Gold Price Targets and Fed Policy

Here are some 2025 price targets for Gold.

Bank Gold Targets Have Two Components

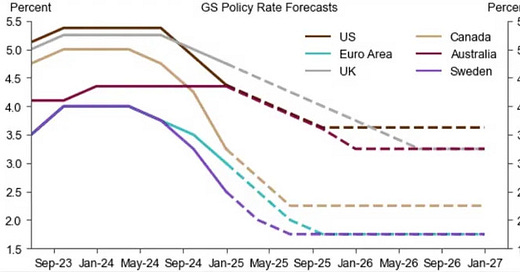

Bank price targets for Gold are comprised of two main factors: Physcial and Financial Demand. Supply doesnt enter into the equation here.1 Physical Demand is exactly what it is— How much Gold do they want for Gold’s sake? Financial Demand is driven by Monetary Policy (MonPol) by Central Banks

Last year Physical Demand (for multiple reasons like Geopol, Collateral needs, and Mutipolar Dedollarization) obliterated most MonPol factors as manifest in resetting financial correlations. For example:

Starting in 2022 Physical Demand Obliterated Financial MonPol effects…

This has mesurably gone on for two years. Will it continue? That depends on Monetary Policy

Does Physical Demand Still Count More Than MonPol?

The question of correlations now resurfaces for 2025. Has the physical demand side been satisfied enough in order for MonPol and rates to reassert themselves as significant drivers of Gold price once again?

Some banks think yes. Others think no.

Two weeks ago Goldman reiterated their $3,000 Gold call forcefully. Their reasons were physical demand will trump Fed policy. Keep that in mind as you read the rest of this brief note.