Housekeeping: Silver had a rough week. We update on that briefly and hopefully clearly in the Commodities subsection of our Market Summary. A layman's explanation of FRA-OIS is included (title is about that). More from Hartnett, Barclays claims inflation is *worse*, not better; JPM macro, and the usual CFTC COT stuff

SECTIONS

Market Summary— The Non-Pivot Pivot is Here

Research— GF, BOA, GS, JPM, Barclays

Week’s Analysis/Podcasts— CPI, the PPT, and more

Charts— Dxy, Gc, Si, CL

Technicals— Gc, Spx, CL, Ng, Btc

Calendar— Empire mfg, LEI

Zen Moment— Cats are not as smart as we thought, thankfully

Full Analysis— premium

1. Market Summary

While stocks bounced back Thursday after the CPI print, the hawkish shift in rate expectations continued Friday and stocks started to catch on to that reality. US equity markets were just as chaotic as bonds (rare as of late) after yesterday's CPI puke and panic-buying squeeze which led to today's reality check lower.

Gilligan’s Island Top Reversal…

Nasdaq ended the day down over 3.0% after being up 1.5% pre-market

The Dow managed to close green

One bright spot: Friday’s lows were above Thursday’s CPI-spike-down lows.

Bank earnings also came out and the sector violently diverged. Wells Fargo and JPMorgan outperformed after earnings beats while Morgan Stanley missed and dumped almost 5%.

