Housekeeping: Good Morning.

Today:

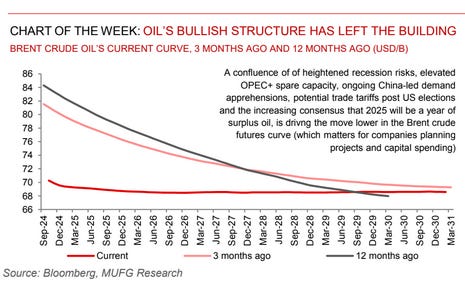

Premium Analysis: Oil’s Floor is Below

News: Technical Analysis Breakdown

Premium Analysis: Where’s The Oil Floor?

Energy: Brent spot prices went below USD70s/b (first time since December 2021). OPEC+ has agreed to extend their extra voluntary production cuts for two months (but may end them sooner than many think) until the end of November following the acute selloff in oil prices.Going forward, there is a risk that OPEC+ pivots its strategy in 2025 towards ramping up production.

Base metals:Base metals remain well down from the May peaks owing to elevated inventories and China’s ongoing growth malaise. We are slightly bearish on prices given US dollar strength, macro sentiment and CTA liquidation.

Precious metals :Gold is on track to notch another record with a stronger Japanese yen, a weaker US dollar and the 10 year Treasury yields down. We forecast prices to rise to USD2,750/oz by year-end and breach the USD3,000/oz threshold in 2025

CONTINUES AT BOTTOM

News: Technical Analysis Rundown

Gold: "If You're Bullish Gold Get Ready...."

Copper: 200 DMA says yes.. 50dma says no

Silver: “Copper is Holding Silver Down”

Oil: Good for a date, not a marriage

Charts in Video

Equity Recap:

US equities rallied on Wednesday, led higher by tech shares. Large caps bested small caps: S&P 500 (+1.07%) vs. Russell 2000 (+0.31%). MSCI Emerging Markets (EEM) and MSCI EAFE (EFA) rose 0.74% and 0.60% respectively.

Market News: Booming Recession

"Inflation in August declined to its lowest level since February 2021... [The CPI] increased 0.2% in August [in line with forecasts]... CNBC

"OpenAI is aiming to raise at least $5bn at a valuation of $150bn from investors including Apple, Nvidia, Microsoft and Thrive Capital, in a deal that could almost double the artificial intelligence start-up’s valuation. FT

"PricewaterhouseCoopers’s U.S. unit is laying off about 1,800 workers, its first formal layoffs since 2009, WSJ

"Many global businesses are pushing China down on their list of investment destinations and consolidating operations in the country, citing slower growth and diminishing profits. WSJ

"Payments in Singapore using stablecoins reached a record high of almost $1 billion in the second quarter, led by transactions at merchant outlets Source: Bloomberg

"Google co-founder and ex-Alphabet president Sergey Brin said he’s back working at Google “pretty much every day” because he hasn’t seen anything as exciting as the recent progress in AI — and doesn’t want to miss out." Source: TechCrunch

"Nippon Steel is mounting a last-ditch push to muster support for its $14.1 billion takeover of United States Steel,BloombergT

Politics/Geopolitics:

Hamas said its negotiation team met Qatar's PM and Egypt's intelligence chief in Doha on Wednesday to discuss the latest Gaza developments.

Palestinian draft resolution at the United Nations demands that Israel end its illegal presence in the occupied territories and called for the establishment of a mechanism to compensate for the damage committed by Israel in the occupied territory, while the draft resolution is expected to be voted on on September 18th during the 10th session of the General Assembly, according to Al Jazeera.

White House is finalising plans to expand where Ukraine can strike inside of Russia, according to POLITICO.

Some headlines via NewSquawk or DataTrek

Data on Deck: NFIB, CPI, PPI

MONDAY, SEPT. 9 Wholesale inventories

TUESDAY, SEPT 10 NFIB optimism index

WEDNESDAY, SEPT. 11 CPI year over year

THURSDAY, SEPT 12 PPI year over year

FRIDAY, SEPT 13 Consumer sentiment.1

Final Market Check…

Premium:

***DO NOT SHARE THIS***