At first glance this report is all about China’s domestic policy and how they need to strengthen their currency if they wish to get themselves out of the quagmire they are entering. That is in fact what this report is about.

TL;DR

China needs a strong Yuan

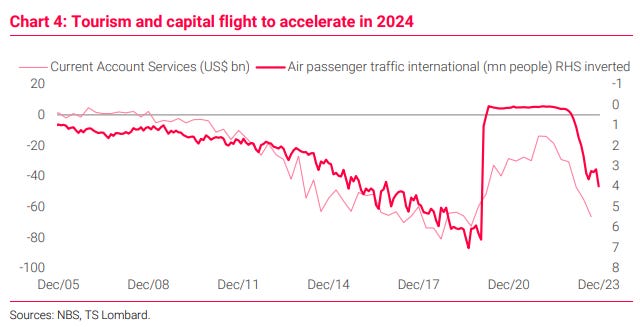

Raising interest rates to achieve that in their current situation is not helpful

Investors are leaving in droves and want the Chinese to consume more

A Trump victory will not be good for their policy goals

Rory Green, the author, believes a strong Yuan/RMB policy is emerging in China now. While this report does not discuss BRICS implications, if is significant.

After a brief, pleasant, informative exchange with the author Friday we have some positive thoughts to share with subscribers. More on that below

Rory was helpful in fleshing out some ideas and answering questions about this report directly pertaining to our interests, although the conversation was not about Gold at all.

Here is a summary following that conversation in context of the report below

China’s Domestic Economy and Overseas Investors

Report summary with added color

China wants/needs a strong Yuan

China can’t retain investment from other coutnries without one

If China raises rates to create an ”artificially” strong yuan without resetting how its economy makes money, it will be deflation-bad.

China can boost its economy by consuming more with the strong Yuan.

But they do not want to be a consumer economy. They want to be exporters 1

Their welfare system is also fragile2 - yes. a former communist country has a bad welfare program

China and BRICS Partners

Prior Assumptions

The BRICS want China to internationalize the Yuan

China agrees

A stronger Yuan helps it internationalize easier

China and BRICS Partners

Assumptions restated

The BRICS want China to internationalize the Yuan

China agrees

A stronger Yuan helps it internationalize easier

To internationalize properly a currency must have 3 things.-more on those next week.

China is sorely lacking in one of those three things.