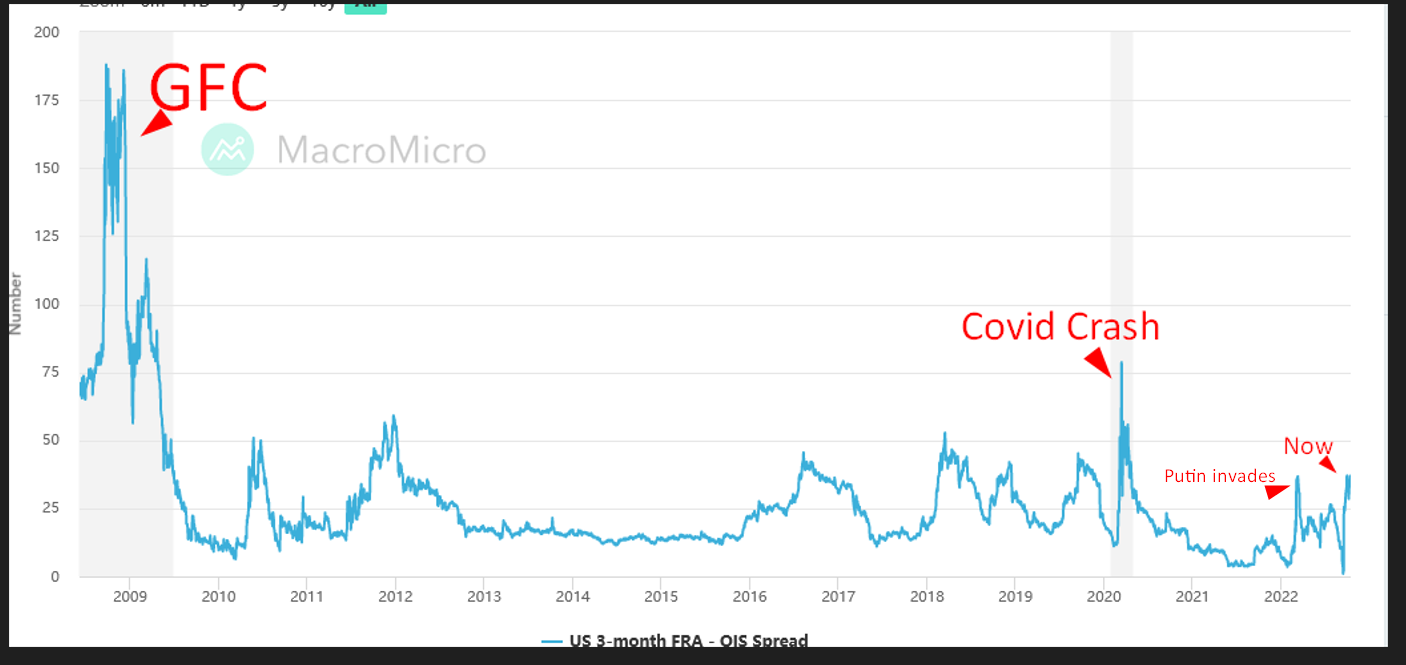

Finally, the market's real fear gauge, The FRA-OIS spread (a differential between two key interest rate swaps) is surging higher. Credit determines stock prices ultimately, not VIX which is now manipulated daily.

Powell has not Pivoted yet despite panic on the continent and in the UK. Yellen however is panicking right now. Thus we suspect Powell is not the only one who is looking at FRA-OIS. So lets get to that and then list the Pivot-like behavior of Yellen Friday.

H/t Zerohedge for data and some graphics.

FRA-OIS Says Either Pivot or Bailout is Coming

The FRA component of this spread reflects interest rates demanded by banks to lend to each other ( LiBOR, SOFR stuff), while OIS reflects overnight risk-free interest rates and is Fed Funds based.

The FRA-OIS measures liquidity and will increase (the spread between the two rate swaps widens as mkts get less liquid) when banks are uncomfortable loaning money to each other. It typically is useful as an indicator in times of: QT (less money), acute crisis (Covid), or when an industry problem (a bank or banks is in trouble and thus untrustworthy) is arising.

Simply put, according to ZH:

‘If the FRA-OIS spikes another 10-15 points, the Fed will have no choice but to emerge from its hide-out and publicly reassure markets that the US financial system isn't about to experience a credit related seizure.’- Source

It is no doubt what Powell looks at during times like these….

THE BREAKING POINT IS VERY CLOSE

Why 10-15 bps? We feel because that is where the last spike got mysteriously capped at the inception of the Ukraine-Russian war. Somebody stepped in then, and it is reasonable to think somebody will step in near that level again. Even if they do not, its a damn safe bet they are watching closely now. The money offered to Switzerland and the UK this week was directly related to this indicator spiking we’d wager. More on that below. First a little recap of what it actually measures.

CONTINUES IN PREMIUM...Sectors and Technicals:

Discretionary and Tech were laggards

Staples & Healthcare outperformed

Commodities:

Dollar rallied for a second straight week, albeit with some crazy volatility

Gold suffered its worst week since July (after 2 weeks of gains), unable to hold its bounce back above $1700

After last week's surge higher, oil prices tumbled this week with WTI unable to hold $90 (falling further Friday after an unexpected jump in the rig count)

Silver was slammed over 9% lower on the week, its worst week since Sept 2020.

But- the EFP went negative again post selloff signaling the physical buying is back buying dips.

The alternating “buy dips like physical guys do and sell CTA short covering rallies” concept is in tact for almost 2 months now. That’s big

Trade the range with the EFP as your guide and have a home run bias months or years from now.

Swing for singles, and be happy when one leaves the park. Do not strike out swinging for fences every time up. Be Pete Rose, not Dave Kingman (look it up, we’re old)

Bonds:

In the US, Treasury yields are all higher on the (shortened) week with the short-end underperforming (2Y yields closed the week above 4.5%)

10Y Yields rose back above 4.00% again

The market's expectation for The Fed's terminal rate surged to 4.96% (in March 2023). At the same time, market expectations of post-recession rate-cuts also surged

Crypto:

Despite Thursday’s surge higher, cryptos ended the week lower (with Bitcoin holding above $19k).

2. Research:

1- GoldFix: FRA-OIS Says Either Pivot or Bailout is Coming

This time, however, the Fed may keep on hiking and bail out the ones (banks, pensions, or industries) they deem worth saving. That is a pivot, even if they do not lower rates.

