Market Rundown:

Good Morning. The dollar is up 15. Bonds are weaker. Stocks are slightly stronger, up between 10 and 80 bps. Gold is down $12. Silver is down 33 cents. Copper is down 1.70% Crypto is strong, up between 2.3% and 4% recovering some losses the past few days. Grains are again down with Corn the weakest down almost 2%.

Today’s data implied weaker labor, but the source, ADP has been notoriously off of late. Therefore stocks are not moving too much, and are now back to unchanged as of this post.

Included Below:

Citi on Copper

HSBC on commodities

Michael Moor’s Gold and Bitcoin Technical podcast

What is Going on in Metals?

The reasons are clear and simple for this behavior, but no less painful to read or hear. But here they are.

Fed QT and tough talk at Jackson hole have been forcing equity investors to re-think their portfolio allocations for months now. Powell’s Jackson Hole speech just put some of their trades into overdrive. That is taking everything down.

Those investors also are simultaneously barraged with ideas to hedge recessionary behavior. Those ideas are: Get out of your stocks, Hold onto stocks but sell the tech and buy the conservative ones, Hold onto your stocks, but sell something else that is economically driven like Copper or Silver… etc. This recommendation by CITI below came out today. It is not the first, it will not be the last. When they get bearish Copper, they sell Silver

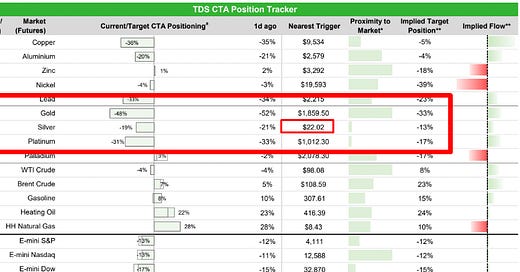

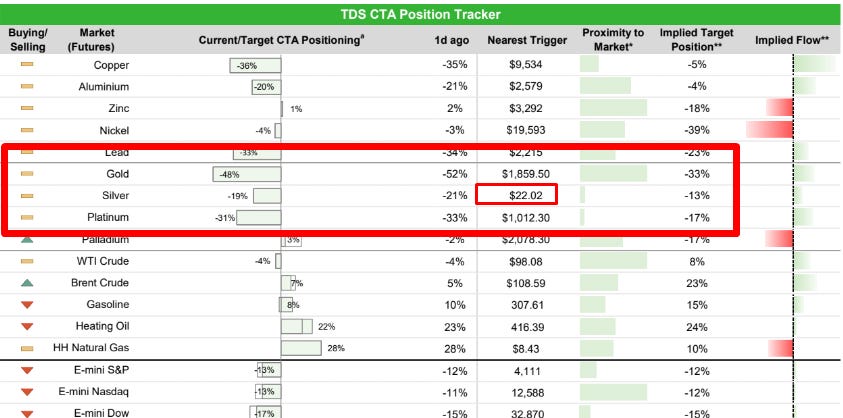

Those investors who have CTA accounts are also speculating aggressively on a continued weakness in silver especially. These CTA types have an outsized effect on markets in low volume environments like this summer.

Eventually they cause their own demise, but they are a powerful force like stampeding wildebeest. Just as powerful as when the Reddit kids were buying meme stocks. This is not new, but the MSM is just now catching up with it.

Before these trades hit the markets, savvy bank traders will position themselves to take advantage of the ebbing monetary tide and will cause the prophecy to fulfill itself in a selloff. It ends up becoming a classic case of traders and research/salesmen causing an echo chamber of market behavior.

How Does It Resolve?

The timing is not something that can be predicted, but it goes something like this: Retail and CTA types pile into a short position as they have been in Silver and Copper for months now. Occasionally some get squeezed out like they did 2 weeks ago which we discussed. The majority remain short or add in rallies basedo ntheir pocket depth.

Further. the majority of them have profitable trades this time since shorting near $22 an ounce (and Gold from around $1850) and will not close their positions, especially when their stock portfolios are taking on so much water.

