Housekeeping: This is slightly autobiographical out of necessity to give readers proper context on what we all know to be true— Gold is money— but some of us are still awaiting the MSM to announce. Don’t hold your breath. Just read this and know you are right.

Today:

Market Rundown

The Petrodollar is Dead to China

Zen Moment: Spillproof Bowl

1- Market Rundown

Good Morning. The Dollar is down 43 points. Bonds are somewhat stronger. Stocks are trading on either side of unchanged with the Nasdaq slightly down and the SPX and Dow slightly higher. Gold is marked up $8 after being $19 higher earlier. Silver, similarly, is up 9 Cents after being up 26 cents during Europe trade. Oil is up 57c. Nat Gas is up 3c after rising 10% yesterday. Crypto is up 3% over $30,000 now.

2- The Petrodollar is Dead to China

In 2017 while researching business ideas for possibly unretiring as an option marketmaker, much was learned about the growing rift between the BRICS and the G7 as it was manifesting even back then.

NYMEX Oil and Natural Gas Option Marketmaking…

One byproduct of this explorative experience was seeing1 how global commodity supply/demand pricing dynamics could handicap global trade trends.

Regarding Gold, this is what we learned back then:

Since 2013 global players in Gold (and Oil) had been slowly opening up shop in the East and closing it in the West. Demand had been moving eastward, and related businesses followed that demand.

Over some years, a slow but unmistakable drift from the US to China was observed in Gold businesses. Between 2013 and 2017, gold demand in Asia caused a great migration eastward of vaults, physical and financial trading operations, and finally exchanges themselves to open shop there. Why? Because that is where the demand was.

What was also learned and observed was a growing but inextricable tie forming between Oil, Gold, and the Chinese Yuan.

That learning gelled during a conversation between a physical oil trader and this author.

The physical oil trader (paraphrased) said this in 2017:

A few months ago, Russia did some Oil deals with China amounting to about $3BB testing Blockchain connectivity. The deals somehow were done through Seychelles and called for settlement in Yuan with a kind-of embedded call [EDIT- his words not mine-VBL] to convert to Gold on demand. So basically Russia and China did a Gold-for-Oil trade and used Blockchain to verify the Gold in Shanghai for custodial chain purposes.

The oil trader and myself had been discussing blockchain potential in Oil and Gold clearing trades. But, long story short, the whole mechanism for Gold remonetization worldwide was witnessed in a single mind-blowing moment.

Since then this author has written and spoken (NY Mines and Money) on the obsession many times to anyone in earshot.

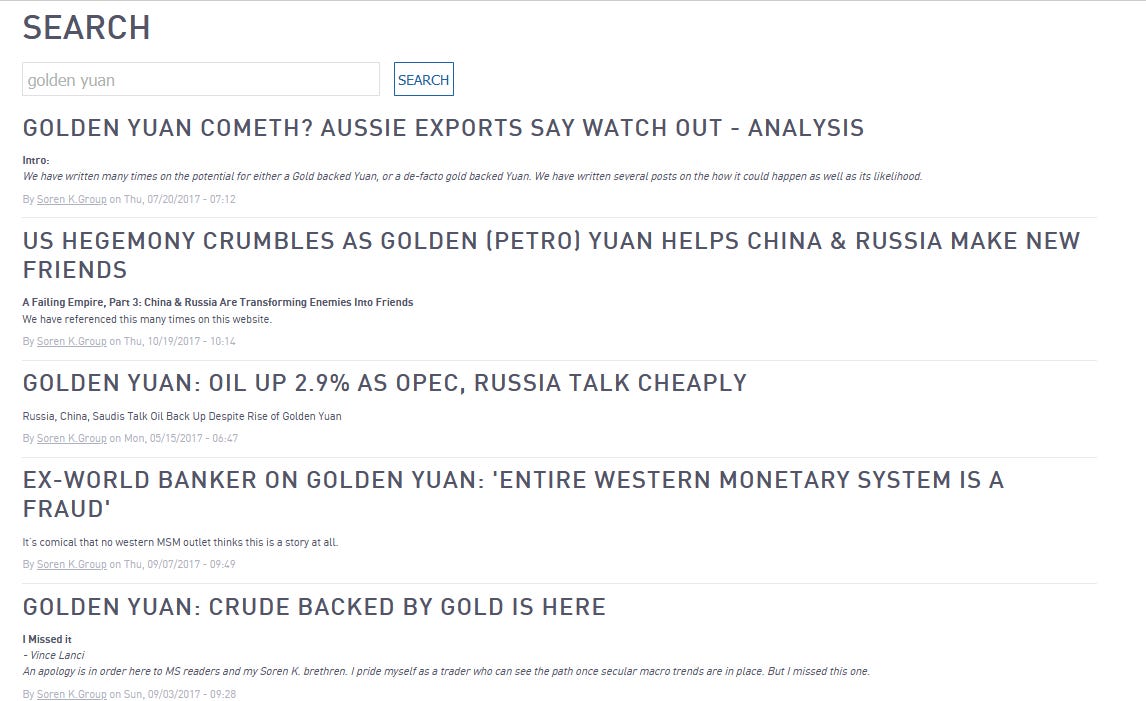

Golden Yuan 2017 Articles…

One article remains as coming-out moment for this development from September 2017:

What I saw as a test of Blockchain between Russia and China was much further along than originally seen.Deals are being done…

And the info I got was that the gold paid to Russia never left the Chinese vault. Source: Golden Yuan: Crude Backed By Gold is Here

Golden Vindication

Fast forward to today reading this from the excellent Christopher Wood2 at Jefferies on the 2017 style Oil-for-Gold trades.

GREED & fear heard one interesting rumour when in China recently that Saudi was using the renminbi it was receiving for oil to buy gold on the Shanghai Exchange. GREED & fear has no idea if there is any truth to this but it is certainly interesting that such stories are circulating.

On this point, it should be remembered that China launched in 2018 renminbi-denominated crude oil futures contracts on the Shanghai International Energy Exchange, and the renminbi has been fully convertible into gold on exchanges in Shanghai and Hong Kong since 2017.

That paragraph woke us up straight away. No coffee was needed after reading it.

The section mentioned is must-read (see below along with the April 7th Barron’s Gold article) for BRICS-curious investors and big picture aficionados. It focuses on the changing energy trade between China and the Res- of-the-World.

For example: “China’s exports to the Global South, for want of a better term, now amount to 35% of its annualized total exports, up from 21% at the beginning of 2008.” And a growing proportion of this trade will likely not be transacted in US dollars.

China has a bigger customer than the US now. They’ll happily pay with Gold..

Suffice to say the whole Jefferies piece is excellent weaving big picture global issues into macro manifestations using Energy as a focus. Also discussed are the shrinking universe of stocks that carry the S&P 500 higher, The growing BRICS trade footprint, and the usual macro measures necessary for trade decisions.

It Is Over

But for us, a 5+ year thesis is proven true. Gold, the only neutral monetary asset with no associated liability risk, is being used again to continue trade in an increasingly divided world pursuant to the Mercantilist3 economic model.

The case is now rested. We also recently added to our permanent long physical positions.

-VBL