The China/LATAM Silver Cartel (Update)

On July 28th we published Exclusive: China and LATAM Silver Part 1 with the intention of publishing Part 2 relatively soon thereafter.

Part Two will be posted this weekend and contain an interview with a Silver mining exec. The post will largely focus on these questions:

QUESTION: What is Silver Concentrate, Dore bars, and where do they fit in the chain?

QUESTION: The supply deficit is about 4 years old now and running, how is this shortfall being covered?

QUESTION: We have been seeing since 2022 a marked drop in financial hedging for LATAM silver miners using Comex and also as reflected in the SiFO rates for leasing metal. Is that consistent with what you are seeing on the ground there?

QUESTION: We’ve been told that China silver production has been declining for quite some time and they’d been outsourcing increasingly. Any comment on that?

QUESTION: Are you seeing more direct purchases of Silver now? If so, by who?

QUESTION: Where do Bullion Banks Fit in?

The China Silver Premium Puzzle

We had also hoped to include an update on the Silver VAT controversy based on a new and highly anticipated Silver VAT report’s release from CPM Group1. We believe the price premium in China Silver is *not* due to a China VAT fee and is merely indicative of supply/demand dynamics already confirmed by China’s feverish activities to acquire more Silver in LATAM.

The CPM conclusion (yay or nay) would be helpful in determining t owaht extent that belief has merit. Unfortunately the new CPM report (1st one at full at bottom) has not been forthcoming as of this writing.

Therefore we will post Part 2 of the China/LATAM connection this weekend without it. Here, however, are some broad strokes on the topic as communicated directly to CPM Group on the X.com platform.

China Silver VAT Controversy

On June 10th CPM Group — a well known and respected Silver analytics firm headed by Jeffrey Christian— published “Part 1” of an analysis (“as requested by their client Silvercorp”), explaining the SGE (physical) and/or SHFE (futures) Silver price premium as they are publicly displayed versus Silver prices ex-China.

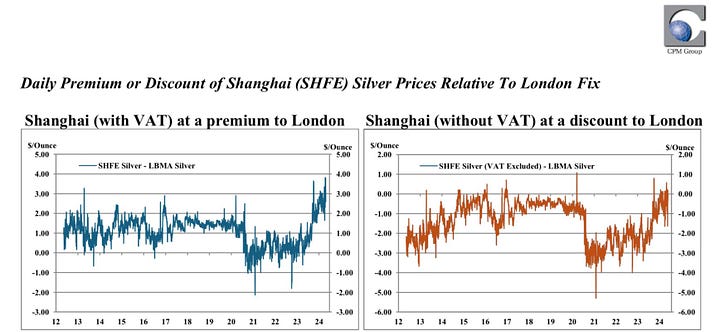

The CPM report’s early tentative conclusion was that the price differential may largely be due to China’s VAT. (pic 1, pic 2)

Since then major bank reports (eg Pic 3) touching on the topic have been published that do not corroborate this, while not addressing a VAT’s presence or absence at all.

From : BOA Loves the Silver

GoldFix and interested parties would like to know if further analysis is near completion towards the expected 2nd part of CPM’s cursory observations on this matter.

While it is possible our reading of the report is incorrect, —as elsewhere in the report it seems the analysis does imply captive silver demand in China’s region is at least partly driving the price differential— further explanation would be helpful.

It should be noted we have calls into the banks asking for clarification of their own work and others claiming knowledge of the market structure there.

Bottom Line: We are posting the Part 2 interview without the VAT update this weekend

CPM first report at bottom

BONUS: CHINA REALITY CHECK

We have had occasion to discuss China with Rory Green of TS Lombard and find his understanding of China to be very good. Without being a China-doomer, he has layed out the paths China must take to get out of its current malaise and in doing so kept us grounded in our own work on BRICS/China momentum

l