Housekeeping: Fred Hickey on Miners, TSL on Central Banker follies, HSBC and GS on Oil, and we think retail may be too long Products.

SECTIONS

Market Summary— Good week for stocks, CTAs are too long Oil

Research— FH, TSL, GS, HSBC

Week’s Analysis/Podcasts— Silver, RRP, Gold

Charts— Silver outshines all, Heat cracks come in

Calendar— PMI, PPI

Technicals— must read GC Friday Post mkt summary

Zen Moment— volleyball excellence

Full Analysis— The Great Volatility, CTA positions

1. Market Summary

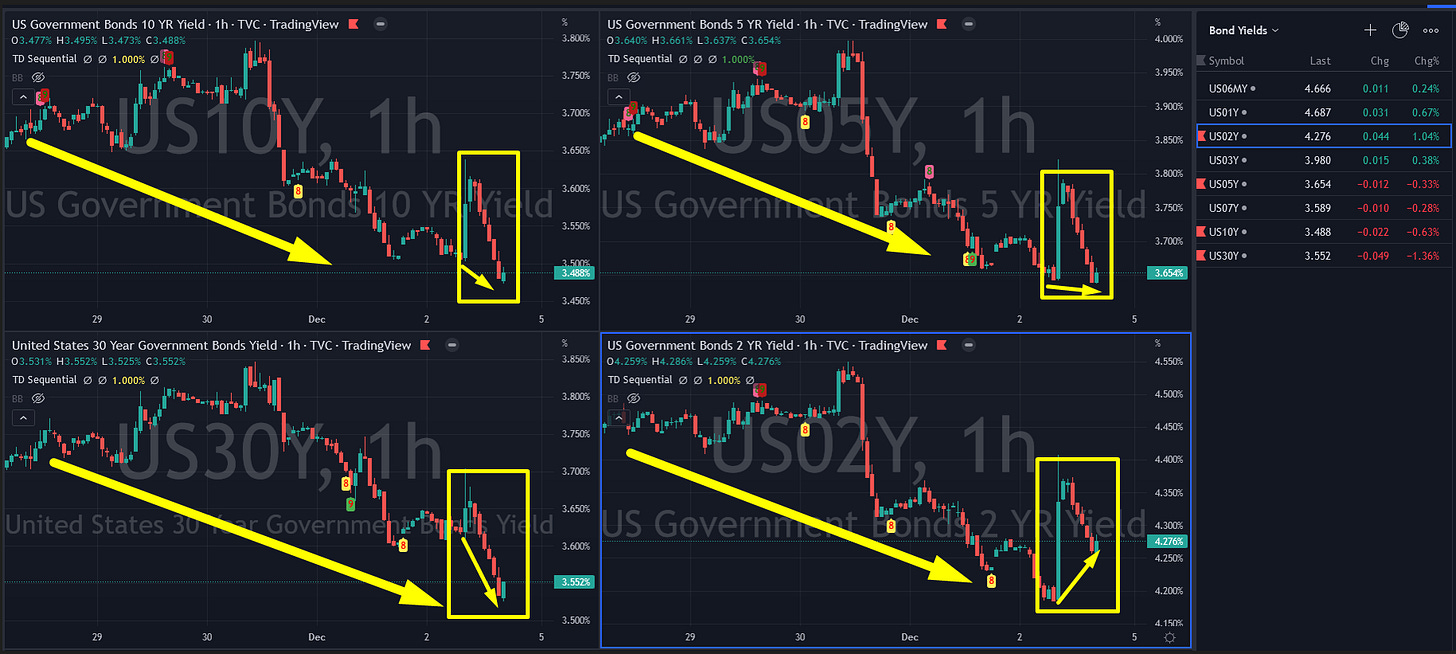

We had a typical week of: China headlines mixed with OPEC production cut rumors, sprinkled in with ugly economic data (PMI/Housing) and "great" economic data (payrolls, wage growth). Key was Powell’s speech that came across as dovish for rate hikes. See the red rectangle in chart below for that effect. All of this pushed stocks higher on the week.

The Nasdaq was the week's best performer

Feels like counter-trends across the board with Dow stocks giving ground to Tech again. Could be Fed pivot stuff, could just be counterbalancing into the new year

Sectors

Miners are Exploding. No doubt the reallocations are being placed

Healthcare, largely under the radar, has been a winner all year

Energy took a hit. We think this is more of the Sell some oil buy some gold play manifesting

Banks were soft, but had a nice run recently

Commodities:

A noisy week for crude but WTI ended the week up at $80

Gold surged back above $1800 this week - its highest since August

Bonds:

Bonds were bid on the week, with the entire curve basically down around 17-18bps on the week

The yield curve shape ended largely unchanged on the week.

Crypto:

Cryptos managed gains on the week with Ethereum up 7.5% and Bitcoin up around 3%

H/t Zerohedge for data and some graphics.

2. Research Excerpts:

This Week

Hickey on Miners**

TSL: Policy Makers Are out of Luck, “Polycrisis risk is here”

GS: Oil’s Bumpy Road Higher

HSBC: Oil 2023

1- Fred Hickey Notes Gold’s Seasonality

This month’s Tech Investor has a section on Gold. In it Fred Hickey notes:

With the strongest seasonal months ahead (over the past two decades, the December through February period has provided almost two-thirds of all gold’s gains), the setup is promising.

