Housekeeping: Today we discuss the stock rally, break down a gamma squeeze, and include research offerings from RBC, GS, JPM, and BOA. We note that Michael Hartnett openly discusses the Fed raising its inflation target to 3%. Our report, “Higher Inflation Tolerance is Coming" is included. Have a good one.

SECTIONS

Market Summary— Gamma Squeezes and Pivots

Research— GF, RBC, GS, JPM, and BOA.

Week’s Analysis/Podcasts— Lot of Silver

Charts— Gc, Si, CL, HG, JPY, CNY, Ng, Dx

Technicals— Gc, CL, Ng, Spx, Btc

Calendar— FED DAY, NFP

Zen Moment— Rainbow road, Dog referee

Full Analysis— How we know higher inflation tolerance is coming

1. Market Summary

Two things mattered this week: The market believing a pivot or pause will once again come, and Friday’s WSJ article which, if pressed again can affect stocks greatly Monday. First the Pivot/Pause stuff, then the WSJ stuff.

PIVOT PAUSE RALLY

The main market driver of the week, despite META’s huge meltdown was the Fed’s movement towards a Pause if not a Pivot for December. Please note last week we opined Powell doesn’t have to pivot in the strictest sense of the word (from hike to ease in one meeting) unless something literally breaks. That was also because Yellen pivoted for him.

From Powell Didn't Pivot Yet, But Yellen Just Did

Powell has not Pivoted yet despite panic on the continent and in the UK. Yellen however is panicking right now. Thus we suspect Powell is not the only one who is looking at FRA-OIS. So lets get to that and then list the Pivot-like behavior of Yellen Friday.

No doubt they had asked Powell to ease and he said no, maintaining his independence for now. But last week signs were definitely given he Fed will, if not Pivot, then pause (mini-pivot, pivot-light etc). So maybe Powell’s cover was blown and a pivot of sorts is actually coming before a break down? That is what the markets thought. And they screamed higher. We note the performance was centered on Dow stocks. The table was set before hand as well.

GAMMA SQUEEZE HAPPENS AGAIN

There were several other factors adding fuel and tinder to the fire once started. The most important three were CTA shorts, spec call buying, and broad put selling.

Factors adding fuel to this fire were:

Short Retail: CTAs were very short with no money left to sell, only closing trades to do

Gamma Squeeze: One day calls were accumulated (suspiciously or not) by those thinking a policy change was good odds and spec’d (YOLO’D) on the trade. Which pains market makers (the author is very experienced in this behavior) because you cannot effectively hedge the massive short gamma from selling a a 1 day call by purchasing a 30 day call with massive vol and tiny gamma. Hence GAMMA SQUEEZE.

Massive vol selling in the rally on the put side made markets even more bid.

Number 3 has been explained as bears were puking their puts as they were no longer fearful. That is correct. But they were puking them to marketmakers who then re-puked them. Which makes it even more important. That is related to number 2.1 and is closely tied to gamma squeeze dynamics.

DEALERS SHORT GAMMA, CHOKING ON VOL

All those marketmakers who got short 1 day calls ( in #2 above) were buying 30 day calls to hedge their upside risk. Which, while helping them mitigate that risk somewhat, made them extremely long volatility. So what did they do? They sold out the puts they no longer needed as the market rallied. Again— this is something we are very familiar with for all the wrong reasons.

Zerohedge outlines Nomura’s accurate play-by-play of it here. Lexicon aside; this is about substitutability. When you get a better substitute (30 day call) for what you actually need (1 day call), you discard the inferior (90 day put) one after you buy that better substitute. Follow? lol.

Which brings us to the Saturday twitter post we read by the WSJ.

POWELL PROXY AIMS TO DAMPEN RALLY

Anyway, stocks rallied a whole lot. Which brings us to Saturday’s cryptic WSJ post. The background goes like this.

THE HAWK- Powell is all about inflation fighting

THE HIDING OUT- Powell has decided that speaking less is better for the markets so they can deal with the uncertainty properly. Remember Ride of the “Volkyries”?

WSJ LEAKER- Powell still hides out but uses the WSJ’s Timaraos to leak his missives now it is generally believed

YELLEN PANICKED- who has pivoted all by herself so close to midterms (with nothing actually breaking here) no doubt after insisting Powell back off, which he has not.

So.. Saturday after the massive rally last week, Timiraos said this in a much larger piece:

The bottom line: while the Fed isn’t data-point dependent and the decision for next week of 75 basis points seems unlikely to change, another uncomfortably high ECI reading might argue for a somewhat higher terminal rate and could muddy the debate over slowing the pace in Dec.

What does it mean? Powell is reminding everyone he does not have to do anything on 1 data point, he reserves the right to NOT back off hiking, and don’t get too comfortable. Further, maybe he doesn’t hike 75 points in December, but he does raise the terminal rate at which he stops hiking. So he will hike for a longer cycle if need be.

