Housekeeping: Happy Thanksgiving. Included Hartnett's Calls for 2023, Goldman's comments on 2022, Gold and Ghana

SECTIONS

Market Summary— Stocks, Silver, Bonds all like the Holiday

Research— *BOA, GS, and GoldFix on Gold

Week’s Analysis/Podcasts— Gold, Oil, and more

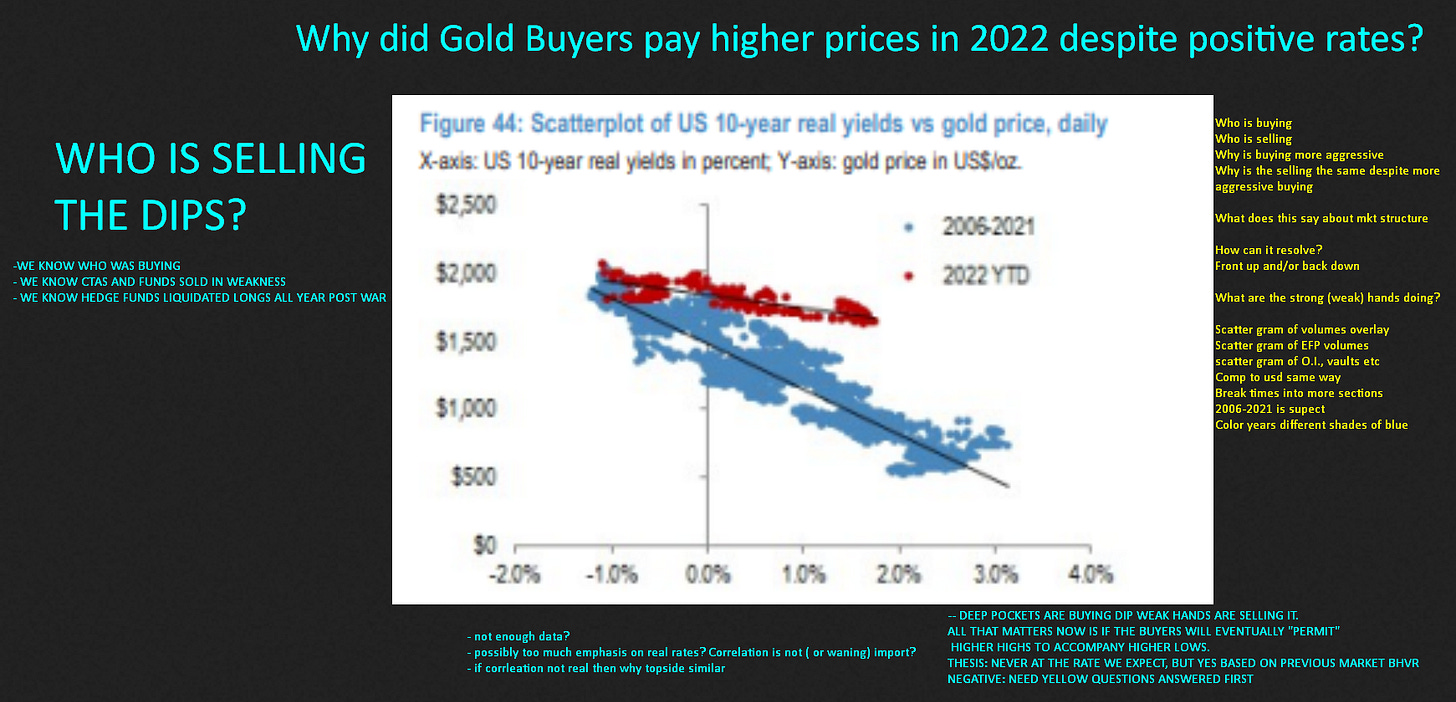

Charts— *2022 Asset Performance, Gold Dip buying

Calendar— GDP, PCE, Powell Speaks

Technicals— GC, SPX, BTC, CL

Zen Moment— Virtual apartment flooding

Full Analysis— Ghana Announcement etc.

1. Market Summary

The holiday-shortened week of low liquidity enabled Bonds and Stocks to rally as the dollar drifted lower on the heels of dovish hopes. These sent chances of rate easing higher and chances of a lower terminal rate.

We’re not convinced at all, but our opinion aside, there is just too much money now rotating in stocks to ignore the behavior until Powell does his next verbal smackdown. It’s the rotation out of one thing and into the other thing that matters.

Aside from Energy, which got sold (albeit not that badly considering) from WTI’s selloff; Basic materials, and older industry did noticeably better than their tech brethren. Notice the red rectangles below. The Dow was higher when the Nasdaq was lower.

Zerohedge notes the longest-duration stocks actually underperformed thanks to selling pressure Friday with The Dow leading higher on the week. This is the continuation of what we know is happening — stocks that weather persistent long term inflation are better off than tech. The revenge of the old economy as Goldman recently warned in its post is alive and well in stocks.

QT is now underway and the Fed’s balance sheet has begun shrinking with no disasters thus far as noted by ZH. Then this came from Goldman’s Trading desk:

"...for every one dollar of US GDP, there are still 34 cents on the Fed balance sheet... just before COVID hit, that number was 22 cents. in the third quarter of 2008, it was just 6 cents. even at the end of WWII, it was just 11 cents."

