The US is Revaluing Gold and Strengthening the Dollar

A revaluation of gold could serve as a catalyst to reduce U.S. debt without destabilizing the dollar or bond markets. Trump’s Sovereign Wealth Fund (SWF) proposal, coupled with an analysis that extends James Grant’s recent observations, indicates that gold monetization could serve as the bridge to economic health.

By marking gold to a higher value— say $3,000—1 and borrowing against it at 0%, and using the proceeds to retire high-interest U.S. debt, the SWF would function as a modern sinking fund—a Hamiltonian approach to restoring fiscal stability. This mechanism reestablishes a link between gold and bonds, signaling to markets that America is betting on itself. The world is likely to follow suit.

At that price, The US would free up approximately $800 Billion in buying power and according to James Grant could buy 16% of the outstanding public debt maturing in 11 years or longer. That would not be chump change in reducing interest payments from our current $83.6 billion (see chart down page) in interest spending annually.

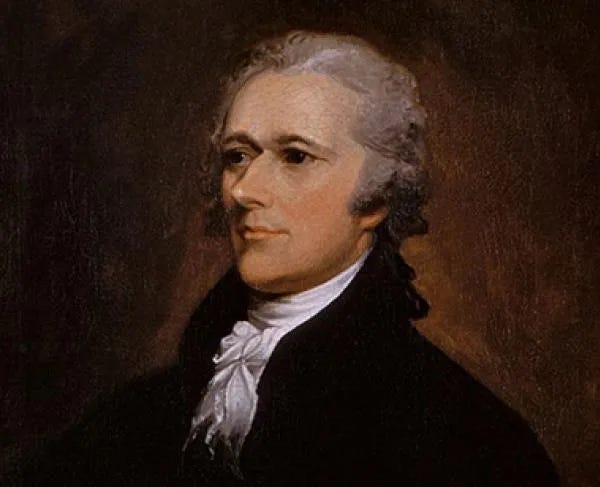

The intersection of gold, debt, and sovereign finance is not a new phenomenon. Alexander Hamilton recognized its importance over two centuries ago. Today, that same concept is resurfacing, with a potential gold revaluation serving as a vehicle to retire U.S. debt while preserving the independent stability of both the dollar and the bond market. The catalyst? Trump’s SWF proposal, coupled with insights from James Grant and remarks from Scott Bessent, suggests that a modern iteration of Hamilton’s sinking fund is on the horizon.

Understanding the Context

Late last month, Trump signed an executive order initiating steps toward establishing a U.S. Sovereign Wealth Fund. During the signing, Bessent remarked, “We’re going to monetize the asset side of the U.S. balance sheet.” The statement raised eyebrows. What U.S. asset could realistically be monetized to fund such a vehicle? Gold quickly emerged as the logical answer.

Clip: Scott Bessent’s SWF Statement

Source: Arcadia Economics

Bessent’s comment gained further significance for us when paired with Grant’s recent commentary. Grant (with professors Alex J. Pollock and Paul H. Kupiec) argued that a gold revaluation could fund a debt retirement program without triggering a collapse in the dollar or bond markets.

From Dear Scott Bessent:

Mark up the government’s gold from the obsolete carrying value of $42.22 an ounce to $3,000 an ounce. [Then] buy bonds. Tell the world it is a first step toward the restoration of Hamilton’s sinking fund. Attack the debt. Redeem the paper dollar. Make American finance great again. Source: Grants

This sinking fund idea filled a gap in GoldFix’s own prior ideas on gold remonetization as a debt reducer. Many, including ourselves, had speculated about gold repricing (e.g. asset-backed bonds, gold standard reinstatement, etc.) but have lacked a clear mechanism to integrate it into the U.S. financial system without risking destabiliziation of incumbent U.S. structures—namely, the U.S. dollar as Global Reserve Currency and the existing U.S. Treasury float as a store of value. The SWF, acting as a modern sinking fund, could be that mechanism.