Goldman Not Backing Off Commodity Price Spike Belief | Market Rundown

We explain why this should or shouldn't be taken seriously.

Market Rundown: Happy Friday

Good Morning. The DX is up 48 points. Bonds are stronger. Stocks are up 40- 70 bps. Gold is up $3 after being down $8. Silver is up a nickel. Copper remains down a percentage point plus. Crypto is flat and Grains are down some. UMich today.

GoldFix Podcast: Silver Physical Demand Update, UMich as Biden Poll.

Goldman is Not Backing Off

Comment: All research is part marketing for banks. Some is real analysis. And when/if prices start to turn yoy can bet Goldman will be reccomending to their clients to buy alongside them based on the following analysis. That said:

Goldman put out a report re-emphasizing their belief the commodity dips we are experiencing are not permanent. We do not know if they are right. But we have seen this kind of work before and lived through the trades they did on the back of it.

The last two times they spoke like this they were indeed committed to the thesis. we described this type of research last year for premium subs.1 We cannot emphasize the importance of reports like these for continued analysis of commodity trends enough.

Here is their conviction in higher commodity prices ( eventually) restated:

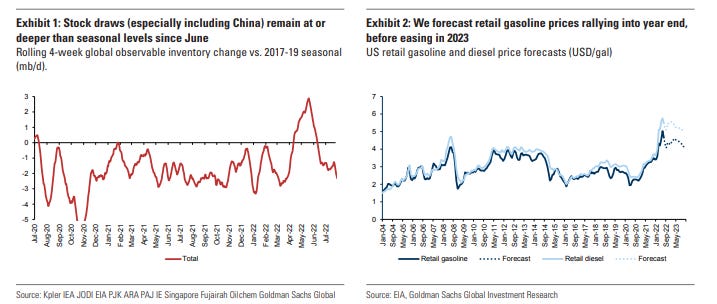

The only rational explanation in our view [ for the recent price drop] is destocking as commodity consumers deplete inventories at higher prices, believing they can restock once a broad softening creates excess supply, a dynamic apparent in metals and agricultural markets today. Yet should this prove incorrect, and excess supply does not materialize as we expect, the restocking scramble would exacerbate scarcity, pushing prices substantially higher this autumn potentially forcing central banks to generate a more protracted contraction to balance commodity markets

Bottom Line Drivers:

Irrational expectations make for unsustainable prices.

Macro markets generate commodity tail risk

Liquidity destocking exacerbates macro mispricing

Cross-market curve shapes send warning to investors

More at bottom Commodity Monthly UNIcredit

Global Oil & Gas: Expanding Europe and Russia Energy Standoff

In July, Gazprom announced another cut to Nord Stream 1 pipeline gas flows. Flow dropped to just 33Mcmpd or 22% of its full capacity for further compressor turbine maintenance. Despite a smooth restart after annual maintenance, eyes are on the Nord Stream’s gas flows. As member states look at cutting gas consumption by 15% from August, including potential mandatory cuts, concerns about winter gas supply continue to rise.

Copper: EVs Take Copper to the Fast Lane

Ford’s new plan is to reach annual run rate of 600k EVs by late 2023 and more than 2M by the end of 2026. The company expects a compound annual growth rate for EVs to exceed 90% through 2026, more than double forecasted global industry growth. General Motors (GM) plans to produce 1M EVs annually in North America by 2025. To meet their targets, Ford and GM have recently signed contracts with supplies to secure the batter capacities and raw materials for their EV productions.

More at bottom