Weekly: Gold Wrangled, Amazon Ascendant, and Meta Mangled

Housekeeping: Sunday’s Founder’s Class will be 3 p.m. ET. Zoom Link Here. Topics for discussion here. Founders use usual password please. See you then.

It is a long, dense post intended to be read like a weekend magazine or a Sunday paper. Please note some sections have changed order.

SECTIONS

Market Summary: weekly recap

Technicals: active trading levels

Podcasts: GoldFix and Bitcoin

Charts: related markets

Calendar: next week

Premium divider

Precious Research and Analysis

Premium Report

1. Market Summary

If January was volatile and lower, then February’s vibe so far is volatile and higher. This is consistent with the selling in tech stocks based on duration risk discussed at length here (the beginning) and here (the middle). Now it seems this is starting to ebb (the end?) and the general performance later in the week stabilized. That is after the Face(plant)Book fiasco.

The transition from January to February began with stocks soaring higher as monthly flows were anticipated. But the market continues to bifurcate now as divergences get more and more granular.

First the broader market split into tech and non-tech stocks. Then stay at-home versus back-to-work stocks. Remember the K Recovery? Next the indices themselves became bi-polar with most of the S&P 500 stocks down and only a few biggies holding things together.

By The Way: The K Recovery

Since around the year 2000, Wall Street and Main Street have been decoupling. The Lehman crisis events and government response accelerated that divergence, and, most recently, policymakers' response to the COVID crisis has driven the divided between Wall Street's success and Main Street's distress has never been wider. The chart below is a microcosm of the post covid K-shaped recovery.

Investopedia defines A K-shaped recovery as: occurring when, following a recession, different parts of the economy recover at different rates, times, or magnitudes. This is in contrast to an even, uniform recovery across sectors, industries, or groups of people.

A K-shaped recovery leads to changes in the structure of the economy or the broader society as economic outcomes and relations are fundamentally changed before and after the recession.

Now within the largest Tech stock sector we see Amazon, Apple, and Google pulling away from Netflix, Facebook, and Peleton. This is a new change.

A post-pandemic focus on big -tech earnings is splitting the markets yet again as the broader market reflects a QT environment possibly. Sadly, it is a next logical ( if diseased) step in what is a long running and very dangerous trend.

The exodus of the broader markets and into a smaller and smaller universe of “winners”. It wreaks of a new take on the “portfolio insurance” concept. The lack of diversity in participants is now seriously being reflected in the lack of diversity in investment decisions.

In English: too many people are in one side of the boat. Either the other side gets fixed and people spread out again slowly, or tipping risk will grow with life jackets in short supply. The other side can and will get fixed, but not during the rate hike scenario. This will be the time for forest thinning again. Maybe the big guys can weather the storm. Still, the risk is there.

But, as the week went on and NFLX and FB were slammed on earnings outlooks. Only Amazon rescued the broader markets. But the week ended well. Friday was a wild day with AMZN's strength leaving Nasdaq up 2% on the day.

On the week, The Dow and S&P managed to get back into the green while the Dow did not

S&P and The Dow bounced off their 200DMA Friday.

Median US stock is hovering back near its lowest levels since Feb 2021.

Pay close attention to Amazon. They rarely buy back their own shares but announced they are now. In 6 months time historically that stock does quite well when they bet on themselves, at least relative to its peer group.

