Weekly: Gold, Silver Get China Boost Friday, Rally 3.2%, 7.3%

TS Lombard says 3% Inflation Target coming, BOA says it's just like 1974

Housekeeping: Today is a very good macro day for readers. Hartnett notes the similarities between now and 1974 in terms of Fed policy possibly easing too early. One of our favorites, TS Lombard now asserts 3% inflation target (as we have since July) is coming. We describe some Gold and Silver behavioral patterns possibly repeating themselves again. And the CTA report

**ALSO: Founder’s pricing will increase very soon. Grandfathering for previous Founders. This does not effect price or quality for Premium subscriptions.**

SECTIONS

Market Summary— Algorithmic Induced Mania

Research— Goldfix, BOA, TS Lombard, and TD

Week’s Analysis/Podcasts— Metals, Higher Inflation Tolerance, and Zoltan

Charts— Metals, Energy, Forex, and more ( 28 charts in all)

Calendar— Elections and CPI

Technicals— GC, SPX, BTC, CL, NG.

Zen Moment— Bounce

Full Analysis— China’s Gold/Silver behavior, and how rare 3% rally in Gold

1. Market Summary

Friday was insane as far as markets trying to makes sense of different data points. The short term and the intermediate term were in serious conflict. For example: The data on balance was very economically bearish ( thus bullish stocks). Meanwhile Powell’s speech was bad for stocks again. But something new on the event horizon happened.. China might be back.

Nasdaq was the biggest loser (down around 6%) on the week

The Dow was down only 1.5%

China put itself out there saying it may be opening back up. Their reopening is bullish inflation (oil demand etc), and also US stocks. Which implies the Fed will be more inclined to hike even more to counterbalance the new upward inflationary pressure. Combine this with the fact that Friday’s Unemployment data was both good and bad from an economic perspective. ZH sums it up (our edits in ITALICS)

Good: payrolls beat expectations (bad for stocks) - HIKE RATES

Bad: wages slowed modestly (good for stocks), full-time workers dropped 490k (economic weakness) NO HIKE!

Ugly: number of unemployed Americans highest since Feb (recession reality - bad for stocks) HIKE BUT NO HIKE?

Add that to the China news and you get a market in dire need of some therapy. Finally add two fed speakers (Collins and Barkin) talking Hawkish at 10 a.m. and you get Cuckoo’s Nest type behavior.

Confused? You aren’t alone. Algorithmic traders had no clue whatsoever as to how to interpret data. Here’s a proper recap

Sectors/ Technicals

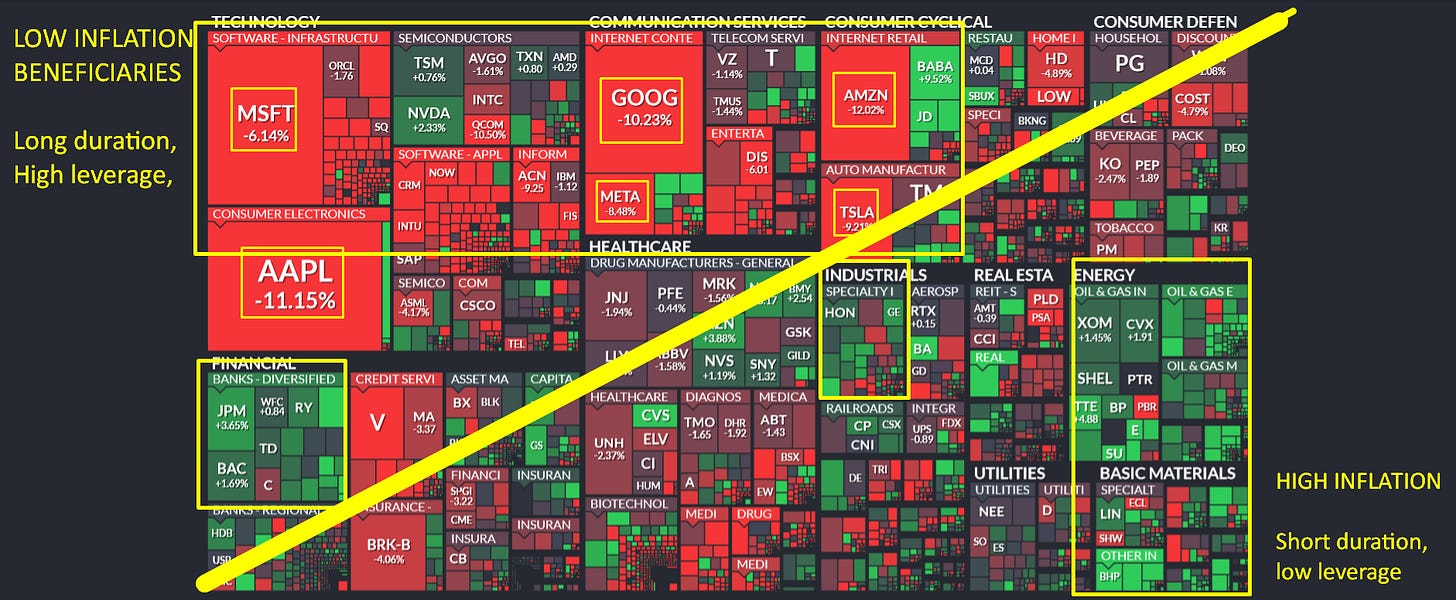

Tech stocks puked around 8% on the week

Energy stocks were up 2%

Two Weeks Ago, an “Up” week…

….Last Week, a “Down” Week

All the majors broke down below key technical levels…

Commodities:

Dollar ended the week almost perfectly unchanged

Gold rallied Friday, hitting its highest in 3 weeks.

