Strait of Hormuz: Political Posturing or Economic Escalation?

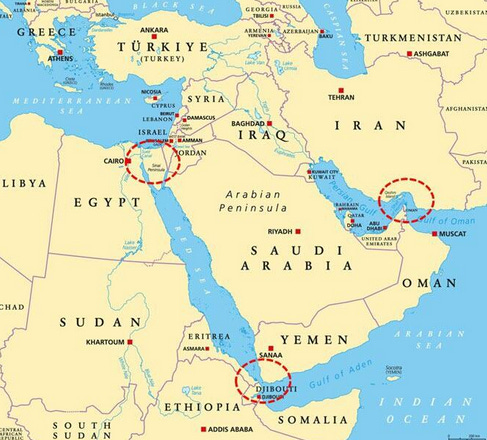

The Iranian Parliament has formally voiced support for closing the Strait of Hormuz (Source: ZeroHedge) with Press TV quoting Major General Kowsari of the National Security Commission: “The Parliament has reached the conclusion that the Strait of Hormuz should be closed, but the final decision in this regard lies with the Supreme National Security Council.” If Iran’s Supreme Leader Ayatollah Khamenei endorses the move, the market consequences will be immediate. Nearly 30% of global seaborne oil and 20% of LNG transits through the strait.

While threats to close Hormuz are not new, this time the momentum is paired with direct conflict escalation. The shift in tone follows U.S. B-2 bomber strikes on Iran’s nuclear facilities at Fordow, Natanz, and Esfahan. The geopolitical risk repricing has been swift: prediction market Polymarket saw odds of a Hormuz closure jump from 15% to 60% in a matter of hours.

Market Pricing Worst-Case Scenarios

JPMorgan’s chief commodity strategist, Natasha Kaneva, previously outlined a closure scenario that could push Brent crude to $120–$130 per barrel. These figures, once considered tail risks, are now being treated as base case contingencies by some in the market.

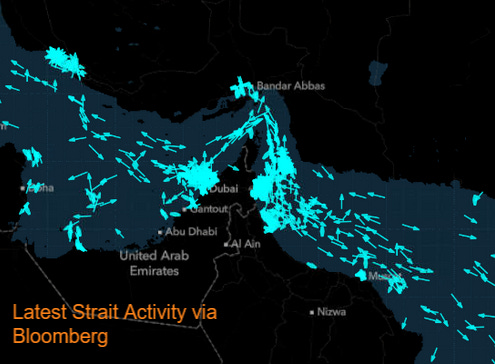

Bloomberg strategist Julian Lee outlined key questions: Could Iran successfully block the strait? Would it require force? Would the U.S. Navy intervene? And could Iran trigger significant disruption without deploying a single warship?

Lee’s analysis suggests that disruption tactics such as harassment via small patrol boats, drone launches, and coastal missile strikes could create sufficient risk to halt commercial traffic. This asymmetric approach mimics the Houthi tactics in the Bab el-Mandeb strait, which have already reduced Red Sea shipping volumes by approximately 70% from 2022–2023 averages.

Strategic Calculus and Economic Blowback

Any closure of Hormuz would damage Iran’s own economy. The country depends on the strait for its oil exports, especially to China—its largest customer and diplomatic shield at the United Nations. Alienating Beijing may prove strategically costly. A full closure would not only cut off Iran’s lifeline but risk permanent reputational damage with its remaining partners.

Historically, Iran has preferred calibrated escalation. Harassment and limited seizures have served as tools of leverage, not declarations of war. Several examples illustrate this pattern:

In April 2024, the Islamic Revolutionary Guard Corps seized the MSC Aries, a container ship linked to Israel, just hours before drone and missile strikes on Israel.

In April 2023, Iran intercepted a U.S.-bound tanker, likely in retaliation for a U.S. seizure of Iranian crude off Malaysia.

In May 2022, Iran held two Greek tankers for six months following Greek and U.S. confiscation of Iranian oil.

These actions are disruptive but calculated. Closure of Hormuz would mark a shift from coercion to confrontation.

Historical Context: The Tanker War and U.S. Naval Response

Iran has never fully closed the Strait of Hormuz. During the Iran-Iraq War (1980–88), both sides targeted shipping in what became known as the “Tanker War.” The U.S. Navy responded by escorting ships through the Gulf and launching direct retaliatory strikes. This set a precedent for U.S. force projection in the region. Which Peter Beutel understood very well. the First Iraqi war is how that evolved

Geopol: Oil Lessons From the Greatest Analyst of All Time

About The Greatest Oil Analyst, Peter Beutel

More recently, in 2019, the U.S. formed Operation Sentinel after repeated Iranian harassment incidents. The coalition—now the International Maritime Security Construct—includes key Gulf states and NATO allies. However, in the past year, the strategic center of gravity has shifted southward. The Bab el-Mandeb Strait, where Iran-backed Houthi militias regularly target shipping, has drawn more operational attention from Western navies.

Real-Time Market Impact and Strategic Communication

As of the latest data, ships continue to transit the Strait of Hormuz. However, overnight movements such as the UK-flagged Kohzan Maru reversing course indicate heightened caution. Bloomberg vessel tracking confirms that while traffic remains active, routing decisions are being reconsidered in real time.

In parallel, the political signaling has escalated. U.S. Secretary of State Marco Rubio issued a blunt warning on Fox News: “If Iran closes the Strait of Hormuz, it will be another terrible mistake. It’s economic suicide for them if they do it and we retain options to deal with that.”

Conclusion: Risk of Escalation is Real, But Rational Self-Interest Remains a Brake You’d Think

The Iranian Parliament’s approval of Hormuz closure is symbolic but not yet operational. The ultimate authority lies with Iran’s Supreme National Security Council, and even that may defer to geopolitical realism.

Iran has much to lose by making the closure permanent. However, the tactical use of risk—through short-term threats, minor disruptions, or ambiguous deployments—remains highly probable.

Energy markets are now forced to reprice a scenario that was, until recently, considered improbable. A closure would be a military flashpoint and monetary and strategic shock, one that reorders global shipping, insurance, and energy pricing for the foreseeable future.

Vince, China and Iran will make greater use of the railway that connects the two countries (through Kazakhstan, Uzbekistan, and Turkmenistan).

Also, "Rational Self-Interest" is not a phrase that applies the same to a radically different culture with different values, mores, and interests. For many actors in the world theirs are not ours (and ours are diverse and theirs are likely diverse, but in different ways).