TD Predicts $2700 Gold Despite China Absence-- 'Market bigger than any single central bank'.

GoldFix Newswire

The Gold market is bigger than any single central bank.

Bottom Line: According to TD Bank, there is significant money waiting to buy gold that will step in as it becomes more certain of US Fed rate cuts. Some of it will be American buying due to lower rates thus reducing opportunity cost1. Some of it will be overseas buying due to a predictable reignition of G7 inflation fires.

Both will be correct. The price Gold goes to as a result of these drivers will be $2700 according to TD.

Finally, TD believes China is not done buying, but merely pausing.

TD Predicts $2,700 with Upcoming Rate Cuts

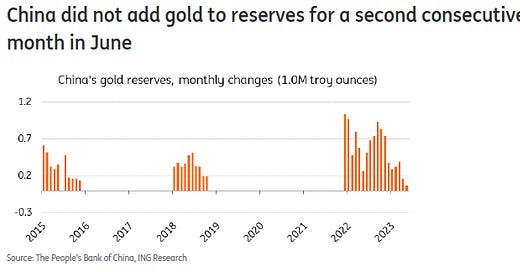

(GFN) In a new report out today, TD Securities believes Gold will hit $2,700 an ounce by early 2025. They observe that despite China's central bank not officially increasing its gold reserves in the last two months, this hasn't cooled the market, with gold rebounding above $2,400 an ounce.