Housekeeping: There is a lot to be condensed today. Something for everyone in continuing a few GoldFix themes playing out.

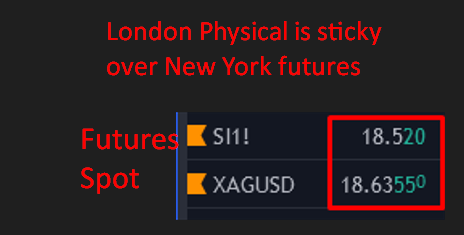

Silver Backwardation

Oil Supply issues

Earnings Season Bearishness

Uranium Stocks

Take your pick and enjoy.

Market Rundown:

Good morning. The dollar is up 50 bps. Bonds are very strong and inverting, discounting big recession coming now. Stocks are down, ostensibly on the back of another earnings miss, this time by Walmart. Gold is down $3 after a weak day yesterday. Silver is up 12 cents.

We think this is the continued physical demand in London as shown by the backwardated EFP making it hard to rationalizeselling silver given the steep decline it has had. When the EFP normalizes, then we see if it has enough spark to light the gasoline the shorts have thrown on it the past few weeks.

Crude is up $1.50 in a wide range but we think noone will sell it given the moves in Nat Gas right now and the bombing tied to grain exports from Ukraine.

Nat Gas itself is up 57 cents no doubt on Russian cut off concerns again. Yikes. Grains are up and crypto is back to its old ways of tracking stocks, but from a higher level

EARNINGS SEASON IS A REALITY CHECK

We mentioned this would be the week where bad news is bad news specifically because it is earnings season and thus a reality check . Here is an excerpt to that effect

From: Bad News is Bad News This Week

But every once in while the market actually looks at earnings; and SNAP gave a preview of this earnings season.

This can cause weaker hands to sell on the news, and absent Fed hand-holding, stocks will drop. That may continue until at least next Wednesday when the Fed ingratiates us again with more economic wisdom. So every once in a while markets behave as you think they should.

Data:

Tomorrow is Fed DayResearch

Bloomberg: Is It Different This Time for Gold and Long Bonds?

1. Are Gold, Bond Bull Markets Over, or Just a Blip? By July 27, in the span of only about 40 days, there's a chance that the Fed will have hiked rates 150 bps, which may be sufficiently aggressive for a reciprocal endgame and base building in gold.

Our graphic depicts enduring bull-market companions -- gold and Treasury long bonds -- which may be top beneficiaries when tightening subsides. Rising rates typically buoy bond yields in the short term, but since the 75-bp hike on June 15, long-bond yields have declined. The graphic of the inverse yield shows a peak akin to 2018, at about the same 3.4%.

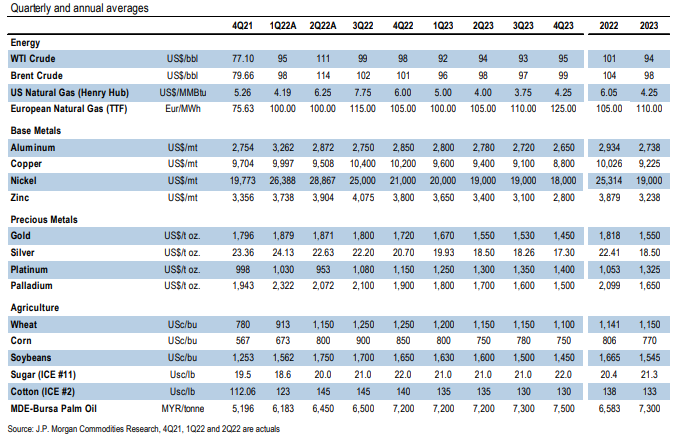

More at bottom JPM: The Week in Commodities

This is a summary note which consolidates the latest views of our global commodity strategists published over the week, to read detailed reports refer to the hyperlinks. It also contains hyperlinks to other related researches/podcasts on global commodities market

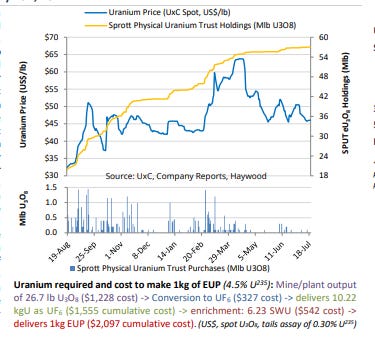

More at bottom Uranium Stocks Top Picks

NexGen, Denison, and why

Zen Moment: What do mushrooms think?

More List: