Weekly: Good Time to Buy, Not Speculate

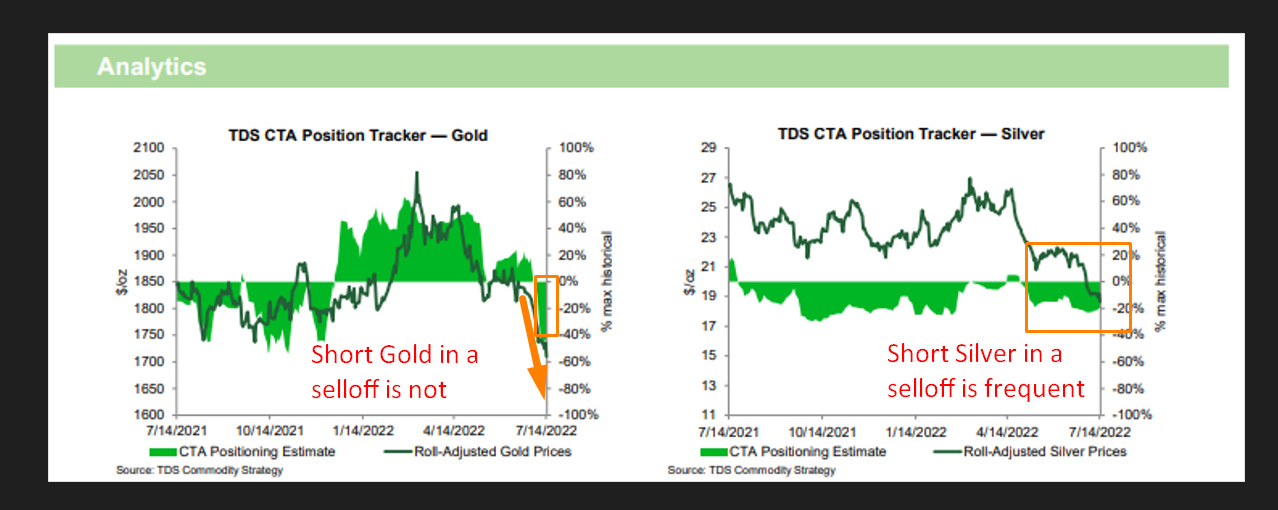

CTAs Are Now Short Both Gold and Silver

Housekeeping: Many will be receiving GoldFix Weekly for the first time. It is different than the dailies. It is more like Barron's used to be. Content touches many areas of markets. The index may help.

**Founders class: SUNDAY PREP. Friday had a sign that Silver may have bottomed and we should see if the open interest confirms this yet. Crypto is strong this weekend. That implies stocks higher Monday, and possibly Silver gets going. Sunday 2 p.m. a brief but important analysis of CoT for gold, Silver, and the oil markets. Plus MoorTrading levels in everything. We're off writing duty Monday. Enjoy the rest of the weekend and thank you to all the new readers.

SECTIONS

Market Summary:

Technicals:

Podcasts:

Calendar:

Charts:

Analysis:

Research:

1. Market Summary

Inflation via CPI came in hot early in the week sparking big fears of a 100 basis point hike in July and therefore a market swoon. ( 9% CPI prep here). Then later in the week, Waller denied the 100bps move would come throwing a lifeline to stocks on Thursday.:

Fed member Waller came out and gave what can definitely be the first material sign of a Fed intolerance for more downside in stocks. He strongly played down the chances of a 1.00 rate hike- Goldfix

Friday retail sales and future inflation expectations tumbled. Stocks ran up hard.

Despite these big rebounds Thursday and Friday, all US Major indices finished lower on the week with The Dow the best and the Nasdaq worst performing.

There are 2 dominant schools of thought now on this 1% rate hike potential.fist one says: They will raise because of headline inflation. The second says they will not raise a full 100 bps because of Waller’s hand holding and Friday’s data. And we are certainly conflicted. Times like this one has to take out a knife and divide reality from hope. Here’s our attempt to pick a side. First the 3 main points being debated

Inflation is high, and may not have peaked in CPI terms. - Yes 100 BPS hike

Inflation expectations are softening along with definite recession- No 100 bp hike

Waller commented Thursday that the Fed wouldn’t raise 100 bps and stock rallied- No 100 bp hike

The Knife

If you believe how stocks went out on Friday, and they are likely to rally next week, then you’d be right to think no 1% hike in July. We think Waller’s comment is worthless except to scare a few short players out. So what, Fed changes its mind all the time. Yes they did it to slow the descent of stocks, and stocks rallied. The threat to NOT hike did its job. Therefore his words are materially meaningless! Numbers 1 and 2 above balance each other out. Therefore 100 bp hike must still be on the table. But there is more…

Two Months of No Meeting

The Fed does not meet in August. That implies 2 months without a meeting to announce policy. Many are not thinking about that yet. The Fed likely does not want to do any surprise rate hikes without a meeting.

Therefore, while we are 50/50 on the 100 bp hike ( futures imply its a 20/80 against bet right now), any indication at all of a good economy (GDP) or high inflation ( PMI etc), and we think the Fed pulls the trigger on it. Also: if stocks rally too much, the Fed will also pull the trigger. The Fed has stated they do not want stocks to be too high, that they seek to diminish the wealth effect. We shall see.

H/t Newsquawk and Zerohedge for data and some graphics.

Sectors:

None of the sectors closed green on the week

Energy was the biggest loser

Financials ripped back higher Friday.

Staples and Utes were best at unch.

Commodities:

Commodities were down for the 5th straight week, tumbling back - based on the Bloomberg Commodity Index - to pre-Putin-invasion levels

Oil prices fell for the 4th week of the last 5, with WTI closing back below $100

Gas prices are down 31 days straight

Biden’s Saudi Meeting. We believe Javier Blas take. Oil rallied and thus it also agreed.

NatGas bucked the trend and surged back above $7 this week

Gold tumbled for the 5th straight week, testing back below $1700 - its lowest since Aug 2021 (spike low).

But gold outperformed silver on the week with the latter at its cheapest to the former since July 2019's peak.

Bonds:

Bond yields inverted once again, months after the last inversion. If you thought we may be in recession as we did then, you must now know this risks a bigger recession. At best it confirms the prior recession. But that is not necessarily bearish for stocks. As long as the market believes the rates will reverse as they do now, then stocks go up. We’re not so sure. The enemy is stagflation still.

Bonds were mixed this week with the short-end higher in yields and the rest of the curve pricing in recession and Fed reaction (2Y +3bps, 30Y -15bps)

10Y yields ended the week back below 3.00%

Whatever happened in 2000?

Crypto:

Cryptos were mixed this week with a late-week rebound lifting Ethereum into the green for the week (2nd up-week in a row),

ETH: the expression goes: Triple tops are made to be broken, but noone tells you when. Actually we got lucky Friday night and called the breakout at about 4pm

Bitcoin had another down week.

But Bitcoin rose back above $21k Friday and Ethereum rose back above $1250

2. Technical Analysis

Report Excerpts Courtesy MoorAnalytics.com

GoldFix Note: Do not attempt to use price levels without symbol explanations or context. Moor sends 2 reports daily on each commodity they cover. The attached are non-actionable summaries.

Gold

TECHNICALLY BASED MARKET ANALYSIS AND ACTIONABLE TRADING SUGGESTIONS Moor Analytics produces technically based market analysis and actionable trading suggestions. These are sent to clients twice daily, pre-open and post close, and range from intra-day to multi-week trading suggestions. www.mooranalytics.com

Energy

Bitcoin

Go to MoorAnalytics.com for 2 weeks Gold, Oil, and Bitcoin reports free

3. GoldFix and Bitcoin Podcasts

Oil Fix: courtesy Moor Analytics

Click HERE for Replay

GoldFix Broadcasts HERE

Bitcoin Podcasts HERE

4. Calendar

Some upcoming key data releases and market events

MONDAY, JULY 18

10 am NAHB home builders' index July 66 67

TUESDAY, JULY 19

8:30 am Building permits (SAAR) June 1.68 million 1.70 million

8:30 am Housing starts (SAAR) June 1.59 million 1.55 million

WEDNESDAY, JULY 20

10 am Existing home sales (SAAR) June 5.38 million 5.41 million

THURSDAY, JULY 21

8:30 am Initial jobless claims July 16 237,000 244,000

8:30 am Continuing jobless claims July 9 -- 1.33 million

8:30 am Philadelphia Fed manufacturing index July 1.9 -3.3

10 am Leading economic indicators June -0.5% -0.4%

FRIDAY, JULY 22

9:45 am S&P Global U.S. manufacturing PMI (flash) July 53.0 52.7

9:45 am S&P Global U.S. services PMI (flash) July 53.0 52.7

Main Source: MarketWatch

5. Charts

DX: Toppy until European panic again

Gold: Stable Thursday and Friday, but no buying

Silver: Very weak, then Friday, real signs of Life as shorts covered on stock rallies

Oil: They Cracked it on Monday, it re-rallied somewhat on Saudi Anxiety

Ethereum: Sleepy, then Friday it touched a big technical area, Someone got stopped out on Saturday

Charts by GoldFix using TradingView.com

6. Analysis: Gold, Fed, Economics

There was a lot of Gold discussion this week. Three interviews were done on Gold, Silver, and current economic situations governing them. All of our writing ideas were left out there this week. Basically, brains are fried.

So with your implicit permission, our analyses and observations are all here in these podcasts. Besides, there is some good stuff to read at very bottom ;)

UPDATE- Quick comment on Gold open interest.

We will say this after our first analysis just now: The buying of physical Gold and Silver is so far not backing off. The selling of Silver by CTAs is slowing, but the selling of Gold is now picking up. It does not predict a rally, but it does warn that something will soon have to give. What can “give” in a battle between patient physical buyers (Central Banks/ Sovereign Funds) vs. momentum hedge funds and retail? Here’s the playbook:

The patient buyers simply lower their bids and we dive more- they never chase

The short funds get spooked by a Data number and we rally- Silver leads up

It simply goes on indefinitely- but we think that is not the case here.

Remember we’ve been saying Silver shorts always get killed eventually, but make money in trending markets. We may not be trending anymore.

Now we see significant gold shorts, and will do some work tomorrow on this to see if a tipping point is reached. It was a good sign that Silver and Copper rallied last Friday. But nothing is certain yet. But if you are a buyer of physical, this is a good place to buy, regardless of the selling. We won’t speculate long here yet. But we will be buying physical next week.

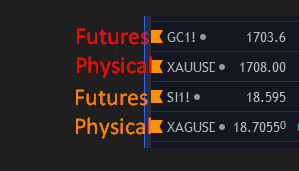

Spot is still trading above futures and it can go on trading like that for a while, but it resolves higher. Right now, we are just watching for trades. The Fed and the War have too much at stake to let metals rally. Paper is trumping physical this month. Buy if you like, but do not get suckered by a salesman that “because the physical is trading over the futures we must rally”. It’s simply not true in any way that can be timed. Good time to buy if you can , not a good time to speculate.

Physical buyers do not chase, ever.

1-The DailyGold Podcast- July 12th

Bifurcated World

Fed Policy: hike until it breaks

Fed Sells Volatility Options

Vix stayed low even when stocks dropped

Fed Breaks Trusted Indicators like Gold, Vix, etc.

Potential for a Gold Flush

Decades of Gold Abuse

It’s ok for stocks to drop if they can get Gold lower too.

Post Covid behavior

Jordan/Vince timeline to November

China problems instigated by the USA

Copper/Silver and Gold.. then Oil

Biden may not run again and how this factors into inflation fighting

The Dollar too strong as a market breaker

Europe Fragmentation stress- Brexit and Grexit parallels

There may not be a Euro/ Anti fragmentation tool

Gold futures prices versus sticky physical demand

A Possible Monetary Future…

2- Palisades Radio Podcast

Summary

Basel III effects on derivative positions of major banks and gold dealers.

Government and the Fed will do whatever it takes to protect the big banks.

Why sanctions on some BRICS nations are accelerating alternative economic systems.

A likely scenario for further inflationary spirals and disastrous stimulus attempts.

Time Stamp References:

0:00 - Introduction

0:44 - Gold Derivatives

4:46 - Gold, Leverage, & Bank Risk

8:10 - Systemic Risks & Bail-Outs

9:45 - Gold is Useless

21:45 - Gold Being Remonetized

23:30 - Russia Gold & Ruble

27:19 - BRICS+ Basket

31:47 - Fed's Path Forward

39:14 - Unemployment Numbers?

41:00 - The Downward Spiral

47:30 - Best-Case Scenario?

51:36 - Compounding Effects

55:16 - Wrap Up

Written by Palisades Radio

In light of what has happened with nickel at the LME and the government will do whatever necessary to protect the major banks. As Keith Wiener says, "Gold is not like other commodities because it is not consumed. All the gold ever mined remains, still exists. It's not destroyed and doesn't become irretrievable."

Because Gold is useless (too expnsive economically for industrial applications) that is why it's a great store of value. Money, including fiat, has no real practical purpose. At the central bank level, Gold remains money unless we find a broad industrial use for it.

Vincent explains why the BRICS countries are looking for ways to improve their economies with a commodity backed currency basket. China and Russia have been sanctioned and are looking for alternatives to the dollar.

At some level, gold will need to be remonetized for trade at the country level. The Fed is likely to back off soon. We may already be nearing a breaking point. Between now and November if inflation remains in the headlines then they will continue to raise rates.

Once we see recession concerns as mainstream news, then they will back off. Tom explains Vincent's recent post about a downward economic spiral caused by economists and governments attempts to resolve problems. We won't be able to recover until there is major pain. Those in charge will have to admit the current system is unfixable. Things have to change.

Tom and Vincent discuss what it would take to get back to normal and why we're likely going lower first. The jenga pyramid is unstable and parts of the economy are faltering. Policies around energy and agriculture are exacerbating the situation.

Vincent explains why all famines are created by men and the multiplier effect around crop shortages. These will further compound effects, and basically, we are looking at disaster.

3- Backwardation and Beyond Podcast - Gold and Silver

7. Research:

TD on Gold

Precious Metals The set-up for a deep liquidation event in gold is building. With gold bugs falling like dominoes, prices are now challenging pre-pandemic levels raising risks that the largest speculative1 cohort in gold will start to feel the pain under a hawkish Fed regime.

After all, the massive prop-trader longs appear to be complacent, but the average trader is still holding nearly twice their expected position size. This length was accumulated in 2020 and does not appear to be correlated to an inflation or Fed narrative, which instead points to a legacy position.

[ Edit- while Gold can certainly go down, there are not many longs left to our knoweldge. Speculators are getting short now. Their own graph confirms this- VBL]

JPM on Flows and Liquidity

While equities have seen an unwind of positions back to pandemic lows, our metrics suggest that previous OWs in credit, including EM have not yet been fully cleared.

Echoing previous recessions, there are some signs that companies have drawn down on credit lines as access to debt capital markets has become less attractive and/or unavailable

Goldman on What Will Let Stocks Continue Rallying

The number 1 question I get on daily basis is: what will it take to get a sustained institutional investor bid in the this mkt?

My answer is a string of (at least 3) economic data points (specifically CPI readings) that show cooler inflation.

And more

Continues at Bottom