing 13% and silver advancing 6%. Both metals have broken through significant technical levels— gold at the end of February and silver at the beginning of May—and their subsequent trajectories have been extraordinary. Since its breakout, gold has surged nearly 35% while silver, following its May rally, has gained 25%. These moves’ sustained strength and persistence suggest that precious metals have entered robust, new bull markets.

For a deeper dive, see the precious metals section of this letter [EDIT- see “Return of the West’ just below] where we explore the renewed interest of Western investors in the physical gold and silver markets. We also examine the notable behavior of central banks and the puzzling apathy Western investors continue to exhibit toward gold equities. This investor indifference, particularly striking given the compelling valuations of gold stocks, is a theme we analyzed in detail in our previous letter.

The early stages of a gold and silver bull market are unfolding, offering investors a rare opportunity. With precious metals markets gathering momentum, we believe it is essential to maintain substantial exposure to this sector.

The Return of the West

In the tumult of the global gold market, the past four years have unfolded as a clash of opposing forces. On one side, the steady drumbeat of rising real interest rates beginning in early 2021 prompted Western investors to liquidate gold holdings with an enthusiasm as familiar as it is predictable. Conversely, an equally determined cadre of global central banks emerged as voracious buyers, amassing reserves with a resolve that seemed to shrug off conventional market pressures.

Initially, it appeared the sellers were winning. By the third quarter of 2022, the price of gold had fallen 20% from its highs. 2

[Physical Demand Overtakes Financial Selling]

Yet, as often happens in markets governed by crosscurrents, the story took an unexpected turn. Central bank buying surged to unprecedented levels in 2022, ultimately overwhelming Western selling. The result was a sharp reversal: gold prices began a remarkable ascent, climbing steadily through 2023 as central banks continued their buying spree. By the middle of 2024, the gold price had vaulted over 70% above its 2022 lows, an extraordinary feat given the headwinds.3

[Western Buyers Return]

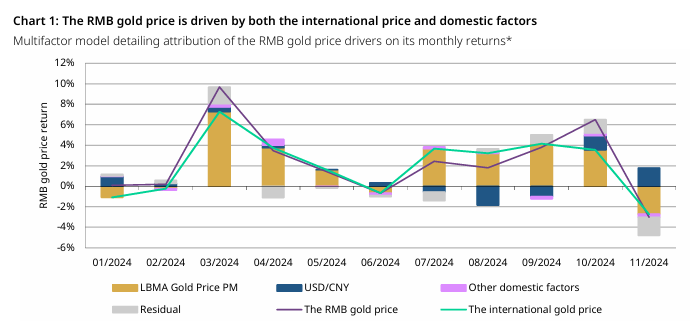

However, the market appears poised on the brink of a fundamental transforma-tion. Central banks, though still buyers, have eased back from the feverish pace of the past two years. Meanwhile, the tide of Western investor sentiment, long bearish, seems to be turning. Declining real interest rates are enticing these erstwhile sellers to reverse course. Between October 2020 and May 2024, the eighteen physical gold ETFs we track collectively shed 1,200 tonnes, rivaling the massive outflows of 2012–2015. But since mid-May, these same ETFs have pivoted, accumulating 150 tonnes—a decisive shift that mirrors broader changes in sentiment.

Silver, often the forgotten sibling of gold, tells a parallel story. From 2021 through early 2024, Western investors liquidated physical silver holdings with abandon, reducing ETF reserves by 13,000 tonnes—two-thirds of the silver amassed during the buying phase of 2019–2021. Yet here, too, the tide has turned. Since May, these ETFs have added 2,500 tonnes of silver, echoing the shift in gold markets.

The current buying phase starkly contrasts the brief resurgence of Western gold demand following Russia’s invasion of Ukraine. Then, gold ETFs accumulated nearly 400 tonnes within two months, but the rally proved short-lived, lacking confirmation from the silver market. Today, the synchronized accumulation of gold and silver suggests a deeper, more sustained shift. 4

[Central Bank Buying Remains Firm Off its Highs]

Central banks remain in the picture, albeit with a somewhat reduced role. In the third quarter of 2024, they purchased 186 tonnes of gold, down 40% from the same period a year earlier. The Polish National Bank led the charge, adding 42 tonnes to bring gold to 16% of its reserve assets, with plans to push that figure to 20%. India followed, adding 13 tonnes in the third quarter after purchasing 18 tonnes in each of the first two quarters. Noticeably absent was China, which, after dominating as the largest central bank buyer in 2023, has now sat out for two consecutive quarters—a pause that reflects the dampening effect of gold’s recent price surge.

[EDIT- Only two days ago China returned to publicly buying after this report was published. Further, China’s clandestine buying however continued even when they publicly reported nothing That said, for the period covered, CB buying definitely toned down compared to priors even with the “secret” gold added in ]

For 2024, total central bank purchases through the first three quarters reached 694 tonnes—a 17% decline from 2023’s record-breaking pace, yet still the third-highest on record. These figures suggest that central banks, while no longer driving the bus, remain key players in what could be a historic transition in global monetary regimes.

[Financial Debasement is Upon Us]

Similar seismic shifts occurred in the early 1930s, the late 1960s, and the turn of the millennium. While the specifics of the impending change remain elusive, the outcome—a serious debasement of fiat currencies relative to gold and other real assets—seems all but inevitable. The price of financial assets will be debased relative to gold and other real assets which happened in the four other monetary regime changes that took place last century. The subject of monetary regime change and its impact on gold prices is a subject we have extensively covered in previous letters.

If central banks set the stage for gold’s recent rally, the return of Western investors could amplify the narrative. Gold prices are in the midst of a substantial bull market, yet investors interest in gold equities remain eerily muted. By several metrics, gold stocks today are as cheap as they were in 1999–2000, a period marked by deep skepticism and relentless selling from European central banks. For more details on the cheapness of gold stocks, please consult our 2Q24 letter.

[The GDX Puzzle]

Despite a 15% rise in gold prices since our last letter, the GDX—the most widely held gold equity ETF—has seen outstanding shares shrink by 5% over the past three months. Since gold’s breakout in March, GDX shares have contracted by nearly 20%, even as gold prices climbed over 30%. This peculiar divergence—the rising price of gold versus waning interest in gold equities—is a study in investor psychology.

The chart below illustrates this anomaly, juxtaposing the advancing gold price against the declining shares outstanding of GDX.

For all the fascination with the “Magnificent Seven” tech stocks, the numbers tell a different story. While the QQQ ETF, which tracks the NASDAQ 100, is up 23% year-to-date, gold and gold equities, as measured by the GDX, have risen 38% and 34%, respectively. Yet the broader investing public remains fixated on tech, oblivious to the quiet outperformance of precious metals.

[Early, Not Late Stage Bull]

We believe we are witnessing the early stages of a gold bull market that will run for years. The current disinterest in gold equities represents a remarkable opportunity for contrarian investors. Gold stocks will likely be viewed as indispensable assets when this bull market reaches its zenith. For now, however, the prevailing disinterest offers a golden—if undervalued—opportunity.