Good morning: The audio1 attached covers only one section of this excellent report in which Bank of America prepares a whole new type of buyer (their GFM Cohort) to take the precious metals markets by storm. These are the biggest financial players, who also have the least exposure to metals on earth.

In doing so, the Bullion bank also drops a hint at their next price target upgrade and the circumstances surrounding it.

Full breakdown and video commentary of this report will be presented over the weekend for premium subscribers.

Listen to the end… their path to $3500 logic gets broken down somewhat

Good Luck

Partial Transcript:

Bank of America has an incredibly thorough report entitled Gold Primer. And the purpose of that report is very educationally biased.

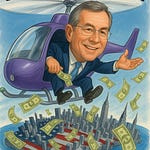

It would be something like we would write for subscribers to get a handle on terminology and how things go. However, it's coming from a bullion bank, and that makes it extremely interesting to us. And the interest comes into realization that what Bank of America is doing is it's preparing a whole new cohort of potential buyers or traders to come into the market, namely their equity side. Massive money, hedge funds, Equity-only institutions are, again, looking at gold. And not just to be long or to be sure, to play directionally. This report touches on, goes into all the venues, the whole market. It describes the EFP.

It describes arbitrage situations. It describes things that would create backwardation in gold. Very rare, but it happens. It truly is a primer. And for them to do this, to divulge or disclose this much... It's really an educational marketing piece and they must recognize increased interest globally. And we have touched on this.

We have pretty much said this over the last month that Hartnett's writing has been very focused on what his equity people are doing and what they will be doing going forward. For example, he had said their equity people should be going into international stocks. And we had said if you're putting people into international stocks,

you're also putting them into gold, because gold is like an international stock, it is like an emerging market, and it is on everyone's radar. And as late as last week we said, trying to skate where the puck will be, we said Hartnett's gonna start recommending miners, or put it this way,

Hartnett's team on the equity side will start recommending miners, and we firmly believe that. But for today, we want to read to you an excerpt from it. Focused on gold. They have many sections in the report, but this one section I think we can share without boring you to tears.