Gold: "A crisis is unfolding. A crisis of commodities"- Zoltan Pozsar

When this war is over, money will never be the same again

In Zoltan’s latest missive on the events in Ukraine, he describes the situation, mechanism, and likely outcome of these global reaching events. They greatly affect how we define money. The report ends with: After this war is over, “money” will never be the same again1… He is right.

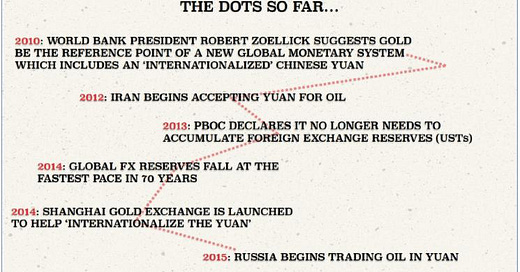

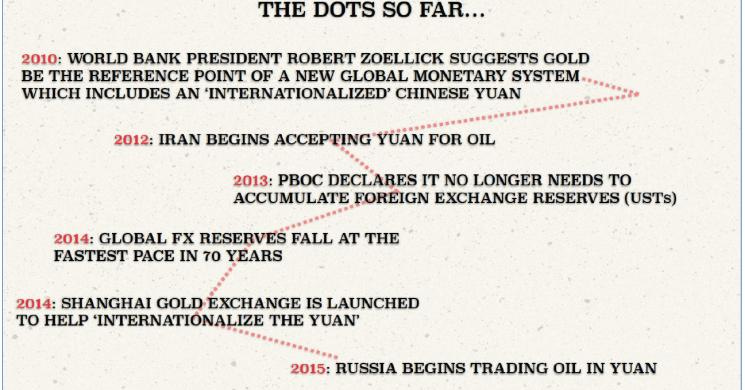

The report, entitled Bretton Woods III lays out in more detail the concept touched on in a Bloomberg Odd Lots interview with Joe Weisenthal and Tracy Alloway. In that interview he explains why Gold is important again and how this recent turn of events can serve as an accelerant of the demise of US Dollar dominance. The latter, we believe has been ongoing since at least 2017.

From our 2017 post Golden Yuan: Crude Backed By Gold is Here:

China is long gold. Therefore it only makes sense they will use it to make payment for oil from Russia and the Saudis. It will either be gold or yuan with "implicit" gold backing.

Back then we identified the transition from Fiat money to a more physically backed currency. But there is much, much, much more to it we are learning.

Commodity Collateral Is Money

Pozsar’s latest is a report combining secular, geopolitical, and flow analysis dives into many interrelated topics. One topic of direct interest to us was

…that markets are moving from inside (core) money towards outside (peripheral) money. What we feel he really means is the core is becoming the periphery and vice-versa.

A crisis is unfolding. A crisis of commodities. Commodities are collateral, and collateral is money, and this crisis is about the rising allure of outside money over inside money.

Collateral is the foundation on which the financial system is based. Collateral equals money in the realest sense. The “outside” collateral is no longer the periphery.

That collateral is a large and grossly undervalued part of the current core’s valuations. Put another way, the derivative-tail has been wagging the spot-dog too hard and too long.