The Commodity Crisis is Here for Europe.

IMPORTANT UPDATE ON MARCH 10th's "A crisis is unfolding. A crisis of commodities"- Zoltan Pozsar

Oil Trader Sunday Night:

The US will feel the inflation, but not the crisis that Europe will undergo. inflation of debt and rationing of supplies is their only way out now. They cannot substitute for lost Russian gas like the US can

UPDATE September 5th:

On Friday, G7 nations announced they had come up with a worldwide scheme to impose price caps on Russian oil. More on the implications of that SPECIAL: JPM Says $380 Oil Possible If Russia Retaliates

The following has happened this Weekend:

(GoldFix Comments in italics)

FRIDAY: Russia announced they will not sell oil to any country abiding by the price caps.

SATURDAY: Russia cuts off all Natural Gas flows to the EU.

No more gas until sanctions are removed according to Russia

Five days prior, seemingly trying to get in front of this news item, Europe announced their Natural Gas storage was 80%+ full

which means absolutely nothing in Natural Gas world. You need pressurized flows of gas to push the stored gas through the pipeline. Natural gas provision is dependent on pressure in the pipeline. This is not hyperbole. Gas doesn’t go through a straw on its own, and you cant use other gasses to push it through the straw without diluting it.

MONDAY: OPEC + announced it will reduce oil production by 100,000 barrels per day in what is a warning shot across the bow

“The 100k cut won’t impact physical volumes to the market, but it sends a signal to the market…. that opec plus is serious about cuts” Amena Bakr

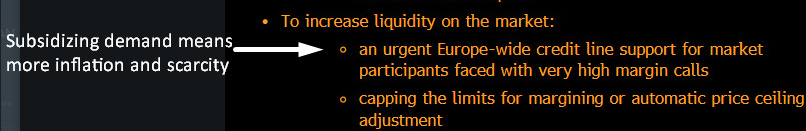

MONDAY: Europe has announced it may suspend trading in Power derivatives ( see pic)

which is the equivalent of banning short sales in stocks. But this is much worse. In a 2 trillion economy that is built on top of $20 billion in Gas, this is tantamount to destroying operating and financial leverage. Deals will not be done due to inability to honor contractual promises. If they do this, it is depression-type deleveraging for the EU

MONDAY: Rationing is back on the table again

and making them take cold showers IS rationing. installing price caps that limits purchasing for customer use IS rationing

Background: German Energy Rationing Begins

MONDAY: Europe will create lines of credit and ease credit requirements for operations to continue running

The West in general and Europe in particular must do the only thing they can in a commodity crisis, attempt to financially paper it over as long as they can until securing supplies. This is inflation morphing into hyperinflation

There are more headlines coming out by the hour, but these are the material points that we see so far that affect all of us and wanted them in your hands

***END UPDATE***

"A crisis is unfolding. A crisis of commodities"- Zoltan Pozsar

Excerpted from the March 10th post: "A crisis is unfolding. A crisis of commodities"- Zoltan Pozsar

In Zoltan’s latest missive on the events in Ukraine, he describes the situation, mechanism, and likely outcome of these global reaching events. They greatly affect how we define money. The report ends with: After this war is over, “money” will never be the same again1… He is right.