Coming Soon

Good afternoon. Michael Hartnett just released his master work for 2023 and we have a copy.

While much of his work is macro-economic equity focused and not precious metals oriented, almost every topic in this year’s release is about gold by inference. Frankly it is an amazingly organized, readable, and enjoyable piece.

It’s like he took every concept we’ve been studying and writing about here, added a chart proving the point, and made a coffee table book of it.

Michael Hartnett nails it with the first of the EOY reports this season.. and it is a keeper.

Think of Zoltan: but easier to read with charts, and in sentences less than 400 words long (without parenthetical expressions)1

Long Gold. Do The Math

Right now we are disassembling it for easier access for everyone (raw PDF just sent to Founders ) to the 150 pictures with summaries included.

Here is one of the slides directly pertinent to our beloved asset class.

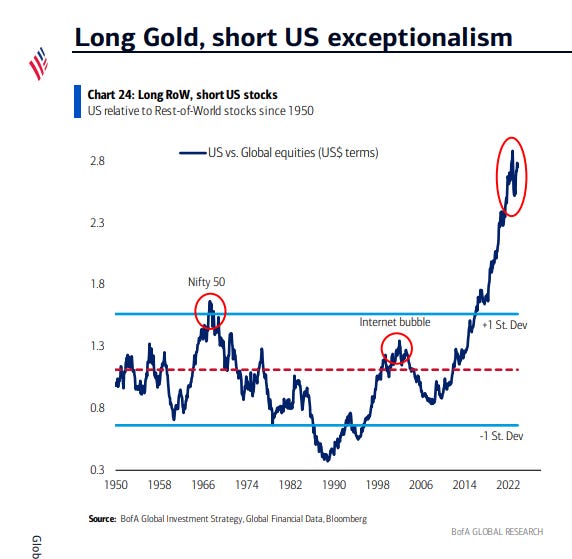

US equities close to 70-year highs vs global stocks…little wonder "US exceptionalism" so consensus; best hedges for "exceptionalism" flipping to "debasement" are real assets, gold, TIPS, small cap value, EM.

Peak AI bubble will undoubtedly coincide with peak US dollar (see peak “Nifty 50” & internet bubble); but greatest risk to US dollar in 2024 is a loss of confidence in US policy credibility (government deficit denial coupled with Fed policy panic before inflation close to target).

Gold, crypto & EM assets the biggest beneficiaries of peak US dollar.

We will have the rest for you in a day or so properly sorted for proper reading pleasure.

Here is the cover page to get you started: