Inflation Bomb: Christine Lagarde Just Showed the West's Hand

RABO: LaGarde Dropped a Quiet Inflation Bomb Monday

To have given this [Inflation target-moving] speech, Lagarde would have had to have cleared it with layers of stakeholders. It wasn’t a mistake or slip. It was a deliberate, establishment-approved declaration:

RaboBank’s Michael Every

Good afternoon. Early Monday we noticed a piece in which ECB President Christine LaGarde actually said the following: (emphasis ours)

The European Central Bank can discuss changing its 2% inflation goal but only after it brings down inflation to that level, ECB President Christine Lagarde said on Monday.

"At the moment... there is absolutely no reason to change that 2% medium-term objective. Once we get there, once we are confident that is (sic) stays there, we can discuss."- Source

For those unfamiliar with Banker-speak; This is what we and (likely) Michael Every heard:

The ECB has begun discussions on raising the inflation target because it is becoming apparent that if we pursue getting inflation all the way down to 2% something calamitous could happen economically that we will not be able to stop.

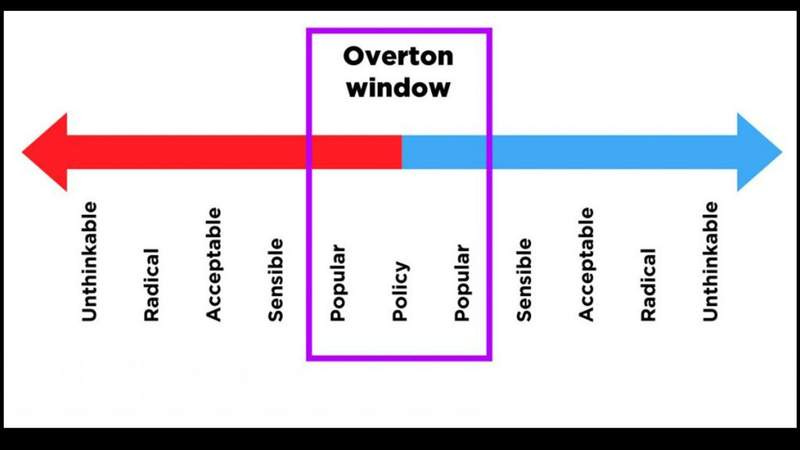

Therefore, starting today, it behooves The ECB to break the ice and start moving the Overton window on inflation publicly now.

Anyway…. RaboBank’s Michael Every also read LaGarde’s comments and dissects it in detail starting at the tape-reading macro level and ending at the secular/global levels. An excellent read1.

Enjoy.

"It Wasn't A Mistake Or Slip": Lagarde Hints At Raising Central Bank Inflation Target

By Michael Every , Global Strategist Rabobank via ZeroHedge

The old Disraeli line is that there are three kinds of lies: lies, damned lies, and statistics. Like most market commentary, I focus on the former two (i.e., politics) and the latter, pointing out all the inconsistencies in the numbers on the screen that get markets so excited, whether that be US payrolls’ birth/death model, CPI’s hedonic regressions, or Chinese GDP’s internally inconsistent expectations-beating ‘magic’. However, yesterday we got a prime example of the Big Market Lie: talking only about statistics, as if nothing else more important is happening.

Monday’s policy speech from ECB President Lagarde, was called “astounding” by a national-security expert, and my team said sounded like she has been reading our research: given the ECB staff do read it, that wasn’t hyperbole. The second-most important central banker in the world behind Powell stated: we are seeing fragmentation into competing geopolitical blocs, which is structurally inflationary; rival FX architecture is emerging; trade invoicing and swap lines are key in that shift; Western fiscal policy must be expansionary on the supply side and into defence; monetary policy needs to act like it did in the 80s; yet it must also work with fiscal policy for “strategic goals” – and Lagarde added later in the day that once the 2% CPI target has been met, “discussions” can be had on changing it(!); central bank digital currency may be needed to deliver hypothecated fiscal spending and trade invoicing; in “systemic competition”, the bloc that does state capitalism/mercantilism best will fare better; and central banks’ role is at the heart of it. We are not talking 2% CPI, nor 2°C.

