“I have supervised situations involving allegations of criminal activity and malfeasance (Enron). Never in my career have I seen such a complete failure of corporate controls and such a complete absence of trustworthy financial information as occurred here. “

-John J. Ray III, FTX CEO as of Nov. 11th, 2022

Today:

GS Macro Slidedeck, Bullard Thinks 5 to 7% is the play for rates

Big JPM weekly on FTX, Unicredit, TS Lombard, and the (quite insane) FTX Bankruptcy Affidavit

Market Rundown

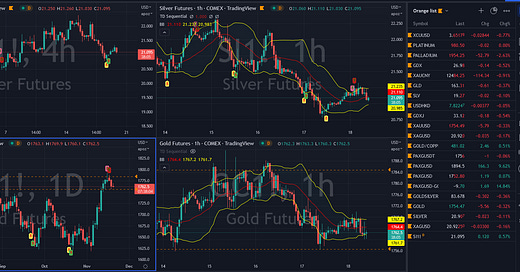

Good morning. The dollar is down only 3 points. Bonds are slightly softer. Stocks are up between 60 and 120 bps after yesterday’s Bullard drubbing and today’s massive OPEX. Gold is down less than $1.00. Silver is up 8 cents. Crude oil is down almost $2.75 and Nat Gas is down 26 cents. Crypto is up small and grains are up between 10 and 40 bps.

We’d caution anyone with a strong opinion on Gold and Silver who were dismayed by yesterday’s performance to not sweat it. But readjust your own expectations for choppy behavior until Gold gets either above $1794 or below $1750. Then make your decision to either trade the range or chase the momentum.

Gold Trading: It’s Just a Range

As far as Gold goes, we are content to say this market is now back in a higher trading range. Any activity between $1794 and around $1750 should be viewed as trading range and ignored for any good or bad Buy Season activity. We are saying this to ourselves as much as to the reader: Levels and discipline matter so much more this time of year because we are firmly biased bullish now above $1750. That means, the profits will take care of themselves if we are right for the next 90 days. It’s the losses we must protect ourselves from even more now if we are wrong. Below $1750 we reassess, and if the market goes above $1794 and then reenters the range, that gets us nervous as well. Otherwise we may just sell options in butterfly form with a slight bullish bias while we wait.

Translated in action for us: that means cut losses short aggressively based on how many trades we want to do for the next month, and let profits run with trailing stops as opposed to taking profits at targets. So for the next 30 days if we will risk 5% losses and we think there will be 5 trades to do, then on no individual trade will we risk losing more than 1%. On profits, instead of selling longs at (2x what we risk) targets in a disciplined fashion, we will let the market “take us out” with a trailing stop. In this way we are miserly on the losses, and greedy on the profits, keeping in mind we risk giving back profits this way as well. We are also more inclined to use options this time of year. Many stay away from them as holidays approach due to lack of trading days ,and that is not a bad rule. We’re quite comfortable1 using them more this time of year, as the global Gold and Silver markets trade, even when the US doesn’t.

Today’s Excerpts

A lot of 2023 marketing pieces coming out now and varying takes on Fed sincerity on their path to higher rates.

1- FTX Bankruptcy Affidavit

FTX's new CEO and liquidator, John Ray III, who also oversaw the unwinding and liquidation of Enron, admits that "Never in my career have I seen such a complete failure of corporate controls and such a complete absence of trustworthy financial information as occurred here."

And just in case his shock at FTX's fraud of epic proportions was not quite clear enough, he adds that "from compromised systems integrity and faulty regulatory oversight abroad, to the concentration of control in the hands of a very small group of inexperienced, unsophisticated and potentially compromised individuals, this situation is unprecedented."- ZH Source

CONTINUES AT BOTTOM

2- Goldman’s 2023 Macro Slide deck

CONTINUES AT BOTTOM

3- Effects of FTX Bankruptcy Continue to Ripple

FTX facing potential criminal misconduct after Bahamas law enforcement suspended its registration and ordered assets tied to the exchange to be frozen.

Crypto exchange FTX victim to $600mm+ crypto attack after filing for Chapter 11 bankruptcy proceedings.

Crypto lender BlockFi preparing for potential Chapter 11 filing after detailing exposure to crypto exchange FTX and sister company Alameda Research.

CONTINUES AT BOTTOM

4- Unicredit thinks Central banks will be less reluctant to pivot than many believe.

Central banks are fighting hard for their credibility and will probably want to keep financial conditions tight until they feel very confident inflation is on its way to target. We see policy rates peaking at 5% in the US and at 2.75% in the eurozone. We expect to see a turning point in monetary policy in 2024, with the Fed cutting rates by a cumulative 150bp and the ECB by 75bp.

CONTINUES AT BOTTOM

5- Goldman’s Trading Desk: Bullard’s Bullish on Rates

The Fed's James Bullard said the level of rates will need to be "sufficiently restrictive" to conquer inflation. He presented charts showing a sufficiently restrictive rate may be between about 5% and 7%. Bullard in his prepared comments didn't say whether he'd favor a 50 or 75 bp move at the Dec. 13-14 meeting.

6- TS Lombard not liking China

Xi's policy agenda undercuts everything that helped China grow since 2000 and the Long-term case for China equity outperformance no longer holds

CONTINUES AT BOTTOM