Housekeeping: Many will be receiving GoldFix Weekly for the first time. It is different than the dailies. This post is more like a magazine. Content touches many areas of markets. The index may help.

***Founder’s Class : No Class this Sunday. Enjoy the day***

SECTIONS

Market Summary

Technicals

Podcasts

Calendar

Charts

Premium divider

Analysis

Research Recap

1. Market Summary

**UPDATE: A piece was excerpted and picked up by Zerohedge Monday:

Anti-Goldilocks: The 5 Year Bear Market for Everything But Gold

What happened last week? Stocks started the week soft with trepidation about if or if not the Fed would raise rates a full 75 basis points Wednesday as people had started to fear.

S&P 4131.9 was last week's closing level

This is the S&P 500's longest weekly losing streak since June 2011

All the majors made new cycle lows

Volatility across every asset-class is surging

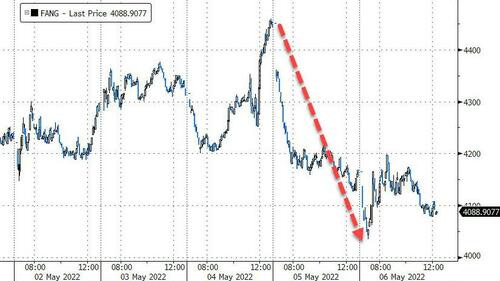

Powell came out on Wednesday essentially stating the Fed would not raise 75 basis points any time soon. Stocks, Gold, and Crypto wickedly rallied on the news. Scared money that was waiting on this news got put to work. Bang zoom.

Thursday saw Jobless claims come in higher than expected in combination with labor costs rising and productivity dropping; a triple whammy for the hopeful. Brutal news and stocks gave Wednesday’s rally completely back.

That brought us to Friday. It was clear to many that the rally post Powell’s dovish statements was too much for the Fed’s attempts to talk the markets down gently. Which meant, Friday’s gaggle of Fed speakers would have to talk tough. They did just that.

Friday’s data was also not helpful although not as horrendous as Thursday’s. Payrolls increased slightly, but hourly earnings went down, and unemployment upticked. Stocks completely undid the rally of 2 weeks ago.

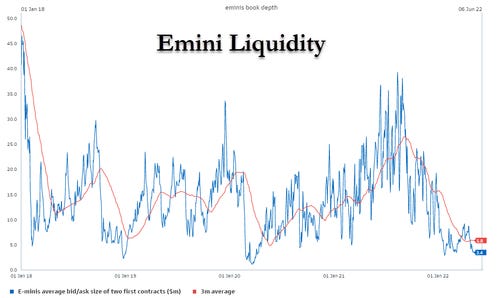

On the week: Stocks dropped. Bond yields rose in the backs while short term rates dropped (bear steepening), and liquidity absolutely dried up. Equity market liquidity is near record lows. “The mess we’re seeing in the market is about liquidity,” explained Mohamed El-Erian.

Why does liquidity matter?

Lack of liquidity causes market moves to exaggerate in both directions. Lower liquidity means higher volatility. Wednesday’s rally was far too much for the news item. Thursday’s reaction lower was equally ridiculous. Friday’s intraday moves were sickening.

The Lower Liquidity Goes, the Bigger Volatility gets…

Normal people just do not want to deal with the roller-coaster. The closer they get to retirement, the less fireworks they want to see. They get out of risk. Thus, increased volatility in both directions is ultimately bearish for stocks and bullish for Gold.

Five Year Outlook

Incidentally, this liquidity stuff is also why Gold will in part, ignore real rates going higher. Real rates rising absolutely mean the opportunity cost of owning gold is going up for sure. But, that means stocks are less attractive also. There are a shit-ton more longs in stocks than there are in Gold.

A prolonged volatile market (growing volatility is the flipside of shrinking liquidity), will aid the stock selloff. The selloff in stocks will, in turn, cause a volatility feedback frenzy, which will finally cause people to put their money into something less volatile.

Most of that will go into cash of course. Some of it will go into Gold as well. So while there will be selling in Gold due to liquidity drying up, there will also be buying of Gold as a flight to less volatile assets. On balance, Gold should enjoy inflows as it takes a larger percentage of a shrinking capital marketplace.

This is a 5 year outlook, and we are betting on it.1 If we are wrong it will be because stocks rally on the back of continued inflation. Which, if that happens will eventually trigger a hard landing moment, but when that is not easily handicapped at this time.

As to a soft landing; sure that could happen, but we doubt it. Assume it did. The terminal rate of Fed rate hikes would have to be low, maybe lower than past cycles. That to us simply means they are running out of room to play their QE/QT game. Dimishing returns for stocks will grow along with unintended consequences in Gold. This is when a reset actually happens

For us, the next 2 years are easy to see: If the Fed gets what it wants, stocks will be somewhat lower, Gold will be somewhat higher, and bonds will be lower in a gentle descent to more normative levels as inflation wanes.

If the Fed does not get what it wants then inflation will remain very strong. If that happens, stocks will rise, inflation will eclipse the stock rise, and bonds will signal a problem. Then we get the actual Volcker moment everyone is bragging they know about but so few understand.

A month ago Zoltan Pozsar mentioned the need for a steeper yield curve in combination with higher rates and lower stock/home prices. This week gave us just that. Here is a summary of what was said then:

From Cure Inflation "By Forcing Long Term Rates Higher"- Zoltan Pozsar

In summary: If the Fed could stop suppressing volatility with handholding speeches and telegraphed behavior maybe the long bond would start to value real economic risks.

Long term rates are going higher. The Fed will have to chase inflation at the short end and let the back end volatility rise along with rates. If it doesn’t their will be a real Volcker moment. That will come with the 30 year at 10% in a possible overnight fiasco.