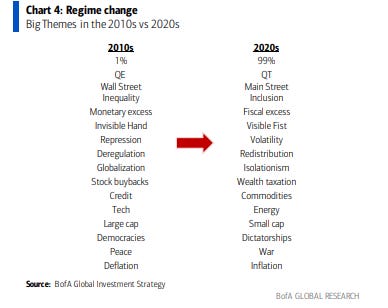

2- BOA’s Hartnett on the Fed Being Close (but no cigar) to a Panic

2022 a simple tale of “inflation shock” causing “rates shock” which in turn threatening “recession shock” & “credit event”; inflation shock ain't over.

3- Barclays: Gets Very bullish Inflation (***big outlier***)

“With CPI inflation remaining stubbornly persistent despite decelerating goods prices, we now expect an even more aggressive hiking campaign by the FOMC into early 2023. We also adjust our outlook, anticipating higher inflation prints through year-end and a somewhat more pronounced downturn in 2023.”

Bottom line is they think services inflatioan is not getting any better before Goods inflation gets worse again. And then they think a massive recession is next. They think, no pivot followed by much bigger pivot.

4- Goldman: Awaiting Peak Hawkishness

In line with our expectations, goods inflation is moderating due to normalizing demand, easing supply chain issues and lower commodity prices. However, services inflation such as rents remains firm, particularly in the US. We are closely monitoring labor markets for signs of loosening and evidence of easing inflation pressures across both core goods and core services as the impact of policy tightening begins to take hold

5- JPM Macro Week Ahead

6- Cot and CFTC Data for Silver and Gold

CONTINUES IN PREMIUM...3. Week’s Analysis/Podcasts

What Did CPI Even Mean?- The PPT is back

***CPI Preview***- The call for volatility

Oil: Two Bridges Blown- Brynne Kelly

The Fed will not save (you) when the tide goes out, even if they pivot

Hartnett: Contrarian Case for Gold and a Hard Landing-Weekly Excerpt

4. Charts:

Dollar

Gold

Silver

Oil

5. Technicals:

Gold:

GoldFix Note: Do not attempt to use price levels without symbol explanations or context. Moor sends 2 reports daily on each commodity they cover. The attached are non-actionable summaries.

TECHNICALLY BASED MARKET ANALYSIS AND ACTIONABLE TRADING SUGGESTIONS Moor Analytics produces technically based market analysis and actionable trading suggestions. These are sent to clients twice daily, pre-open and post close, and range from intra-day to multi-week trading suggestions.

S&P 500

Oil/Nat Gas

Bitcoin

Go to MoorAnalytics.com for 2 weeks Gold, Oil, and Bitcoin reports free

6. Calendar:

MONDAY, OCT. 17

8:30 am Empire State manufacturing index Oct. -5.0 -1.5

TUESDAY, OCT. 18

9:15 am Industrial production index Sept. 0.1% -0.2%

9:15 am Capacity utilization rate Sept. 80.0% 80.0%

10 am NAHB home builders' index Oct. 44 46

WEDNESDAY, OCT. 19

8:30 am Building permits (SAAR) Sept. 1.54 million 1.54 million

8:30 am Housing starts (SAAR) Sept. 1.48 million 1.58 million

2 pm Beige Book

THURSDAY, OCT. 20

8:30 am Initial jobless claims Oct. 15 235,000 228,000

8:30 am Continuing jobless claims Oct. 8 -- 1.37 million

8:30 am Philadelphia Fed manufacturing index Oct. -5.8 -9.9

10 am Existing home sales (SAAR) Sept. 4.70 million 4.80 million

10 am Leading economic indicators Sept. -0.3% -0.3%

FRIDAY, OCT. 21

12 noon Index of common inflation expectations, 5-10 years Q3 -- 3.1%

12 noon Index of common inflation expectations, 10 year Q3 -- 2.2%

Main Source: MarketWatch