Hi All: Here’s a little holiday market comment as described through position management. It includes some details of the thought process active traders may make use of.

For starters: as mentioned this Sunday and sporadically last few days. We are post midpoint of “buy season”. thus the proper risk profile for this account is to

Peel back length- 75% closed

Do not buy dips below 1780- so far so good

Don’t have a tight stop, let it breathe a little- ibid

Do not buy rallies on momentum signals- b/c already long

Additionally: Holidays bring the decision to consider selling volatility in limited fashion on the bet nothing will happen meaningfully

YES: its a triple holiday.

NO: but everybody knows this…

The decision is yes for this account this year. Here are the reasons tipping the scale into doing it (reasons are the story, not the trade)

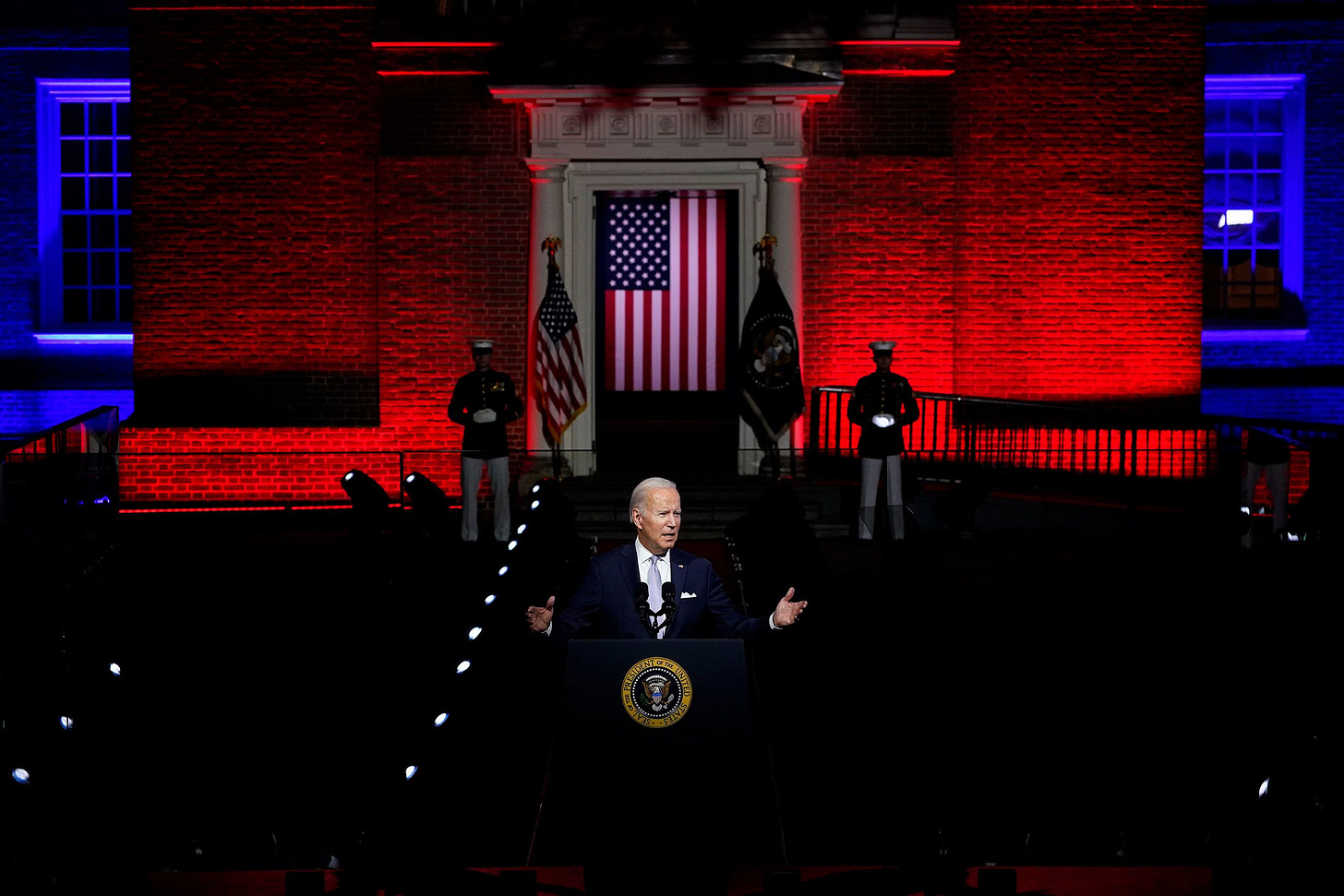

The OBAMA TRUCE

Have noticed Biden admin has gone to a “no drama obama” type playbook recently. Consider these differences:

Between SPR refill idea, price cap being downplayed, lack of confrontational rhetoric on both sides, Russia reducing exposure in winter, midterms over, OPEC stopping their frequent meetings, EU quietly adding nuclear to acceptable fuel, and the general lack of fanfare and speeches last couple weeks it seems:

Obama is advising Biden to stop being so dramatic. How can he not be advising him?!

Someone else’s hand is definitely on the tiller emotionally now. The progressive wing is chilling out a little. They know they’ve pushed it too far. We’re in Obama’s hands now is the guess.

So our take is:

A holiday truce has been called by both sides, and nobody wants a problem over Christmas. The west wants to get through the winter without freezing, and the East wants to not provoke any more sanction type things. The West also wants to not provoke Russia with caps (the current ones are toothless and late).

It also seems confidence is growing in the admin based on the lack of insane rhetoric and Orwellian backdrops, which means it’s a only a matter of time before they overplay their hand. But not until they have to.

But we just cannot help but think: US, Russia, and OPEC are all on the same page right now.

We say seems because we do not know. And even if we are right, some unexpected news item can still happen. Even without one, the markets can get whippy with light volumes (which is why our stoploss has moved away from the market, which is easy to do when you are in the money a little)

Risk Profile:

Attached is a rough risk-profile with the 1780/1800/1820 fly overlaid.

These are good for our style because.. if the market picks a direction and we change our mind, only one leg has to be closed to express that opinion. (separate from the outright futures position)

Bullish? buy the 1800/1820 c.s. back ( long vol/ delta)

Super bullish? buy the 1800 call Longer vol/ delta)

Bearish? sell the 1780/1800 c.s. out (long vol/ short delta)

Super bearish? sell the 1780/1800 c.s. twice (no adding deltas by adding short vol here1

Increase directional risk by reducing open interest and volatility risk is the mantra on these.

The one thing every potential trade has in common from here is: WE MUST BUY VOLATILITY TO EXPRESS DIRECTIONAL OPINION now… since we are short Vol currently.

This is all in keeping with Michael Moor’s levels as well.

WEEKLIES?

We do not trade weeklies on these holiday things. NO WAY. We want to trade short dated yes, but it must have preexisting open interest for an acceptable exit margin of safety. In a disciplined non professional account , we never trade naked or otherwise) short vol in a weekly. Client exposure is different

Your money, your decision

Best

VBL

Moor Techs below.

Bonus: Path to Deflation. Intelligent take that may be right on the inflation/deflation debate.