HouseKeeping: We’ve picked up another bunch of Founder subscribers for which we are grateful. Founders also have full access to Masterclass Archives. Here is part 2 of the Discussion on Spreads.

SECTIONS

Market Summary: weekly recap

Precious: analysis

Reports: research

Technicals: active trading levels

Tools: educational videos and research

Charts: related markets

Calendar: next week

REMEMBER BARRONS?: The weekend report is intended to be more like a Sunday paper with different sections. Barrons of old comes to mind. Best digested in sections between life’s responsibilities. - VBL

1. Market Summary

The week started out very poorly most likely on Tesla driven selling. It rebounded in part on figuring out that the Fed’s Taper program isn’t such a big deal. Thanks to the ubiquitous buying-panic on Friday, stocks almost made it back to green on the week.

The S&P was strongest

Small Caps were laggards

Nasdaq also underperformed.

The K Recovery Continues

Since around the year 2000, Wall Street and Main Street have been decoupling. The Lehman crisis events and government response accelerated that divergence, and, most recently, policymakers' response to the COVID crisis has driven the divided between Wall Street's success and Main Street's distress has never been wider. The chart below is a microcosm of the post covid K-shaped recovery.

Investopedia defines A K-shaped recovery as: occuring when, following a recession, different parts of the economy recover at different rates, times, or magnitudes. This is in contrast to an even, uniform recovery across sectors, industries, or groups of people.

A K-shaped recovery leads to changes in the structure of the economy or the broader society as economic outcomes and relations are fundamentally changed before and after the recession.

This divergence was highlighted even more so Friday, when Americans' sentiment crashed to its lowest in 11 years (UMich) as stocks rebounded back towards record highs.

Sector Performance

While major indices finished down on the week, readers will see more green spaces than red below. The reason is the magnitude of Tesla’s and other big index component moves weighed indices down.

Tesla was sold hard as Elon Musk sold more than he said he would.

Netflix encroached on Disney’s new subscription dominance- see 1

Healthcare bounced after last week’s route from Pfizer’s pill coup - see 2

Restaurants fared poorly maybe as a seasonal function- see 3

Shipping rallied. Seasonality and perhaps Biden sitting down with CEOs might imply they benefit from the meeting- see 4

Basic Materials which includes Miners rallied nicely- 5

Oil companies suffered with Oil’s drop

Companies

Rivian, the new EV maker and competitor to Tesla was priced to start trading in IPO at $78. It exploded 75% higher even while Tesla was doing a deep dive.

Elon Musk not only sold the 10% of Tesla shares as he said, he sold more during the week. Newswires reported “Musk Sold Additional Tesla Shares on November 11”. Zerohedge noted the next day “Tesla’s Musk Sells 1.2 Million More Shares for $1.24 Billion”. But why was he doing this?

Notable short seller and Big Short subject, Michael Burry laid out his own opinion of why Musk was selling.

Whatever the reason it is clear that being Elon is a lonely job.

Commodities: Oil

Oil posted its longest stretch of weekly losses since March with U.S. President Joe Biden keeping investors guessing about whether he’ll act to tame higher energy prices that are driving a surge in inflation.

“The fear is greater than the reality of what the Biden administration can do to bring down oil and gas prices.” said Phil Flynn, senior market analyst at Price Futures Group Inc.

What Phil, a colleague who we have a great deal of respect for1 implies: High profile jawboning, releasing oil from the SPR, and getting OPEC to pump more will create a dip; but not a long-lived one.

It is very notable that OPEC is not being as pliant as they had been in the past. Our feeling is they are sensing weakness on the US end and they may want something big in return. They will pump,but after they get what they want.

Oil Options

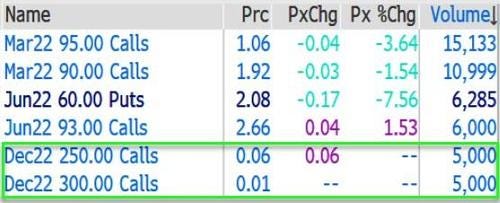

Someone was buying $250/$300 Brent call spreads (in modest size) this week.

This, if anything is a lottery ticket being bought by an under-capitalized player. If you know oil is going up, you do not buy $250 calls. You buy $80 calls. This tactic has been used frequently in meme stocks this year to push buttons of weak shorts. It has been used quite successfully in Tesla as well.

The tactic has origins in Oil back in the 1990s when they used to buy the $100 strike calls. These came to be called “War Calls”.

Could oil go to $250? Sure. Does some lunatic buying calls make the chance of that happening increase? No. It is likely just marketing by a bull who wants to start a conversation. If it goes there, the guy got lucky.

There is another important reason, and it relates to gamma squeezes etc. Players on the refined products side loved to buy gamma-tudinous options in Oil close to expiration. There were no weeklies yet. Then they'd buy crappy deferred calls loud and sloppy to freak out the shorts. Then, because the products markets were easier to move, they'd spoof Gasoline and Heating oil higher. Option marketmakers would start the ball moving chasing over themselves from the immediate negative gamma. Crack spreaders would buy crude because the products were up, and we'd be off to the races for a little. Guess who would be selling into the rally? Sound familiar?

Excerpts and option's data here were pulled from Zerohedge’s Friday post

GoldFix Friday WatchList

Complete Watchlist Here

Crypto Saturday Session

2. Precious: Goldman Likes Gold… Really

Damien Courvalin, Goldman Sachs Head of Energy Research joined “Bloomberg Markets: European Close” with Alix Steel and Guy Johnson, discussing the state of the metals market. Courvalin believes gold is on the road to $2,000. Here’s that intereiw and our analysis of his timely reccomendation. Click VBL link for full interview, ad free.