Housekeeping: There will be a special market comment today to make sense of Bonds, Oil, and Golds, behavior from a geopolitical POV. Just got a very, very nice Uranium report to be broken down for Thursday

Contents:

Market Rundown

**Special Comment: The Kalends of October

Reports:

Special: Tom Luongo’s G, G, & R Newsletter

MUFG Commodity Report

BOA Global Metals Weekly

Zen Moment: 5G Protection

1- Market Rundown:

Good Morning.

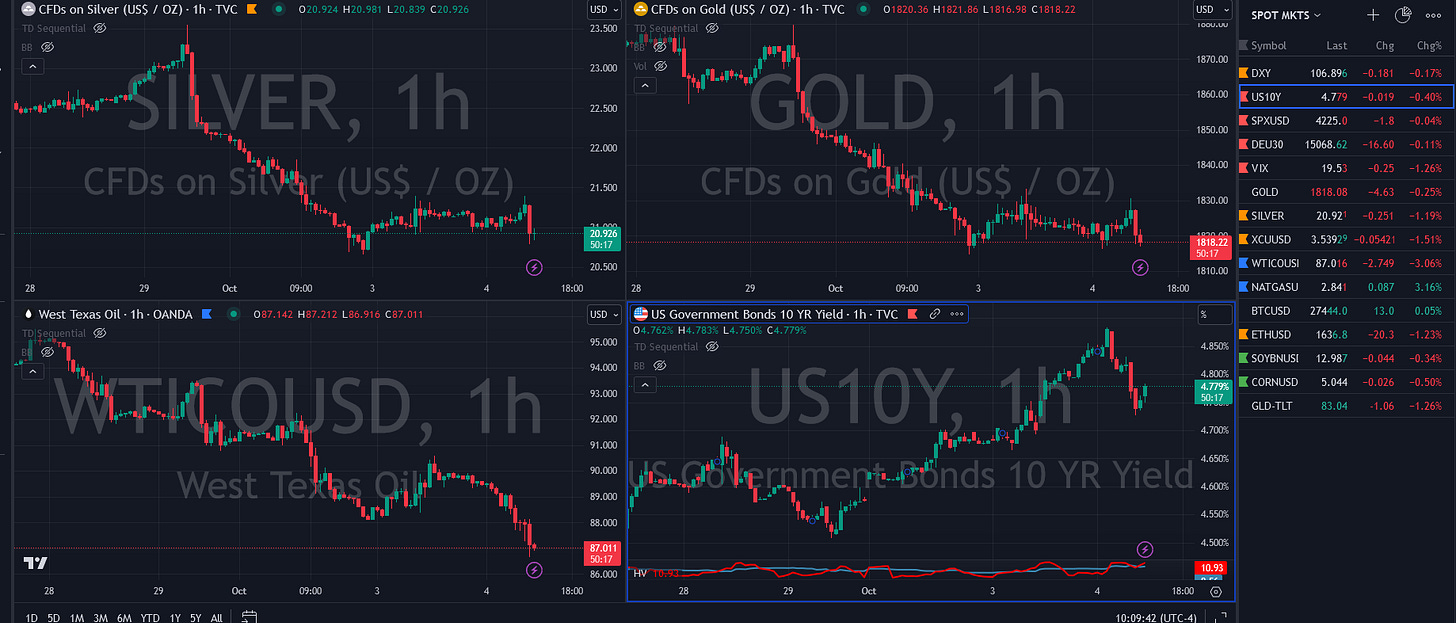

The dollar is down 38. Bond yields are slightly lower for a change. Stocks are all slightly higher between 10 and 60 bps. Gold is down $1. and Silver is down 11c. Crude is down $2.40 and Nat Gas is up 10c. Crypto is mixed and Grains are down some, with Wheat the weakest.

Comment: This is a dead cat bounce after the last few days. More on why later today. Bottom line: They need oil to crack before Bonds do

Barrick Gold will invest USD 2bln in an expansion project designed to increase Lumwana's annual production in Zambia. This type of expansion in the current protective climate means givebacks. Lets see what shows up…

2- Special Comment: Kalends of October

We think some of you know Tom Luongo’s work. Tom and Vince are subscribers to each others content and interact frequently on X-Twitter.

Overlapping areas of interest include Market Structure, Geopolitics, and of course, Gold; All of which is now evident to a growing number of people from a recent podcast he had me on for.

Tom has been very supportive of GoldFix and we wanted to reciprocate. He graciously offered his most recent premium report, which is timely given the Bond market goings-on.

That report’s large excerpt is below with special emphasis on the Kalends of October section which Tom felt “is worth your audience's time and attention”. Anyway, we like adding value to your experience1, and felt this is in your wheel-house.

Gold, Guns N Goats Subscription link

Tom Luongo on X-Twitter

There is no financial incentive for GoldFix.