Sectors

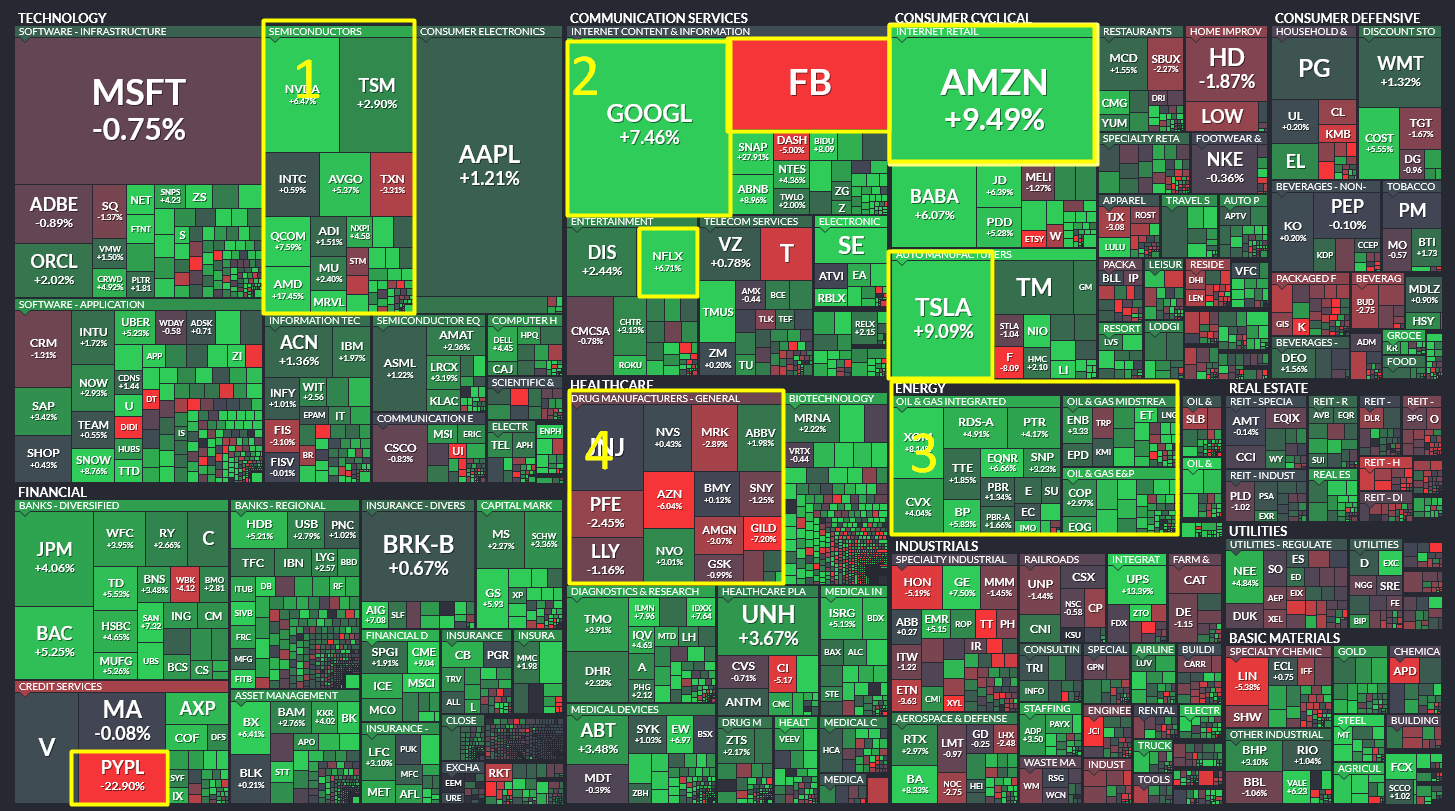

Semiconductors did well #1

Top tier Tech stocks diverged wildly. #2.

Small Caps and Big-Tech languished in the red.

Growth outperformed value, which is odd considering rates pumped.

Remember the duration thing? Could be end of bad news for now. End of year rotation may also be over.

Energy had another good week #3

Healthcare stocks aren’t worried about Covid anymore #4

Commodities

see charts section for graphics

Commodities were higher this week led by Crude and Copper.-charts section

Gold searched for sell-stops several times which were met with fierce buying. - charts

WTI rallied above $93 today, its highest since Oct 2014.- charts

This was the worst week for the USDollar (against its fiat peers) since Nov 2020 (election week)

Cryptos had a big week with Ethereum leading the way.

