Housekeeping: Good Morning. —

“The Gold reset is a process, not an event”

Today

Discussion:

Why The Dollar Must Drop (and Gold rise) Under Trump 2.0

“Make no mistake, there will be consequences, unintended and not, from rupturing the settled global flow of goods and capital, from which the world has greatly benefited since the 1970s ended. Taking this rupture to heart, and Trump’s likely pressure on Fed policy to bring it on-side, including a weaker dollar, means the late 1960s as analogue to today is becoming more evident.”

The TSLombard report broken down yesterday on Trump 2.0 and the death of Globalism anticipates a recalibration of monetary policy to align with the Trump 2.0 administration’s focus on production and trade.

Trump’s influence on the Federal Reserve is expected to push for a weaker dollar, reversing decades of strong-dollar advocacy that began during Reagan’s tenure. As the authors point out, "The Hamiltonian era of global banking dominance is over, and the Fed will adjust to the new reality of domestic economic priorities."

Bottom Line: The dollar has to go down for Trump 2.0 to get his way. And we need him to get his way

Nobody Trusts anybody now.

Nobody will buy our bonds at current rates

No credit means all deals must be cash only

No credit also means no use for our bonds as a SOV.

We need to make and sell actual stuff to pay down our debt

Enter a new Store of Value we Trust

Gold plus export-driven economics = Mercantilism

Mercantilism means protectionism

Protectionism means Tariffs

Tariffs mean inflation

The problem with Tariffs in a GRC is….. The Strong Dollar

Enter The Fed

If the dollar does not weaken, we are done for.

How to Protect against inflation?

Buy buying gold and Silver.. just like the Chinese are doing…

That is what Trump needs to do.

News/Analysis:

Equity Recap:

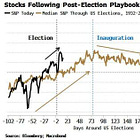

US equities were mostly unchanged on Wednesday ahead of Nvidia's (-0.76%) earnings report after the bell. Large caps and small caps closed flat: S&P 500 (0.00%) vs. Russell 2000 (+0.03%). MSCI Emerging Markets (EEM) and MSCI EAFE (EFA) slipped 0.12% and 0.27% respectively.

Market News: Amazon Killed Target

"Target’s and Walmart’s quarterly results underscore how the two big-box retailers’ performances have diverged. CNBC

"Nvidia assured investors that its new product lineup can maintain the company’s AI-fueled growth run, though the rush to get the chips out the door is proving more costly than expected. Bloomberg

"The US Department of Justice is expected to ask a judge to force Google to divest one or more of its core productsSource: FT

"Elon Musk’s artificial-intelligence startup, xAI, has told investors it raised $5 billion in a funding round valuing it at $50 billion—more than twice what it was valued at several months ago. WSJ

"Delta Air Lines forecast revenue growth in the mid-single-digit percentage points next year, in line with analysts’ estimates. CNBC

"President-elect Donald Trump’s team is holding discussions with the digital asset industry about whether to create a new White House post solely dedicated to [virtual] currency policy." Source: Bloomberg

Politics/Geopolitics:

Israel conducted raids on southern suburbs of Beirut, according to Al Jazeera.

Israeli air strikes on several houses in Beit Lahiya in the northern Gaza Strip killed and wounded dozens, according to medics.

Lebanon’s Speaker of Parliament Berri and US Envoy Hochstein reached a positive conclusion to the implementation of Resolution 1701 after two weeks of contacts, while sources close to Berri said there is agreement on 80% of issues, according to Kann.

Israeli press Yedioth Ahronoth noted that sensitive and final details of Lebanon's ceasefire agreement have yet to be resolved, but there is agreement on about 90% of the terms, according to Al Arabiya.

US Senate blocked measures that would have halted sales of tank rounds and joint direct attack munitions to Israel.

Data on Deck: Housing and Talking

MONDAY, NOV. 18 Chicago Fed President Austan Goolsbee

TUESDAY, NOV. 19 8:30 am Housing

WEDNESDAY, NOV. 20 None scheduled

THURSDAY, NOV. 21 Existing home sales

FRIDAY, NOV. 22 U.S. services PMI/ Consumer sentiment

FINAL MARKET CHECK…