It is important to note that while CTAs are at record shorts in Oil and seemingly extended long in Gold, they are profitable in both so far.

Good Morning. Morning Founders reports have been scarce these past couple weeks. Today we have something very good to share and discuss with a position update

Goldman’s CTA report today is a very welcome addition given the disappearance of TD’s report recently. Hopefully we get that regularly. 1

JPM’s Delta One CTA report also came out today. (no overt Gold commentary).

***EVERYONE IS TALKING ABOUT CTA OIL SHORTS NOW.

Also, just got a brand new Hartnett global flows (no gold but looks good in general especially in context of China) report included at bottom. Will go through it this morning.

Included Below:

Goldman CTA Analysis

What about Buy Season?

Bottom line

Position update

JPM, GS, BOA

Goldman CTA Analysis

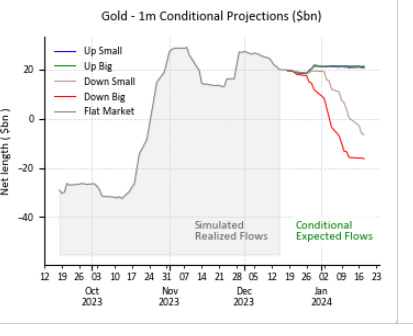

Today’s report. They believe CTAs are almost max long now with little excess money to deploy if the market goes higher. Generally, they are correct. BUT- if Oil goes lower, we contend these lunatics will have more money to put into gold.. Here is why.

Beyond the report, (included at bottom) here is something observed historically and possibly very important for traders who watch flows.

At times like this, one must look not just at CTA total length in a commodity, but where they have big exposure in all assets. CTAs operate on a sum total game.