Housekeeping: Good Morning. We will be doing a complete audio read through of of this report with some comment today.

Bretton Woods Three is a Process, Not an Event

Today:

Goldman just put Copper, Silver, and Gold on notice in one report

Premium: Full Analysis

Yesterday’s Activity:

US equities retreated on Friday ahead of the Federal Reserve's monetary policy meeting this week.

Market Commentary:

Goldman just put Copper, Silver, and Gold on notice in one report. Here are their reasons summarized [ GoldFix Comments ]

A turn in the industrial cycle.

After a prolonged downturn, incremental evidence now points to a bottoming out in the industrial cycle.

[Yes- PMIs say economy is moving to manufacturing replenishment]

China’s green policy put.

Europe’s price stimulus

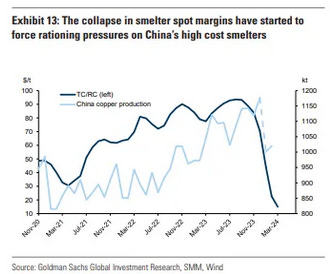

Copper’s supply shock progresses.

The supply shock which began with aggressive concentrate destocking and then sharp mine supply downgrades last year, has now advanced to an increasing bind on metal production.

[That’s Silver’s story also]

Gold’s bullish reawakening

The sharp rally in gold prices since the beginning of March has ended the period of consolidation that had been present since late December..

We increase our average gold price forecast for 2024 from $2,090/toz to $2,180/toz, targeting a move to $2,300/toz by year-end.

[Metals buying begets metals buying]

Aluminium’s China import surge.

In our view, the metal with the most supportive onshore micro dynamics so far this year has been aluminum-

[where aluminum goes in China, Silver follows]

Iron ore’s sobering sell-of

It would be wrong to depict the entire picture of China dynamics as supportive for industrial metals.

[ Not good news.. copper versus Iron ore battle ]

Continues at bottom

Price Action

Gold-

Silver-

Miners-

Oil-

BTC/ETH-

Stocks-

Bonds-

Dollar- ditto

Market News:

"Bond investors who were once convinced that the Federal Reserve would start cutting interest rates this week are painfully surrendering to a higher-for-longer reality and a murky path forward for the market. Source: WSJ

Nvidia has reigned as the investor darling of the artificial intelligence boom, more than quadrupling the value of its shares in the past year. Source: WSJ

"Investors poured a record amount into US equity funds last week, snapping up technology stocks and shrugging off concerns over sticky inflation. Source: FT

SpaceX is building a network of hundreds of spy satellites under a classified contract with a U.S. intelligence agency... demonstrating deepening ties between billionaire entrepreneur Elon Musk's space company and national security agencies.- Source: Reuters

GEOPOLITICS

see attached footnote1

Russian President Putin won 88% of the votes in the Russian election where the opposition was banned, according to FT.

Russian President Putin commented on the French proposal for a ceasefire during the Olympics in which he stated that they are ready for talks and will proceed from Russia's interests on the front line,

White House commented the Russian election was not free nor fair

Some headlines via NewSquawk or DataTrek

Data on Deck:

MONDAY, MARCH 18 10:00 am Home builder confidence index

TUESDAY, MARCH 19 8:30 am Housing starts

WEDNESDAY, MARCH 20 2:00 pm FOMC interest-rate decision 2:30 pm Fed Chair Powell press conference

THURSDAY, MARCH 21 8:30 am Initial jobless claims, U.S. PMI 10:00 am U.S. LEI, Existing home sales

FRIDAY, MARCH 22 None scheduled 2

Premium Attached:

Full Goldman Analysis Excerpts