Bitcoin bounced back above $40k Friday

Bonds

Bonds had a bad week with the entire yield curve higher

The rest of the world scrambled to catch up as they realize that Central Bankers are serious this time.

JGB yields touched the top of their yield control ceiling.

Italian Yields screamed higher, bonds were sold everywhere…

Global negative yielding debt outstanding dropped significantly as investors demanded yield for risk

Rate-hike expectations surged again Friday.

March is now pricing a 45% chance of a 50bps hike up from 20% last week

Gold does not care much apparently. With negative real rates disappearing

globally, Bonds cratering, Stocks whipping and Rates about ot be hiked.. it doesn’t care yet.

A Central Bank may be buying sub $1800. Bullion Banks are covering shorts (beneath the fold) and dips are being bought ferociously for now.

GoldFix Friday WatchList:

Complete Watchlist Here

Crypto Weekend:

2. Technical Analysis

Report Excerpts Courtesy MoorAnalytics.com

GoldFix Note: Do not attempt to use price levels without symbol explanations or out of context. Moor sends 2 reports daily on each commodity he covers. The attached are non-actionable summaries.

Gold

TECHNICALLY BASED MARKET ANALYSIS AND ACTIONABLE TRADING SUGGESTIONS Moor Analytics produces technically based market analysis and actionable trading suggestions. These are sent to clients twice daily, pre-open and post close, and range from intra-day to multi-week trading suggestions. www.mooranalytics.com

Bitcoin

Energy

OIL

Nat Gas

Go to MoorAnalytics.com for 2 weeks Gold, Oil, and Bitcoin reports free

3. GoldFix and Bitcoin Podcasts

4. Charts

Dollar Index

Bond Yields

Gold

Silver

Crude Oil

Copper

Bitcoin Futures

Ethereum Futures

Charts by GoldFix using TradingView.com

5. Calendar

Some of the upcoming week’s key data releases and market events

MONDAY, FEB. 7

3 pm Consumer credit Dec. -- $24 billion $40 billion

TUESDAY, FEB. 8

6 am NFIB small-business index Jan. 97.5 98.9

8:30 am International trade Dec. -$82.9 billion -$80.2 billion

11 am Real household debt (year-over-year) Q4 -- 1.8%

WEDNESDAY, FEB. 9

10 am Wholesale inventories (revision) Dec. 2.0% 2.5%

10:30 am Fed. Gov. Michelle Bowman speaks

12 noon Cleveland Fed President Loretta Mester speaks

THURSDAY, FEB. 10

8:30 am Initial jobless claims Feb. 5 230,000 238,000 8:30 am Continuing jobless claims Jan. 29 -- 1.63 million

8:30 am Consumer price index (month-to-month) Jan. 0.4% 0.5%

8:30 am Core CPI (month-to-month) Jan. 0.4% 0.6%

8:30 am Consumer price index (year-to-year) Jan. 7.2% 7.0%

8:30 am Core CPI (year-to-year) Jan. 5.8% 5.5% 2 pm Federal budget Jan. $25 billion -$163 billion

7 pm Richmond Fed President Tom Barkin speaks

FRIDAY, FEB. 11

10 am UMich consumer sentiment index (preliminary) Feb. 67.0 67.2

10 am UMich 5-year inflation expectations (preliminary) Feb. -- 3.1%

Main Source: MarketWatch

Zen Moments:

Disclaimer: Nobody is telling you to do anything here. Anybody who tells you to do something without first intimately knowing your personal situation is irresponsible at best and manipulative at worst. Worse, anyone who acts on other people’s opinions without first doing an inventory of their own situation shouldn’t be surprised if they lose money.

6. Precious/Feature Analysis

Commitment of Traders below the fold

7. Research Reports

Bridgewater, Equities, Russia, Commodities, TCS, below the fold

6. Precious/Feature Analysis

Gold and Silver are Being Wrangled

Commitment of traders report for activity ending Tuesday 2-1-2022, shows serious short covering