“As things get harder…more people will be turning to the imperfect hedge for all outcomes as opposed to the perfect hedge for the wrong outcome.”

Today:

Market Rundown

Goldman Gets Serious on Gold

1- Market Rundown:

Good morning. The dollar is down 18. Bonds are weaker with the 10 year showing the most pressure. Stocks are up 20 to 80 bps. Gold is up $8 from the 5pm settlement, but added $31 starting from after Powell talked at 2pm. Silver is up 24c from post Powell’s talk. Oil is down 45c. Nat Gas is up 5c. Cryto is strong up 1.3%. Grains are firmer with Corn up 1%

Comment: Post our Powell chart recap, Janet Yellen spoke on the banking crisis and seemed to inadvertently undo the efforts Powell had made to calm investors during his conference. She almost contradicted him at one point saying:

YELLEN: SITUATIONS LIKE RUN ON SVB MAY MORE READILY HAPPEN IN THE FUTURE, REGULATIONS MAY NEED RE-THINKING

*YELLEN: NOT TIME YET TO SAY IF FDIC INSURANCE CAP APPROPRIATE

These statements may have been intended to show vigilance, a nuanced understanding of things, and imply no more aggressive measures need to be taken, but their approach/tone was opposite Powell who himself did not equivocate when he signaled things like: There are no more banks like this, and we have all the tools we need to make depositors whole.1

The market took this very badly. Stocks went from up 1.6% to down 1.2%. Gold and Silver spiked, and regional banks tumbled again. Overall her comments unnnerved the banking sector that things were not at all resolved.

Today stocks have bounced somewhat nicely thus far; But.. neither Silver nor Gold have backed off. The sign of a true hedge for uncertainty.

Perfection

This continues to play into the Anti-Goldilocks idea that what is bullish for stocks (pivot/pause) is bullish for gold. What is bearish for stocks (insolvency) is also bullish for gold.

There are 3 major outcomes now: Deflation created by banking insolvency, inflationary capitulation to stop said insolvency, and a rocky but good landing with inflation at 2%

The bank put put a new report on Gold last night, and we are fortunate enough to have seen it. We will do a full detailed write up on it tomorrow/Saturday, including our own perception of reliability.

Anti-Goldilocks

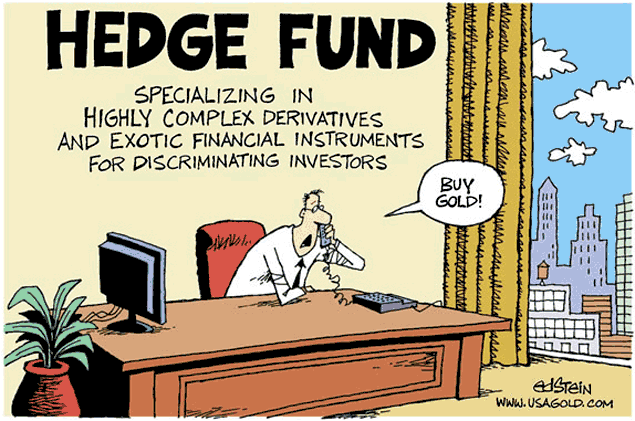

Frankly, the world is publicly waking up to the concepts we’ve been going on about for the last few months— one that is exemplified in this cartoon:

As things get harder to manage and needles get harder for the monetary authorities to thread, more and more people will be turning to the imperfect hedge for all outcomes as opposed to the perfect hedge for the wrong outcome.

Written by their UK/ India team and approved by Jeff Currie ( that means its relevant), here is a peak: