Goldman Identifies The Trigger for The UK Crisis and Why This Will (Not) Happen Here

PLUS SILVER EFP UPDATE

Housekeeping: Have a good one!

Market Rundown:

Good Morning. The dollar is up 3 points. US Bonds are weaker. Stocks are also considerably softer between 1.5 and 2.5% ( note we are now quoting in %terms, more frequently). Gold is down $8 and Silver is down 18 cents. Oil is down 9c and Nat Gas is down 18c. Gilts are weaker by 1.2% giving back a large portion of the knee jerk gains from the temporary QE announcement yesterday.

Comment:

We note that post today’s data, the dollar weakened, Gold firmed, and stocks took a tumble. That indicates one thing: the market ( stocks, and bonds) is again worried about even more hikes. So why did Gold bounce. Try not to make too much of it but here it is: there are shorts that panicked yesterday. This is more of those types waiting for a dip to buy, or some data point that made them “right”. They didn’t get the dip, so they bought in a thin market. One cares about those when the moves are consistently contrary to data, and get bigger. For now, nothing. Same for the Dollar, there are just too many longs that are now sensitized to the risk.

Data:

GDP revision came in as expected. New Jobless claims came in lower than expected signalling again the economy isn’t as bad as one would think, and therefore inflation fighting will go on based on domestic risk.

Silver EFP Update:

The Silver EFP is now trading mildly backwardated again after trading contango in the rally. This indicates physical tightness either from a lack of metal avaialbe for leasing and/or straight up physical demand. one interpretation for today is, the physical market buyers raised their bid again and in doing so, raised he support level at least until (if?) they are filled or change their minds..

Comment: if the EFP trading backwardated is a new normal, then nothing is normal about it. There is no other explanation for the physical trading above the futures than the demand for physical is greater than the readily available inventory from the Comex for delivery. This is a very digital thing. Either they want physical Silver more, or Comex silver is no longer viewed as a reliable place for delivery and thus hedging. We think it is both and will continue listing the EFP in our daily reports until something heals or breaks.

Excerpt: Goldman identifies The Trigger for Everything and Why This Will (Not) Happen Here

Goldman released a macro report today that discusses:

The trigger for the UK selloff

Commodities: weaker demand, Dollar dominance

Why Stock prices are headed lower

Higher Healthcare Costs are almost a given next year

The Italian election fallout

For readers we will focus on the meat of the UK explanation.

Background:

We described what happened and the immediate drivers of behavior yesterday. The thing that tipped the boat in the UK was the Fiscal package of the incoming PM. Bottom line: it has an awful lot of deficit spending ( remember, loose fiscal policies with tight monetary policies?). This again, is the play now, loose fiscal and tight monetary.

From Gold and Monetary Statecraft:

The era of easy money and tight fiscal policy with disinflationary tailwinds is over. The era of fiscal spending and monetary thrift with inflationary headwinds is upon us.

Here’s what that looks like:

When you tell people you are fighting inflation by raising rates, but give people money to buy stuff, you are hitting the gas and brake at the same time.

The markets saw this and bet which foot will be removed first: the Gas, or the brake. In England markets chose the brake. And that’s what they got. The inflation will continue, people will get fired, unemployment will soar, standards of living will drop, and we will all have plenty of money but be unable to afford anything. Bye Bye Middle Class if this continues while the west retools its industries.

Excerpt: Here’s What Goldman says the UK did:

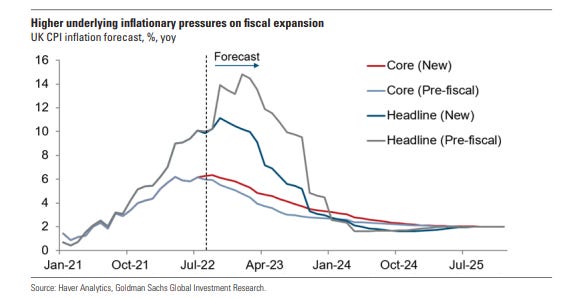

The new UK government announced a big fiscal expansion last week, which we think will raise underlying inflation pressures, and we now expect higher end-2023 core inflation of 3.3% (vs. 2.7% previously), as shown in our chart of the week. The announcement sparked a substantial selloff in UK assets, especially in Sterling and Gilts, which partially reversed on the BoE’s announcement that it would engage in temporary Gilt purchases with the aim of restoring market functioning even as it so far seems to be leaning against an inter-meeting rate hike.

That said, we do expect the BoE to do more than we originally anticipated in response to the fiscal package’s inflationary pressures, and recently revised our BoE rate path to include a 100bp rate hike in both November and December (vs. 75bp previously).

Guess what, somebody noticed.

Investors were taken a back by the new government’s choice to institute its largest tax cut in 50 years while boosting government spending and borrowing with inflation near 40-year highs. This is a Socialist type of Reaganomics. The problem is this had somewhat more success in the US because we were the reserve currency and a more dynamic economy. It is trickle down economics. The UK folks are having none of it now.

Fed Pivot Potential

If the UK pivoted what is to stop the US Fed from pivoting? …

CONTINUES AT BOTTOM WITH FULL REPORT...