Housekeeping: This is the PM GoldFix post combining AM emails with additional intraday posts.

GOLD AND SILVER RECAP:

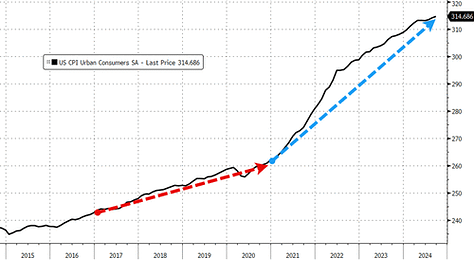

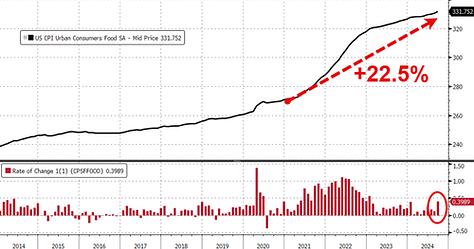

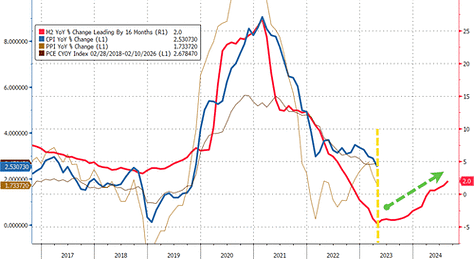

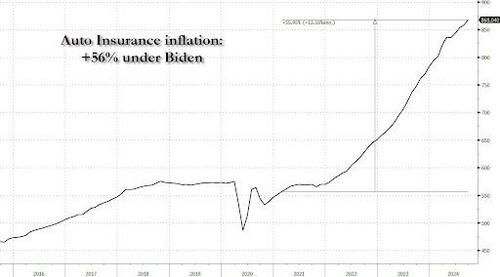

The CPI data came in higher than expected, indicative of unabated inflation. Also as Goldman expected, auto insurance propped up the supercore measure again.

What was not expected, but very welcomed, was the reaction of precious metals to the data. With CPI coming in a little bit stronger than expected, you might expect a continuation of the sell off in gold and silver. But that did not happen.

The metals rallied. Between 9 AM and 1 PM both markets gyrated back and forth but at higher prices. Then at 1 PM, after Eu markets closed, metals marched with little apprehension or hesitation to make new afternoon highs.

Whoever the seller was in the morning went away with London’s close. We have our suspicions as to who that seller was, but no fingerprints were left behind.

This rally also seems like more than a dead cat bounce. The proof of that is in yesterday’s open interest changes. They confirmed speculative funds sold and fresh buying bought it from them.

In the sell-off yesterday, someone caught the falling knife. It suggests that another wave of Macro fund buying is present and likely re-positioning itself for the election.

One day does not confirm our suspicion. However, we would not be interested in being short this market anymore. Our wish for a healthy retracement could be bearing fruit.

Knock on wood… this market may want to go higher again.

Here are some more eye popping charts via ZH:

Tomorrow is PPI.

Thanks GF…busy working, I didn’t get to see CPI print and was checking in seeing Au, Ag fall all day….now I have the news along with context, color (and hope)…Tyvm. This is why I subscribe…

Gold and silver give me hope in an otherwise dismal future world