In context- This is the same old thing we always see. When stocks rally the Fed tries to talk them down. To the extent the Fed is taken seriously, stocks back off. If stocks continue to rally, The Fed doubles down on its message. Then the market either calls its bluff or drops. If the market calls the bluff, then we get a Come-to-Pappa moment when a data point confirms Powell is a hawk again adn hopes aree dashed. This is what happened in June-July. A rally on pivot hopes, a warning from the Fed, the warning ignored, the bad data point, and whoooosh.

One thing is different in December however. The midterms will be over. Then Powell CAN pivot without fear of being called a political tool. So for now.. it’s business as usual.

Buyers will buy until Powell is taken seriously or bad inflation data comes out. Economic data like GDP and NFP in our opinion mean less to Powell if nothing visibly breaks. Powell may pause/pivot post election, but he does not want to telegraph that before midterms for fear of being called a political dependent.

H/t Zerohedge for data and some graphics.

Sectors:

Industrials led the week along with Staples, Real Estate, and Utes

Discretionary and Energy lagged

The Dow is on pace for its best month since since 1976

Nasdaq is 'only' up 5% on the month

Commodities:

The dollar fell for the 2nd week in a row

Oil managed gains on the week

Copper, gold, and silver all slipped lower. we commented more in a Metals Update Saturday morning for everyone

Bonds:

Odds of a 75bps rate-hike in December surged Friday

Treasuries were also bid on the week with the long-end outperforming

Crypto:

Bitcoin was up on the week, holding mid-week gains above $20,500

2. Research:

GoldFix on higher inflation tolerance

RBC on Commodities

Hartnett on Fed inflation target raised

GS “Fed Chatterbox”

JPM on Amazon

3. Week’s Analysis/Podcasts:

How Nation-States Will Use Bitcoin In The Power Projection Game

COMEX Deliverable Silver far less than imagined as 50% of ‘Eligible’ is not Available

Super-Backwardation: Cushing hub still weeks away from effectively running out of crude despite SPR

4. Charts:

Gold

Silver

Crude

Copper

Yen, Yuan, NG, DX

5. Technicals:

GoldFix Note: Do not attempt to use price levels without symbol explanations or context. Moor sends 2 reports daily on each commodity they cover. The attached are non-actionable summaries.

Gold:

TECHNICALLY BASED MARKET ANALYSIS AND ACTIONABLE TRADING SUGGESTIONS Moor Analytics produces technically based market analysis and actionable trading suggestions. These are sent to clients twice daily, pre-open and post close, and range from intra-day to multi-week trading suggestions.

S&P 500

Oil/Nat Gas

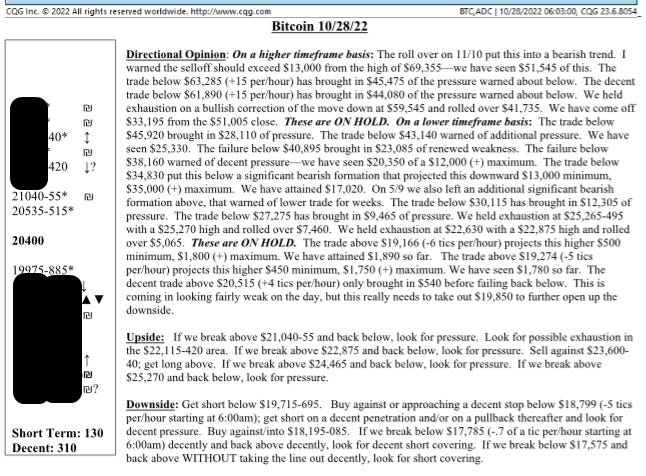

Bitcoin

Go to MoorAnalytics.com for 2 weeks Gold, Oil, and Bitcoin reports free

6. Calendar

MONDAY, OCT. 31

9:45 am Chicago PMI Oct. -- 45.7

TUESDAY, NOV. 1

9:45 am S&P U.S. manufacturing PMI (final) Oct. -- 52.0

10 am ISM manufacturing index Oct. -- 50.9%

10 am Jobs openings Sept. -- 10.1 million

10 am Quits Sept. -- 4.2 million

10 am Construction spending Sept. -- -0.7%

Varies Motor vehicle sales (SAAR) Oct. -- 13.7 million

WEDNESDAY, NOV. 2

8:15 am ADP employment report (level change) Oct. -- 208,000

10 am Rental vacancy rate Q3 -- 5.6%

2 pm FOMC announcement -- 3%-3.25%

2:30 pm Fed Chair Jerome Powell press conference

THURSDAY, NOV. 3

8:30 am Initial jobless claims Oct. 29 -- N/A

8:30 am Continuing jobless claims Oct. 22 -- N/A

8:30 am Foreign trade deficit Sept. -- -$67.4 billion

8:30 am Productivity (SAAR) Q3 -- -4.1%

8:30 am Unit labor costs (SAAR) Q3 -- 10.2%

FRIDAY, NOV. 4

8:30 am Nonfarm payrolls (level change) Oct. -- 263,000

8:30 am Unemployment rate Oct. -- 3.5%

8:30 am Average hourly earnings Oct. -- 0.3%

8:30 am Labor-force participation rate, ages 25-54 Oct. -- 82.7%

Main Source: MarketWatch