Housekeeping: Good Morning.

“Strategy is just tactics on a longer timeline”

Topic:

Silver’s Highest Midyear Close Ever

Gold and Silver Rise as Fiscal and Liquidity Pressures Converge

Market Analysis:

*Silver’s Highest Mid-Year Close Ever

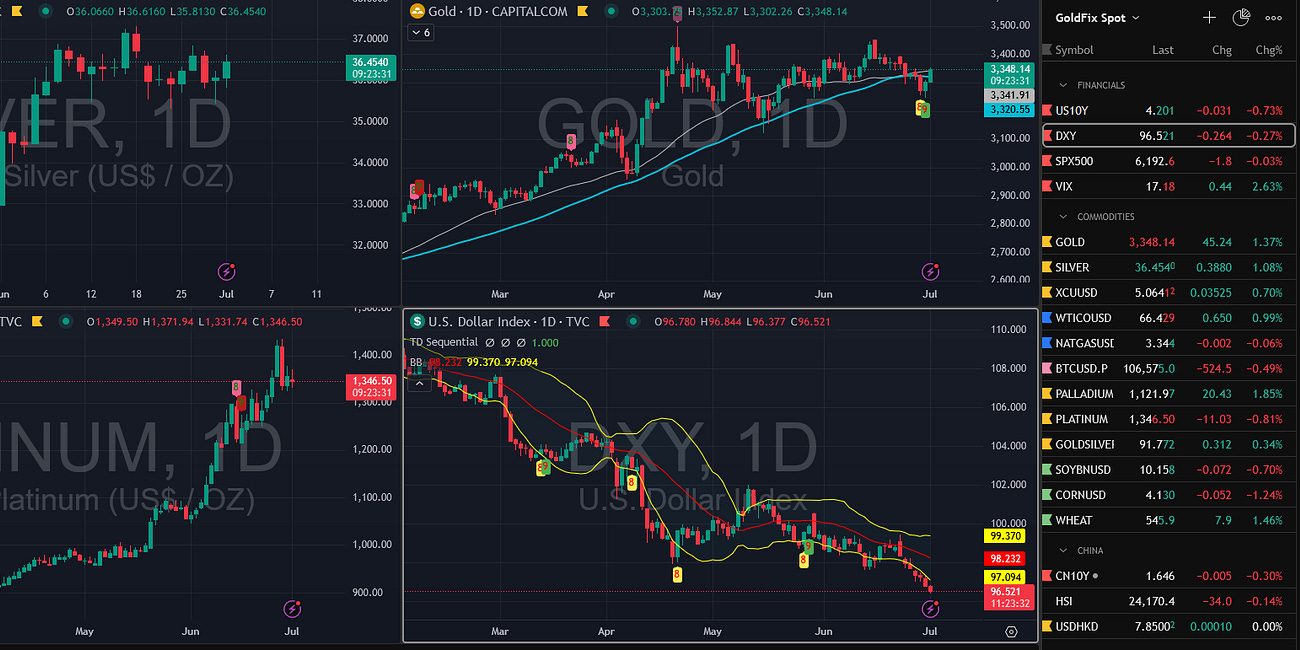

Silver just logged its second-highest quarterly close in history—only 2011 was higher. More significantly, this was the highest half-year close on record. Suppressed markets don’t usually allow this. Macro funds that chased gold’s record annual close may now eye silver next. A post-holiday surge remains a live possibility.

Gold, Silver Bid as US Concerns Grow

A Broader Backdrop of Risk:

Use of the Federal Reserve’s reverse repo facility has spiked in recent days, driven by declining reserve balances, heightened demand for Treasury collateral due to net issuance, and quarter-end liquidity pressures.

Elon Musk has reignited his criticism of Trump’s so-called “Big Beautiful Bill,” a nearly 1,000-page spending package. Musk called it “insane” and “destructive,” warning it will add trillions in debt and kill future-facing industries.

The fiscal drama and liquidity stress arrive just as several key macro events loom: the passage of the debt bill, the upcoming BRICS Summit, the planned Basel III implementation, and the expiration of a key tariff ceasefire.

Together, they form a potent mix of monetary, trade, and policy uncertainty. While geopolitical tensions may have cooled Gold’s run temporarily, the renewed focus on domestic fiscal imbalances and systemic strain has revived interest in precious metals. This time, silver is riding alongside gold. Finally, Financial repression is also coming as covered here.

Full analysis in Premium

Related Posts:

Coming Soon:

*TRUMP, ASKED ABOUT DEPORTING MUSK, SAYS HAVE TO TAKE A LOOK

TRUMP: MUSK IS UPSET HE LOST THE EV MANDATE BUT 'HE COULD LOSE A LOT MORE THAN THAT'

Doom. That is what is coming soon if we don’t grow up

Final market check

Data on Deck:

MONDAY, JUNE 30 9:45 am Chicago Business Barometer

TUESDAY, JULY 1 9:45 am S&P final U.S. manufacturing PMI

WEDNESDAY, JULY 2 8:15 am ADP employment

THURSDAY, JULY 3 8:30 am U.S. unemployment rate

FRIDAY, JULY 4 None scheduled, July 4 holiday

Full calendar1

Charts and Final Market Check

MONDAY, JUNE 309:45 amChicago Business Barometer (PMI)June43.040.5

TUESDAY, JULY 19:45 amS&P final U.S. manufacturing PMIJune--52.010:00 amConstruction spendingMay-0.1%-0.4%10:00 amJob openingsMay7.3 million7.4 million10:00 amISM manufacturingJune48.648.5%TBAAuto salesJune--15.6 million

WEDNESDAY, JULY 28:15 amADP employmentJune120,00037,000

THURSDAY, JULY 38:30 amInitial jobless claimsJune 28240,000236,0008:30 amU.S. employment reportJune115,000139,0008:30 amU.S. unemployment rateJune4.3%4.2%8:30 amU.S. hourly wagesJune0.3%0.4%8:30 amHourly wages year over year3.9%3.9%8:30 amU.S. trade deficitMay-$61.6B9:45 amS&P final U.S. services PMIJune--53.710:00 amFactory ordersMay8.2%-3.7%10:00 amISM servicesJune50.5%49.9%

FRIDAY, JULY 4None scheduled, July 4 holiday

Share this post