Intro: Breaking the Seal

The Precious Metals and Energy analysts at Goldman Sachs Daan Struyven, Lina Thomas, Samantha Dart have overtly taken a step to recommend replacing a portion of Bonds in the rules governing the 60/40 (Stock/Bond) portfolio mix. This is neither a short term trade idea, nor is it one of those macro “plays” the market has seen so much of these past two years. This is a call to change how Pensions and the largest institutions allocate big money to hedge equity risk. As such, it is (to our eyes) the very first shot across the bow for global money managers to take heed on how they’ve been allocating client money for the last 15 years.

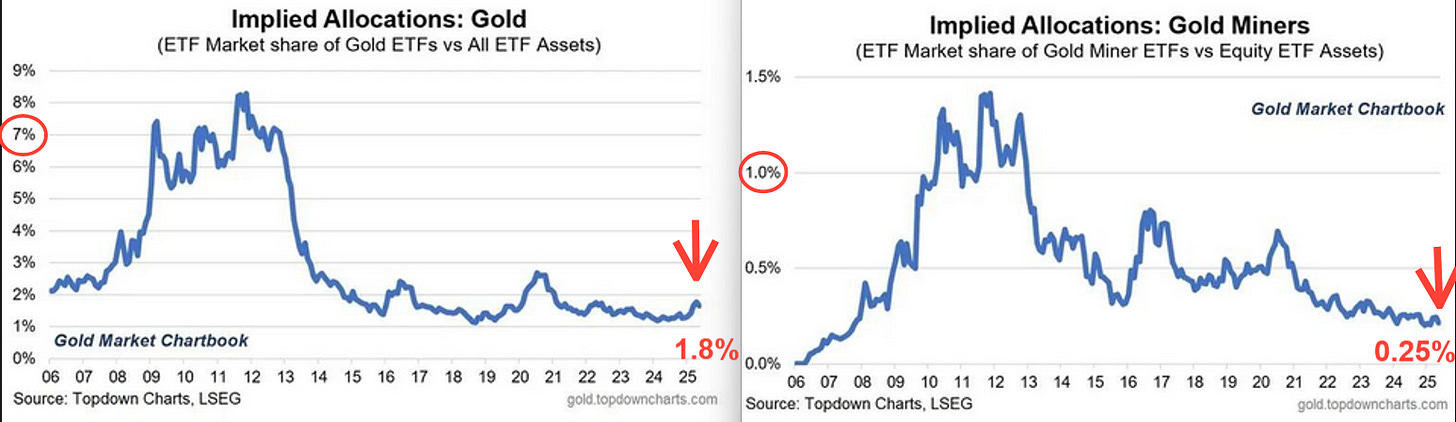

Put another way: Sovereign entities like Central Banks started replacing Bonds with Gold more aggressively when the Ukraine war started. Now, privately held institutions have begun following that lead. This charts below serve as a reminder of how far gold has yet to go in terms of broadening reinvestment.1 We have much more to go in restoring Gold as a proper asset for global financnail health.

On that note, this analysis is must read for those seeking the road map laid out for pension asset allocators for the next 5 years. This could (should) be the next tailwind to underpin and drive gold relentlessly upwards to where it belongs in the pantheon of assets.

Contents (1400 words, 16 slides)

Portfolio Breakdown Begins with Policy Failure

Two Assets, Two Risks

Gold Is the Core Hedge

Oil Is Still a Hedge—But With Limits

Proof: Two Investor Profiles, Same Conclusion

Final Thought: Gold as Neutral Collateral

Appendix