Housekeeping: Good Afternoon.

"We estimate that a 10% drop in the Shanghai gold price boosts physical China gold demand by 16%."

-Goldman

Contents: 1570 words

Intro

China’s Household Demand Drivers

Physical Demand

GS Gold Model

Structural Drivers

Still Bullish Gold

Something to Think About

About Goldman’s Demand Model

Final Comment

Slide Deck

PDF

China’s Structurally Resilient Gold Demand

1- Intro: In a report put out by Goldman’s precious metals analysts Lina Thomas and Daan Struuyven dated July 22 ( the day after the $50+ selloff), The bank reaffirms its case for stronger gold prices reinforced by resilient Chinese demand. Their focus for this report is on physical demand in China, and within that narrower subsection, China household demand.1

2- China’s Household Demand Drivers:

The report discusses three major points of interest noticed in their Household analysis in reaffirming a $2700 price target for 2025. Those are: Physical Demand, The GS Economic Model, and Structural Drivers. Here they are broken out and summarized with some additional observations.

Physical Demand: remains robust

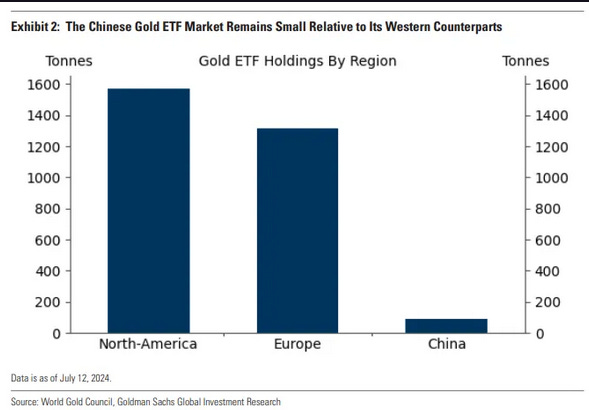

China’s financial market for Gold is growing, but physical demand still dominates.

Paradoxically, this is because in China, access to physical is easier than it is in other parts of the world2, and even easier than Financials. The current market structure and culture promote Gold as the marginal purchase over Stocks. Only a tiny fraction of Chinese have equity exposure, yet most have Gold.