Note Gold is currently not dropping much with dollar strength, yet now rallying with DX weakness. Bonus: Buy season is coming.

Oil prices soared this week (helped by chatter about easing China COVID restrictions) with WTI back above $92 (at 3-mo highs)

Bonds:

2Y yield sup 25bps

30Y up only 10bps

On the week, short-term interest rates signaled a notably hawkish tone shift

Crypto:

Cryptos rallied today lifting them into the green for the week. Litecoin was strong

Bitcoin rallied back above $21k

H/t Zerohedge for data and some graphics.

2. Research:

GoldFix Note on Chinese Gold and Silver buying and 3% moves higher

Some behavioral macro comments on Gold and Silver for your to consideration. China's Yuan soared Friday, along with Gold. That is the new pattern worth watching. Meanwhile domestic China traders who were short everything from recession worries including Silver (just like US CTA types) are now in need to cover those shorts…

TS Lombard: They will raise the Target rate to 3%

Fed is about to get a lot hotter – from all sides. This is one reason why I have long believed, as have many others, that the Fed ultimately bails and raises the inflation target to 3%. Powell does not have the same license to keep unemployment high and real growth low for an extended period as did Volcker (more so in retrospect than at the time). My guess is, Powell knows that.

BOA’s Hartnett on the Great Pivot of 1974

many similarities…big, fat trading ranges, co-dependency of Wall St & Fed (Chart 12-15), stop-go economic policies, Fed emphasis on core not headline inflation, political instability, war, oil shocks, food shocks, fiscal excess, industrial unrest and so on; but of greatest interest to investors in Q4’22 was the Great Fed Pivot of Q4’74… • Fed policy had tightened through 1973/74 in response to inflation, oil shocks…Fed funds 5.5% to 13% • Fed first cut July 1974 as GDP turned negative…

3. Week’s Analysis/Podcasts:

Zoltan Pozsar: 'Volcker was lucky'- Weekly Part 1.

Zoltan Pozsar: "Expect five years more of problematic inflation."- ZeroHedge

Founders Email: Zoltan implies Volcker was lucky

Why are Silver and Gold Up today? and Goldman's Fed Day Prep

4. Charts:

Metals and DX

Metals/PGMs

Energy

Forex

5. Calendar

MONDAY, NOV. 7

3 pm Consumer credit (level change) Sept. -- $32 billion

3:45 pm Cleveland Fed President Loretta Mester and Boston Fed President Susan Collins speak about women in economics

6 pm Richmond Fed President Tom Barkin speaks on inflation

TUESDAY, NOV. 8 Election Day

6 am NFIB small-business index Oct. -- 92.1

WEDNESDAY, NOV. 9

3 am New York Fed President John Williams speaks at Swiss National Bank event

10 am Wholesale inventories (revision) Sept. -- 0.9%

11 am Richmond Fed President Tom Barkin speaks on outlook

THURSDAY, NOV. 10

2 am Fed Gov. Christopher Waller speaks on central bank digital currencies

8:30 am Consumer price index (monthly change) Oct. 0.6% 0.4%

8:30 am Core CPI (monthly change) Oct. 0.5% 0.6%

8:30 am CPI (12-month change) Oct. 7.9% 8.2%

8:30 am Core CPI (12-month change) Oct. 6.5% 6.6%

8:30 am CPI (3-month SAAR) Oct. -- 2.0% 8:30 am Core CPI (3-month SAAR) Oct. -- 6.0%

8:30 am Initial jobless claims Nov. 5 219,000 217,000

8:30 am Continuing jobless claims Oct. 29 -- 1.49 million

2 pm Federal budget (compared with year ago) Oct. -- -$165 billion

FRIDAY, NOV. 11 Veterans Day holiday

9 am Philadelphia Fed President Patrick Harker speaks on economic outlook

9:35 am Dallas Fed President Laurie Logan speaks on energy and the economy

10 am UMich consumer sentiment (early) Nov. 59.5 59.9

10 am UMich consumer 5-year inflation expectations (early) Nov. -- 2.9%

12:30 pm Cleveland Fed President Loretta Mester speaks

1:30 pm Kansas City Fed President Esther George speaks on energy and the economy

6:35 pm New York Fed President John Williams speaks

Main Source: MarketWatch