This has vast implications across every asset class, the economy, and the political economy. To have given this speech, Lagarde would have had to have cleared it with layers of stakeholders. It wasn’t a mistake or slip. It was a deliberate, establishment-approved declaration: we face an open-ended global political-economy competition with policy drift in just one direction, not a rate-hiking cycle, or a pause, and certainly not a pivot.

And how did the market react? It didn’t. How did the financial press covering every market cough, sneeze, and shill react? It didn’t. There were very few headlines, almost no commentary, and no analysis. [EDIT- Almost- VBL]

The focus was on relatively irrelevant statistics like Chinese GDP, or subscriber numbers. In short, we got an orchestrated ostrich-like policy of denial.

Some might say that the magic of 0DTE options trading means nothing means anything anymore, and market volatility can keep going down, and stocks up, while real world volatility is exploding higher; but forever, and if rates keep rising?

Some might say there’s a Gramscian hegemony over intellectual debate in markets (“Don’t mention the war! Do mention the pivot!”). But that’s not true from recent coverage of the trends in geopolitics, which have even mentioned Gramsci, Kalecki, Polanyi.

Some might defend markets by noting the difficulty of talking political-economy rather than basis points or pips. As Taleb just tweeted on universities, applying here too: “The standard academic is selected to go very deeply and rigorously into the most shallow questions, and very shallowly and handwavingly into the most significant issues. Knowledge comes exclusively from the rare, very rare, tail exception.” So why listen to such market voices? At least ask them how they think their markets would trade if Lagarde is flagging a policy shift, rather than assuming she isn’t ‘because my market’.

Some might say “quirky” (I prefer “iconoclastic”) big picture narratives don’t matter because while this might all happen one day, in the meantime the adults have to make money. Taleb asks how that standard academic stance worked in the GFC or the worst bond performance in centuries in 2022 - and more examples will follow if Lagarde is a harbinger. Indeed, the CSIS think tank, in ‘It’s All about Networking: The Limits of Renminbi Internationalization’, stresses CNY cannot replace the USD in the global system, but bilateral trade settled in CNY reduces China’s reliance on the dollar, exert more influence over its trading partners, and mitigate risks from potential US financial sanctions. The latter implies the US would have to lean on real economy decoupling or non-financial weapons for pressure. That is deeply concerning, and I have expressed that here repeatedly of late, even if most markets won’t see it.

However, on the most profound level, I understand the lack of reaction. As Dostoyevsky put it: “Very little is required to destroy a person: one has only to convince him that the business he is engaged in is not necessary to anyone.”

On which, veteran market player Jeremy Grantham just broke Gramscian hegemony to tell an interviewer that the US financial sector is: “In a way, like a giant bloodsucker. We have more than doubled in size, and are sucking more than twice the blood out of the economy. And we do not generate any widgets. We do not generate any real increase in income. We are just a cost. Collectively, we fulfil a completely necessary service. But what we have done is created layers upon layers of more convoluted, expensive financial instruments. And that’s what makes all the profits for the financial industry. And it’s taken a lot of ingenuity and salesmanship to make this happen. A lot of lobbying in Congress, etc. And we have imposed on the rest of the economy the idea that banking and finance are utterly important at all times. If you do anything wrong to us, the entire economy will collapse in ragged disarray.”

Ask yourself, is this sustainable in a “systemic competition” between global blocs where the other side is using ‘common prosperity’ to co-opt its financial sector to accelerate the shift to supply-chain and production? Do we need a reallocation of resources from “convoluted, expensive financial instruments” to “widgets” too? The purveyors of said instruments, and their media, will say no, but the Pentagon, which had its eye on SVB, says yes – and now so does Lagarde. We only have Powell left to flip, which even markets might notice: Jackson Hole this year is going to be interesting.

But, until then, I expect that even as everything is about the big geopolitical picture, all we are going to hear are lies, damned lies, and statistics.

End

GoldFix: Two Percent Inflation is Still a Fairy Tale

Readers may remember we have discussed the 2% inflation target as folly several times in this space. That was on the heels of reading some excellent work by TS Lombard that gave the basis for *why* getting inflation to 2% would significantly increase unemployment and it would also put a major dent in GDP given the backdrop of things That post is "Two Percent Inflation is a fairy tale” for those of you looking to read more on the relationship between inflation and unemployment.