He then proceeds to go through some of his favorite mining stock picks including but not limited to: Agnico Eagle/Pan American Silver, Hecla, SilverCrest, Wesdome and more…

CONTINUES AT BOTTOM…

2- TS Lombard: Policy Makers’ Luck is Running Out

Sometimes TS Lombard can be scathing in their criticism of policy. Here they are writing another way to look at what we call the Anti-Goldilocks era.

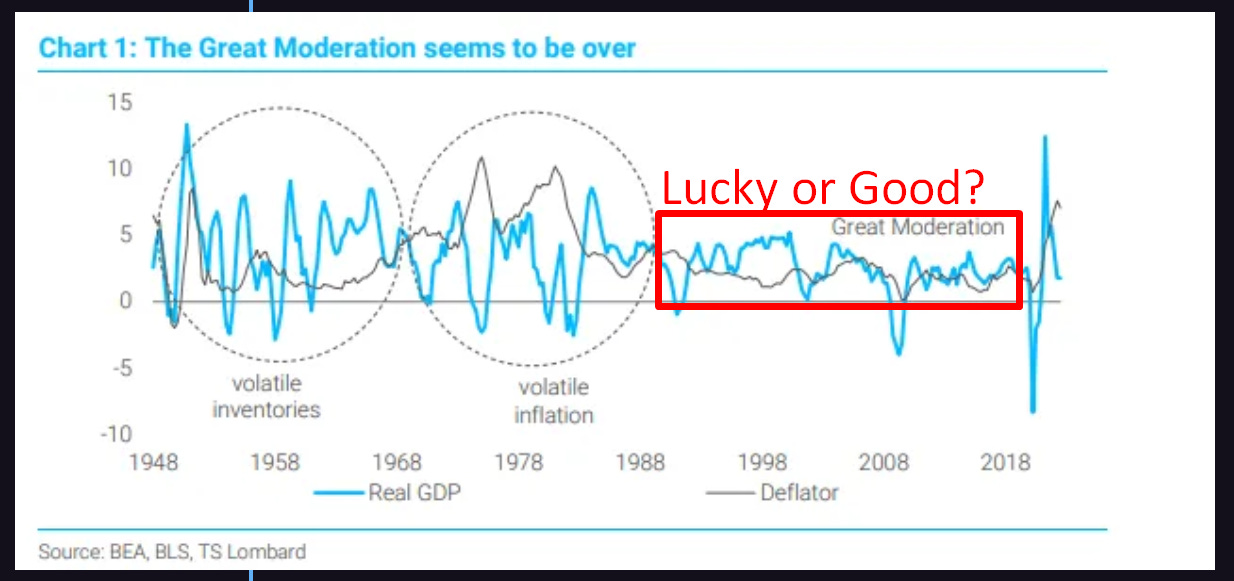

Global policymakers are always quick to take credit for the Great Moderation, which started in the 1980s. Now, unfortunately, their luck seems to be running out.

Besides raising questions about the competency of policymakers, a regime of macro instability could have important implications for financial markets.

This macro report goes into what made the Great Moderation of the 80s and 90s so great. Then it walks through the situation as it currently exists and asks aloud if policy makers can do anything about it.

CONTINUES AT BOTTOM…

3. Week’s Analysis/Podcasts:

JPM: Sell Some Oil, Buy Some Gold in 2023- ZeroHedge

Ghana's Gold for Oil Deal is Not Good for The USD- ZeroHedge

OIL: Revenge of the Contango- Brynne Kelly

Gold’s Role in the International System- GoldFix Reads

LME Autopsy- Matt Levine

Is Gold Ready For Lift-Off?- GoldFix Reads

4. Charts:

Metals and DX

Bond Yields

Crypto

Metals/PGMs

Energy

Forex

5. Calendar

MONDAY, DEC. 5

9:45 am S&P U.S. services PMI (final) Nov. 46.2 46.1

10 am ISM services index Nov. 53.7 54.4

10 am Factory orders Oct. 0.7% 0.2%

TUESDAY, DEC. 6

8:30 am Trade deficit Oct. -$80.0 billion -$73.3 billion

WEDNESDAY, DEC. 7

8:30 am Productivity (SAAR) revision Q3 0.4% 0.3%

8:30 am Unit labor costs (SAAR) revision Q3 3.5% 3.5%

3 pm Consumer credit (level change) Oct. $30 billion $25 billion

THURSDAY, DEC. 8

8:30 am Initial jobless claims Dec. 3 230,000 225,000

8:30 am Continuing jobless claims Nov. 26 -- 1.61 million

FRIDAY, DEC. 9

8:30 am Producer price index final demand Nov. 0.2% 0.2%

10 am UMich consumer sentiment index (early) Dec. 56.8 56.8

10 am UMich 5-year inflation expectations (early) Dec. -- 3.0%

10 am Wholesale inventories revision Oct. 0.8% 0.8%

Main Source: MarketWatch