These types have come to view Silver as a hedge economically. Shorting Silver is like buying Puts on their position. Because of the decades of activity in Silver lower, they feel quite comfortable doing so. It saves them money on their stock losses and makes them feel like sophisticated investors. And let’s face it, in trending protracted macro driven moves like now, it works. Nobody has extra money to speculate long Silver. But everyone has long stock positions they can’t bear to sell, but need to hedge. They will likely sell those stocks 50% lower 2 years from now, but we digress.

Absent true changing vibes from the Fed (likely from a stock market crash or 5% plus unemployment), or an overnight ending of the Ukraine war and the trade problems arising from it; this will continue until you see flows that show a large increase in short open interest in Silver with the market just not washing out much in that last particular pile on. Then you are running into the point where the physical buying will not be satisfied with just buying a little and waiting on the rest to come to them at lower prices anymore.

That means the buyers’ patience for time is running out. Only then will you have a table set and ready for some bullish news to create a massive updraft started by those same lemmings who will also be piling back into stocks.

When that happens Silver and Gold will run in a big way. But, unless you are trading and not owning metals, this all should not matter to you. Until then trade technically and agnostically like we do, or keep stacking with a 5 year horizon and do not worry ( like we are).

What Truly Matters

What truly matters to the owner of Silver is this: Due to chronic increase in energy costs, and more industrial applications of Silver; above ground stocks are being gobbled up by smart players. There will be a massive crisis in Silver at some point. But we are not trying to get you excited to go out and buy today.

We are saying if you own Silver and Gold in a 5 to 10% ( or more unleveraged) allocation of your investment portfolio, especially in physical form in a sensible investment portfolio, you are in good company.

There is a new currency regime coming, a Bretton Woods 3 if you will. Many assets that trade globally or are priced more actively in Asia ( Nickel, Zinc, Nat Gas, Power) are now trading at a price closer to their true value. And nobody gives a damn about their future prices anymore. But assets like Oil, Gold, and Silver are now under heavy influence of Western rehypothecation. Why? Because they can ,and they must to keep the Western peace. Meanwhile Eastern buyers ( and we suspect western governments taking delivery at a regular clip on Comex) are using those prices to add to positions before the currency change. Physical assets will then fetch a premium like never before. But only if you have it in your possession.

Physical Buying Activity and CTA Shorts

Somebody continues to buy all the physical that they can in Silver down here, and it seems this metal will not be coming back on the market. The buyer is not a speculator as we define it. That somebody knows paper prices are just there to present a buying opportunity and is taking advantage of it. Just like many of us are. That buyer is also not spending money they cannot afford to lose, just like we all should be doing. They do not care about price except to get volume purchased. They will continue to be patient buying value as long as “price watchers” continue to be stupid.

Eventually many of the short CTA types lose money, but not until way too many take refuge in selling metals short. How do we know? We know from experience having seen this many times. We know from being buyers of dips for fundamental reasons while this herd of lemmings tramples us in our trading too many times. We also know from the witnessed behavior on the buy-side right now.

Price is Not Value. The Crisis of Commodities is Real

The most important thing is to not underestimate entities that have control over the public pricing mechanism that is the Gold and Silver markets. We are not referring to bank manipulation, as real as that had been. We are talking about the obvious disconnect of financial markets and physical markets, not just in Silver, but in all commodities in this new era. That is what is driving the commodity crisis we aer now experiening in slow, painful, motion. As alluded to above in the BW3 comment, the price is set in financial markets in the West. But the value in spot markets is set in the East. And the shortage of collateral is wreaking havoc in almost every other spot to futures market except Silver. That should tell you something very important about the current structure of things.

Meanwhile, as long as CTA “investors” continue to believe price is value in this asset, they will continue to get killed. Futures prices are correlated to spot prices, but they are getting less and less so every year. It will all break at some point.

Price is not value. But if price is bothering you, then maybe you are a little too leveraged and should be bearish futures and bullish physical, or are just being (rightfully) annoyed at the constant reminders of this complete pricing nonsense.

Put another way, if you bought physical Silver at $22 and sold futures 6 months ago, you’d actually be up money now with Silver trading $18.00. Not a retail sort of idea, but that is how it works. And that is how the banks trade it.

Anyway, it seemed appropriate to mention all this based on messages recently received.