Post Fed | Banks Predict Ten or Eleven More Hikes

Yesterday stocks loved only a 25 point rate hike; Today, Gold loves it.

Housekeeping: Anyone who signs up gets a free premium week as a trial run. If you get something out of it, pls support it. Subscribe here Thank you.

Market Rundown

Good Morning: The dollar is slightly softer. Bonds are stronger some. Stocks are down small in a tiny giveback to yesterday’s post fed (and hopeful Ukraine news) rally ripping higher.

Gold is up $14 from the Globex settlement. 1 Silver is up 22 cents. Crude is up a very strong $5.60. Grains are mixed. Crypto is also mixed after a strong post fed performance.

Cheers

Post: Gouged Either Way

The Fed raised rates 25 basis points yesterday. Stocks loved it.

For our money, the 25 basis point hike was Powell testing the water for stock volatility. We think a 50 bps hike is what he wanted to do, but fears the ramifications for equities if that happens. So the 25bp hike is him sticking his toe in the water testing for future more aggressive hikes.

Nordea sees a total of 10 rate hikes terminating in mid 2023:

The Fed started its rate hikes today with a 25bp move. We now see similar 25bp rate hikes in each of the six remaining Fed meetings this year and four more in 2023.

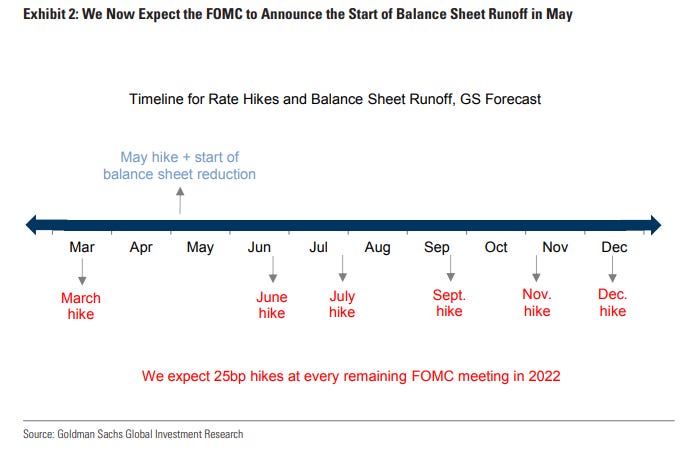

Goldman sees 11 more hikes with rates peaking at 2.75-3.0%

We continue to see a meaningful risk of a 50bp hike at some point, but we are sticking with our forecast that the FOMC will deliver seven 25bp rate hikes this year and four more next year, for a terminal rate of 2.75-3%

JPM sees similar to Goldman but with the increased caveat of a 50bps hike somewhere in there

Almost half (7 out of 16) of the Committee participants look for more than seven hikes this year, a fact which was also highlighted by Chair Powell; this adds credence to the idea that at least one 50bp is a live possibility later this year.

If yesterday stocks loved only a 25 point rate hike; Today, Gold loves it. What does that tell you?… **Continues at bottom**

Have a good one

If you enjoyed this piece, please do us the HUGE favor of simply clicking the LIKE button!