To recap since then:

Volatility across every asset class is surging…

Mortgage rates will keep rising while houses are about to be worth less than before due to rising rates and a steepening yield curve...

Stocks are lower…

And Gold is violently unchanged to slightly higher….

Thank you to Zerohedge for data and some graphs.

Sectors:

FANG stocks crashed almost 10% from the post-FOMC spike

Energy did well on Nat Gas activity

Semiconductors did well

Banks love a steepening yield curve so far

Commodities:

dollar managed gains this week, pushing up against 20 year highs,

Gold was unable to hold $1900...

Oil is back above Biden SPR levels

Retail gas prices are back above Biden SPR levels

NatGas had a wild ride this week, soaring to within a tick of $9 and plunging

Bonds: The Broken Ladder Effect

The entire yield curve is above 3.00% from 3Y out...

Some data and graphics courtesy of Zerohedge

Crypto:

Crypto had another down week...

Bitcoin leading the drop (back below $36k), as the correlation between the major crypto and the big tech stock index has reached basically '1

GoldFix Friday WatchList:

Complete Watchlist Here

2. Technical Analysis

Report Excerpts Courtesy MoorAnalytics.com

GoldFix Note: Do not attempt to use price levels without symbol explanations or context. Moor sends 2 reports daily on each commodity they cover. The attached are non-actionable summaries.

Gold

TECHNICALLY BASED MARKET ANALYSIS AND ACTIONABLE TRADING SUGGESTIONS Moor Analytics produces technically based market analysis and actionable trading suggestions. These are sent to clients twice daily, pre-open and post close, and range from intra-day to multi-week trading suggestions. www.mooranalytics.com

Energy

Bitcoin

Go to MoorAnalytics.com for 2 weeks Gold, Oil, and Bitcoin reports free

3. GoldFix and Bitcoin Podcasts

More GoldFix Broadcasts HERE

More Bitcoin Podcasts HERE

4. Calendar

Some upcoming key data releases and market events

MONDAY, MAY 9

10 am Wholesale inventories (revision) March 2.3% 2.5%

11 am Consumer 1-year inflation expectations Q1 -- 6.6%

11 am Consumer 3-year inflation expectations Q1 -- 3.7%

TUESDAY, MAY 10

6 am NFIB small-business index April 92.9 93.2

11 am Real household debt (SAAR) Q1 -- 2.5%

WEDNESDAY, MAY 11

8:30 am Consumer price index April 0.2% 1.2%

8:30 am Core CPI April 0.4% 0.3%

8:30 am CPI (year-over-year) April 8.1% 8.6%

8:30 am Core CPI (year-over-year) April -- 6.4%

2 pm Federal budget April $220 billion -$226 billion

THURSDAY, MAY 12

8:30 am Initial jobless claims May 7 191,000 200,000

8:30 am Continuing jobless claims April 30 -- 1.38 million

8:30 am Producer price index (final demand) April 0.5% 1.4%

FRIDAY, MAY 13

8:30 am Import price index April 0.6% 2.6%

10 am UMich consumer sentiment index (preliminary) May 64.4 65.2

10 am UMich 5-year inflation expectations May -- 3.0%

Main Source: MarketWatch

5. Charts

Gold

Silver

Oil

Bonds

Nat Gas

Daily for context:

Bitcoin

Charts by GoldFix using TradingView.com

6. Analysis: Credit Card Roulette

The Weekly report was broken into 2 pieces, the analysis piece is below.

Bottom line: As rates rise to try to slow inflation it will cause recession as well. To cushion that risk, the govt has, in the past and unbeknownst to many, directed banks to ease credit requirements. Banks happily comply for profit-driven reasons. They did this during the dotcom crisis in 2000, and the GFC crisis in 2009. They are doing it again.

Several (5 or 6) of our colleagues have seen a large uptick in credit card applications for balance transfers and a general increase in credit offers starting in January. This is intended as bridge off the stimulus to keep consumer demand stable.

Includes source research report used for GoldFix analysis

7. Research:

TD on Gold

Gold traders began to aggressively liquidate gold ahead of this week's FOMC meeting. Net non-commercial futures length plummeted -3.5% on the week, with participants shedding some complacent length associated with the war in Ukraine ahead of the Fed's highly-anticipated hike and announcement on quantitative tightening. With the Fed telegraphing its every move, positioning analytics will be key for price action. We still see a significant amount of complacent length remaining in gold, while the breadth of traders short has just started to rise from near-record lows. The bar is now razor thin for CTAs to join into the liquidation vacuum, with ETF outflows and Shanghai trader liquidations already weighing on the yellow metal.

GS on Stocks

As long as inflation is well above target and the labor market still extremely tight, the logic of tighter financial conditions and slower growth is hard to avoid. the more resilience that activity and equity markets show, the higher rates will likely need to go. for that reason, a period of easing financial conditions again sowed the seeds of its own demise. continued Fed hawkishness -- Source

DB on Geopolitics

Next week will also be an important one in geopolitics. Amid the Ukraine crisis, Finland may decide whether to apply for NATO membership as soon as next week, and Sweden is due to publish its security policy assessment before May 13. An update from Russia on the conflict and associated developments may come on Monday as it will be the Victory Day, traditionally marked with a military parade and a President's speech.

GS on Commodities

In the case of additional disruptions and supply shocks, say if additional severe sanctions were imposed on Russia or Ukraine’s inability to plant leads to a severe global shortage of grains, then we could see a further steepening in backwardation that will likely come hand-in-hand with elevated volatility. Ultimately in commodities, volatility spikes when inventories deplete

More at bottom…Zen Moment:

More at bottom…