By that comparative measure, there is a lot more to go. There is one important difference between now and right before Covid hit. The Fed had an austere fiscal regime to counterbalance its monetary largesse. Now, however, the Fed’s role is increasingly to counterbalance the fiscal ease with which the Biden administration ( reminiscent of the 1970’s) has moved towards.

Finally, the market is for now pricing a much worse recession than we have already. 1 For that reason it will continue to rally as CTAs cover, RIAs reallocate during "buy season", and inflation continues to drop. Which is fine. China reopening, the war ending, or Powell & Co. talking tough again will be the only things to dissuade the rallies now.

Commodities:

USD fell for the 5th week of the last 6 to its lowest weekly close in 3 months

Silver outperformed (with gold flat)

Crude sliding amid (despite?) Russian price cap scheme headlines and China COVID cases soaring. The Oil price cap has no teeth and is designed to ensure Russia doesn’t have real cause to retaliate. It is a face-saving joke

Bonds:

Bonds were bid

The yield inverted even deeper, moving towards short dated

Crypto:

Bitcoin and Ethereum ending the week down around 1-2%.

Solana outperformed

H/t Zerohedge for data and some graphics.

2. Research:

GoldFix Pros and Cons of the Ghana Announcement

**BOA’s Hartnett: 2023 top 10 trades**

Goldman’s Trading Desk 2022 Summary

Excerpt: Five Reasons Why Ghana is Good For Gold And One That Makes Us Wrong

Some thoughts on The Ghana Gold announcement. Why it is good for Gold, what some current bears are saying, and one risk that makes it all a big nothing-burger.

1- Less Means Less

Less physical to LBMA2 (or wherever) means less physical is controlled by intermediaries. Paper shorts will be forced to accelerate covering as less metal is available for deals. Like Nickel but infinitely slower.

2- Gold Takes Oil-Deal Marketshare from USD

The seller of oil, the most used energy resource on earth, is we’d assume as represented by Ghana telling everyone that Gold3 is acceptable as payment. All that matters is the price-haircut if one exists.

3- Global Renegotiation of Dollar Deals at Adverse terms for USD, Better Terms for Alternatives

There are many countries mining Gold that buy oil. Historically their only effective access to getting cash for their Gold has been to transact with Bullion banks using Bilateral swap agreements, credit lines, and hedges. These were captured deals that amounted to a customer with little alternative recourse to monetizing their Gold as they needed USD to exist. This created moral hazards4 for banks having exclusive relationships with those countries. Ghana is a country seemingly treating Gold like money and not a resource to be sold for money. Much more below

MUCH MORE AT BOTTOM…

3. Week’s Analysis/Podcasts:

China thought to be stockpiling gold to cut greenback dependence

Is Someone Front-Running the Gasoline Winter Build? by Brynne Kelly

Jim Grant on Gold's Central Bank Buying and Possible Revaluation

4. Charts:

Metals and DX

Bond Yields

Crypto

Metals/PGMs

Energy

Forex

5. Calendar

MONDAY, NOV. 28

12 noon MarketWatch interviews St. Louis Fed President James Bullard

TUESDAY, NOV. 29

9 am S&P Case-Shiller U.S. home price index (SAAR) Sept. -- -9.8%

9 am FHFA U.S. home price index (SAAR) Sept. -- -7.6%

10 am Consumer confidence index Nov. 100.0 102.5

WEDNESDAY, NOV. 30

8:15 am ADP employment report Nov. 200,000 239,000

8:30 am Real GDP (SAAR) revision Q3 2.7% 2.6%

8:30 am Real gross domestic income (SAAR) Q3 -- 0.1%

8:30 am Real domestic final sales (SAAR) revision Q3 -- 3.3%

8:30 am Trade in goods deficit (advance) Oct. -- -$92.2 billion

9:45 am Chicago PMI Nov 47.3 45.2 10 am Job openings Oct. -- 10.7 million

10 am Quits Oct. -- 4.1 million 10 am Pending home sales index Oct. -- -10.2%

1:30 pm Fed Chair Jerome Powell speaks at the Brookings Institution

2 pm Beige Book

THURSDAY, DEC. 1

8:30 am Initial jobless claims Nov. 26 230,000 240,000

8:30 am Continuing jobless claims Nov. 19 -- 1.55 million

8:30 am PCE price index Oct. -- 0.3%

8:30 am Core PCE price index Oct. 0.3% 0.5%

8:30 am PCE price index (year-on-year) Oct. -- 6.2%

8:30 am Core PCE price index (year-on-year) Oct. 5.0% 5.1%

8:30 am Real disposable income Oct. -- 0.0%

8:30 am Real consumer spending Oct. -- 0.3%

9:45 am S&P U.S. manufacturing PMI (final) Nov. -- 50.4

10 am ISM manufacturing index Nov. 50.0% 50.2%

10 am Construction spending Oct. 0.2% 0.2%

Varies Motor vehicle sales (SAAR) Nov. -- 14.9 million

FRIDAY, DEC. 2

8:30 am Nonfarm payrolls (level change) Nov. 200,000 261,000

8:30 am Unemployment rate Nov. 3.7% 3.7%

8:30 am Average hourly earnings Nov. 0.3% 0.4%

8:30 am Labor-force participation rate, 25 to 54-year-olds Nov. -- 82.5%

Main Source: MarketWatch